How Return on Invested Capital and Growth Creates Value

Value is driven by 3 things: growth, return on invested capital (ROIC), and the cost of capital (COC).

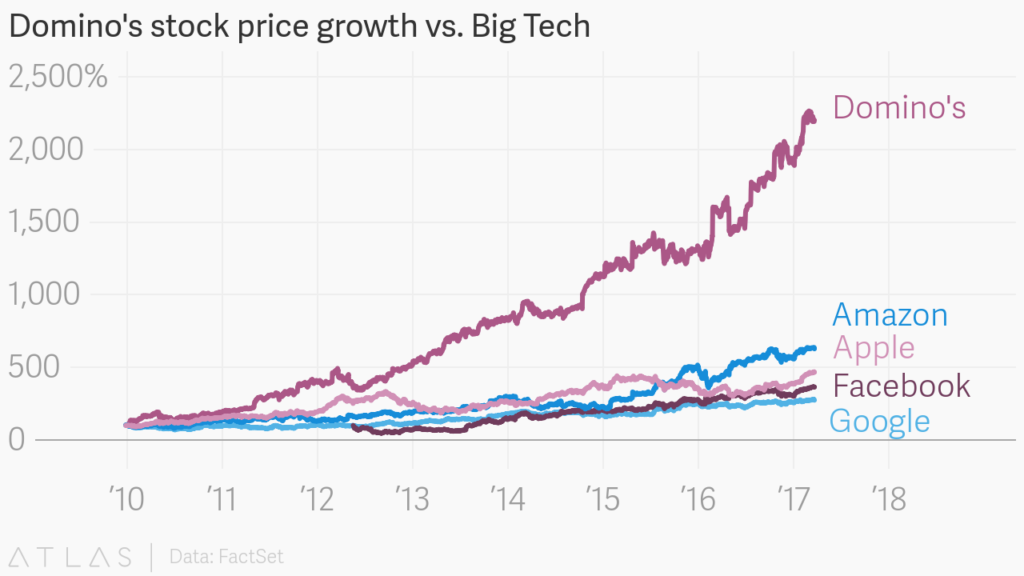

Domino’s Pizza: How to Better Understand Restaurant Franchises

For anyone looking to start learning how to invest, I would always recommend starting with products or services you use. Being a foodie myself, F&B naturally falls within my circle…

How Growth, Return on Capital, and Discount Rate Affect Valuation

Nobody will know where interest rates are headed, but it is important to appreciate the relationship between the discount rate and long-duration assets. In other words, we should be mindful…

Why Pay More for Quality Businesses?

Over the long term, it’s hard for a stock to earn a much better return that the business which underlies it earns. Likewise for companies that are able to sustainably…

Why You Should Keep an Investment Journal

When it investing, it helps immensely to have these 3 tools in your arsenal — an investing journal, a watch list, and investing checklist.

As I was reviewing my investing journal…

Why I Initiated a Position in Fastly

Initiated a stake in Fastly this week to make myself follow through on deep diving into this company. They reported a strong set of Q2 results, with revenue rising 61.7%…

What Fund Managers are Saying about the Current Environment

The year 2020 has been interesting, to say the least. With the market crashing down at an astonishing speed, and then shooting back up within a short period of time….

How to Analyze SaaS Companies

Despite most of the SaaS companies commanding lofty valuations, not all of them will meet the high expectations set out by investors. We have to first ask ourselves if this…

How to Screen for High-Quality Compounders?

Using the gross profitability method, a dollar invested in the market between 1973 to 2011 grew to over $80. While the same dollar invested in businesses that have high gross…

Amazon and the Problem with Reported Earnings

Where the key value driver of a company is in intangible investments, investors need to look beyond reported earnings. Especially for innovative companies in their early stage as they invest…

How to Find the Next Multi-Bagger by Understanding Operating Expenses

Reported earnings of high growth companies are often misunderstood by investors. Current earnings do not equate to real earning power.

Companies that are growing rapidly often reinvest heavily and their…

Analyzing the Gross Profit Margin

Reading the financial statements may be daunting for beiginners. This post will bring you through revenue, cost of goods and gross profit with case studies such as Costco, L Brands,…