This is the second of a two part series. Check out Alibaba Deep-Dive Part I here.

I write about investing, business breakdowns, and growth philosophies. Join 3,400 Steady Compounders by subscribing here:

A research report on Alibaba cannot be complete without mentioning the behemoth inside it, Ant Financial, in which Alibaba holds a 33% stake.

Ant Financial was scheduled to list on the Shanghai Stock Exchange (SSE) and Hong Kong Stock Exchange (HKSE) on 5th November 2020, but regulators halted the deal. The company has grown tremendously since its humble beginnings as a payments company. Jack Ma aspired to turn it into a one-stop shop for all things financial and beyond.

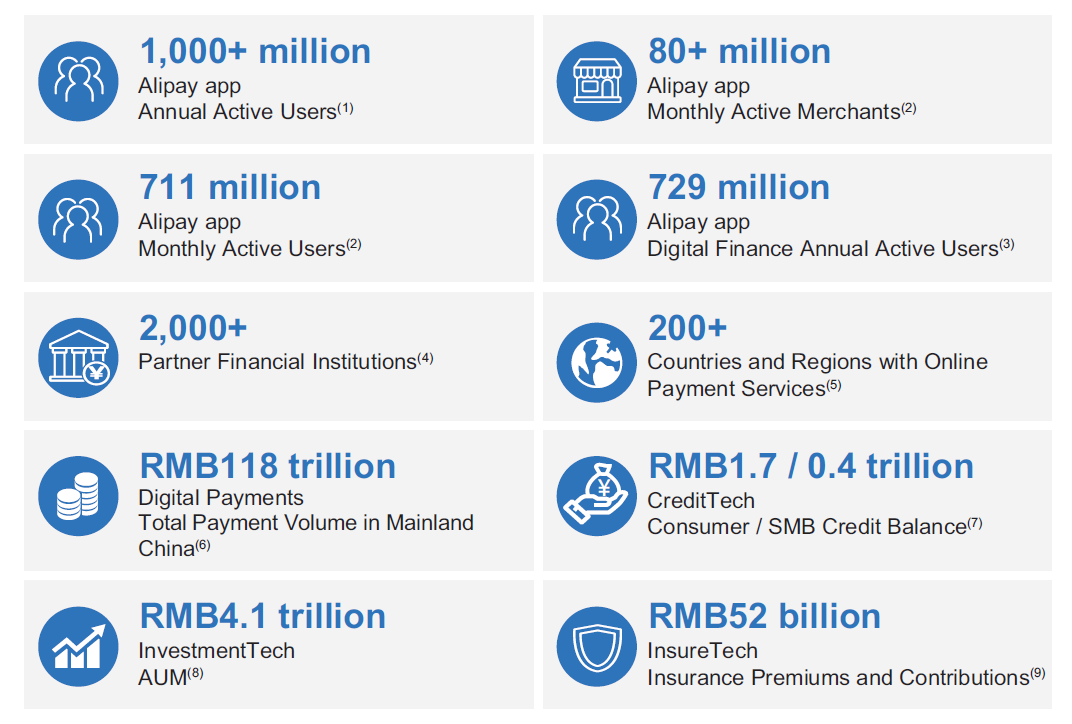

Let’s examine their size and scale today.

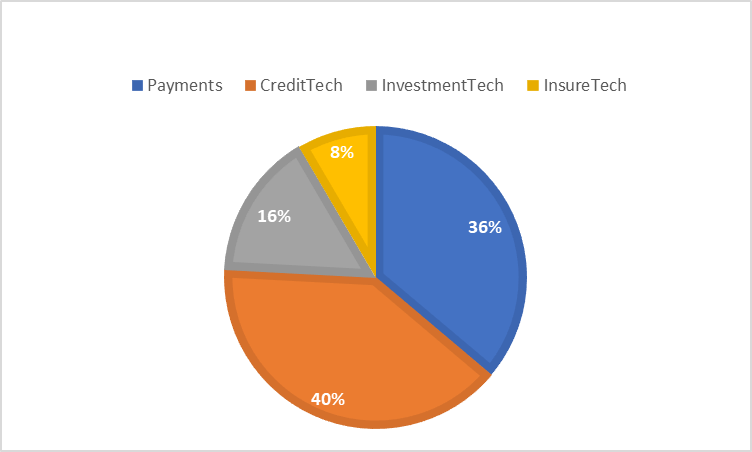

As of its IPO filing, its “digital payments and merchant services” revenue only accounted for 35.9% of its total revenue while its “digital finance technology platform” was 63.4% and is growing at high double digits.

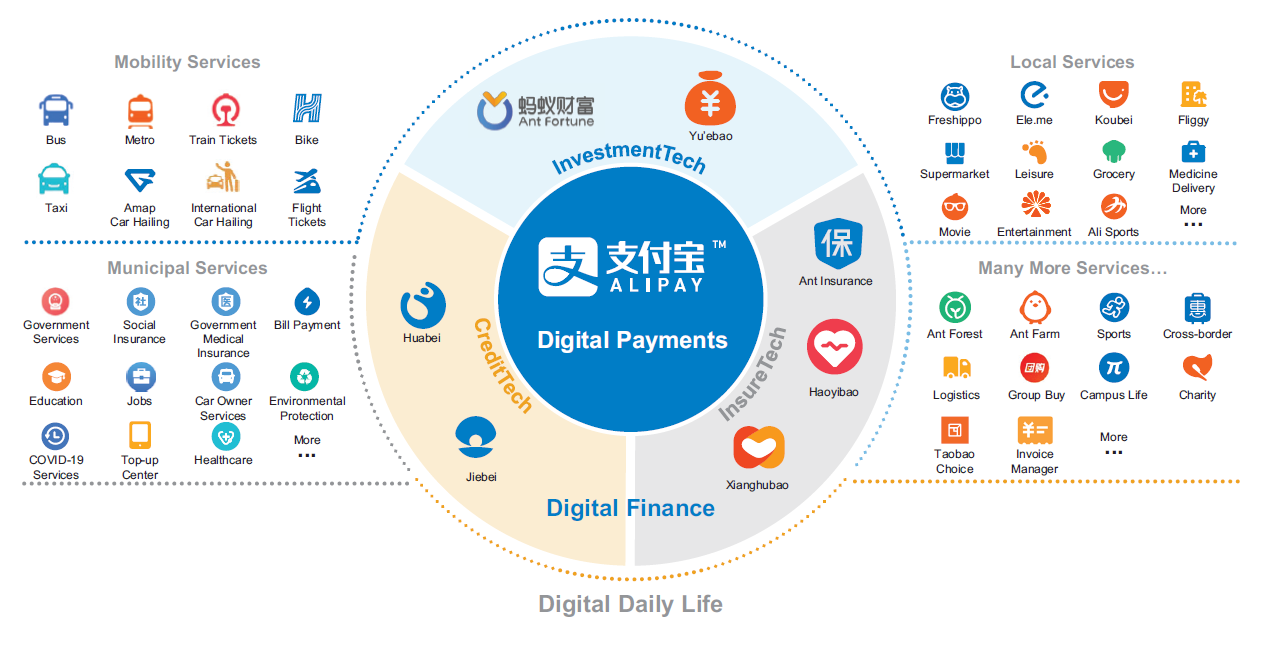

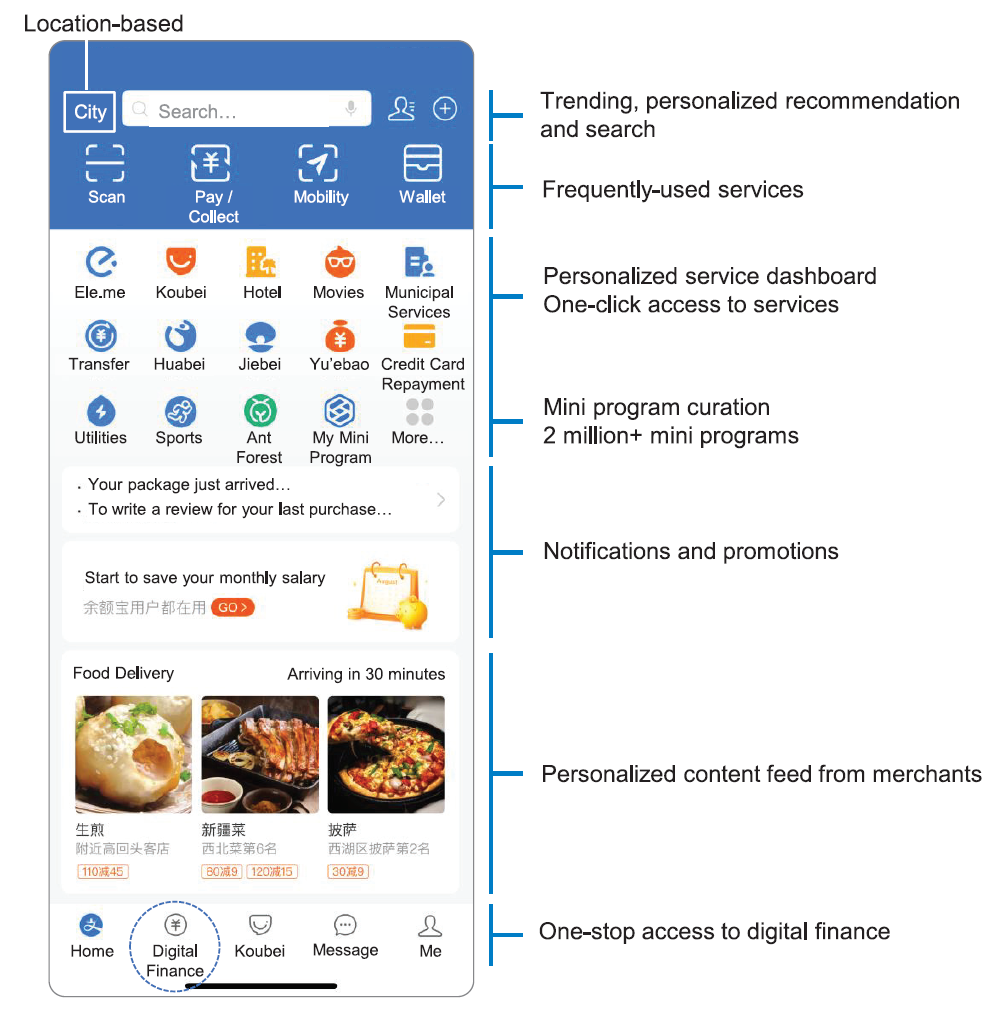

Ant’s business arms can broadly be classified into three segments: (1) Digital payments, (2) Digital finance, and (3) Digital daily life services.

Let’s look at Ant’s business model to see why regulators were concerned.

Digital Payments

In May 2003, Taobao was launched, and the first issue to be resolved was trust. As China’s first escrow service, Alipay was designed to facilitate online transactions.

In the land of QR codes, payments in China are an oligopoly—Alipay and WeChat Pay. The market share of Alipay and WeChat Pay were 55.4% and 38.5% respectively, according to Analysys.

In 2013, Alipay launched Quick Pay (快捷支付) which revolutionized payments in China, where users only have to enter their PIN to complete a transaction. Consumers had to jump through 7 pages before they could complete an online transaction previously.

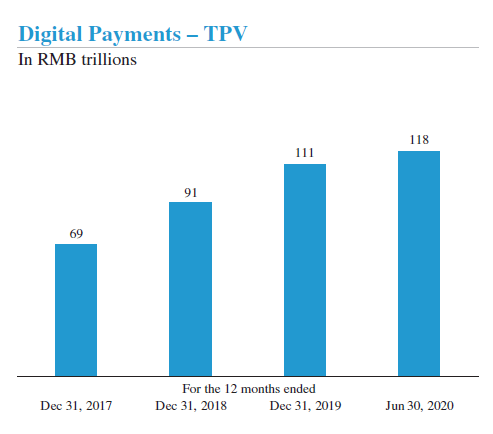

As of 30 June 2020, it had processed RMB 118T (USD 18.5T) on its network! In comparison, Paypal, Mastercard, and Visa processed 0.94T, 6.3T, and 8.8T respectively.

It also charges a very low take-rate for its services due to its scale. Below is a table comparing different payment providers.

For every $100 transacted using Alipay, the platform only takes a cut of $0.55!

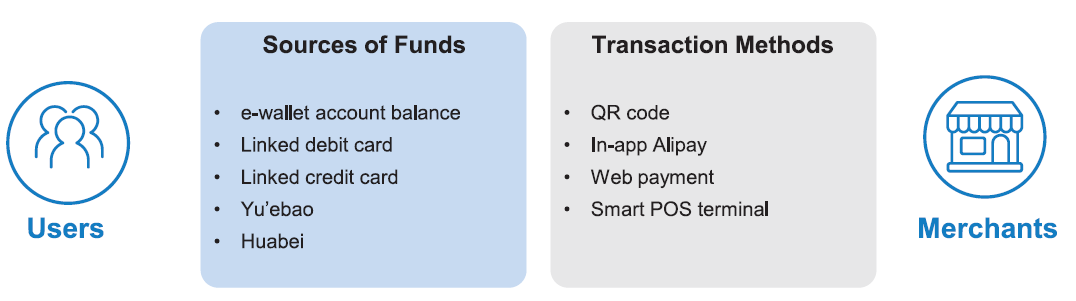

With AliPay, consumers and merchants can transact where, when and how they want, using a range of transaction methods highlighted below:

Yu’ebao allows you to make payments directly with your investments, where a portion of your investments is liquidated to serve as payment for your transaction seamlessly.

Consumers can also use Huabei to buy products and pay for them in installments, similar to buy now pay later (BNPL).

More of these products will be covered under “Digital Finance”.

Digital Daily Life Services

Alipay offers merchants numerous value-added services in addition to payment. Thanks to their data and advanced technology, they are able to provide targeted marketing tools, such as mini programs, loyalty programs, and mass marketing events.

Alipay and Alibaba, for example, launched the 7.17 Shopping Festival, an offline marketing campaign to distribute e-coupons to offline merchants of all sizes via the Alipay app, and consumers could redeem the coupons at millions of merchants across China when they paid with Alipay.

Seven million merchants participated, and they were able to reach Alipay’s huge customer base in a targeted way to increase sales.

Through Zhima Credit, merchants can assess consumer trustworthiness and offer deposit-free services to those with eligible Zhima Credit across a variety of services such as hotel booking, ride sharing, shared power bank rentals, car rentals, and more!

Alipay has over two million mini programs. A mini program acts like an app within an app, enabling merchants to attract new consumers and offer services, all within the Alipay app.

Starbucks has a mini program that allows consumers to order beverages online and access membership benefits.

As a result of this ecosystem of mini programs, Alipay is able to create high touchpoints with customers as they can access a range of mini programs within one app, resulting in increased traffic and higher conversion for its highly profitable digital finance segment.

Digital Finance

It’s time to deal with the elephant in the room, its digital finance technology platform was the main reason the regulators shelved its IPO.

There are three main services offered by its digital finance division: (1) CreditTech, (2) InvestmentTech, and (3) InsureTech.

(1) CreditTech

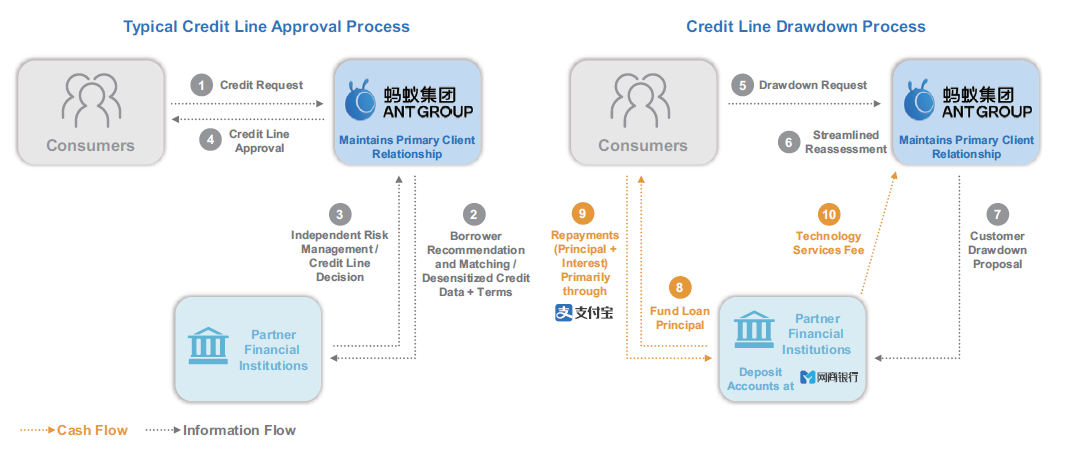

Alipay is the largest online credit provider in China for consumers and small businesses. As an aggregator, the company helps banks lend at scale.

The two main credit products are Alipay: Huabei (花唄) and Jiebei (借唄).

Huabei (花唄), which means just spend, is a digital unsecured revolving credit product offered to consumers in China, with the average loan balance of RMB 2,000 (USD 314). Alipay users can instantly apply for a Huabei credit line at the point of sale.

They could be shopping on Taobao or in an offline store, for example. Users of Alipay can opt to pay with credit and pay down their loan in 40 days (interest-free) or in installments over 3 to 12 months (with interest).

Huabei’s typical customer is young and Internet-savvy, but does not qualify for a credit card due to insufficient credit limits. With Huabei, consumers can enjoy a convenient user experience and build a credit history while enjoying more inclusive credit services.

Jiebei (借唄), which means just borrow, is designed for large transactions, and users must have developed a credit history with Alipay in advance. Credit approval used to take hours and dozens of forms. Creditworthiness can be assessed and a decision made within seconds with Jiebei.

The user will receive the funds in his Alipay account immediately and can also prepay outstanding balances at any time without penalty.

The annualized interest rate charged by Huabei and Jiebei is 15%.

Thanks to its massive data and AI, Alipay is able to determine a customer’s creditworthiness and how to best market a credit product to increase adoption. One of its key competitive advantages is the ease and accuracy with which they assess creditworthiness.

Consumers don’t have to wait in lines, fill out forms, or compare multiple banks for the best deal. With just one click, you can take out a loan at the point of payment!

Alipay simplifies the process of issuing, monitoring, and collecting loans for banks. If a consumer fails to make a payment, Alipay will directly deduct the principal and interest from their Alipay balance or liquidate their investments.

It is important to note that Ant Financial does not assume credit risk. The banks are the ones that issue the loans and take on the credit risk. Alipay is simply the platform that facilitates the transaction for a fee.

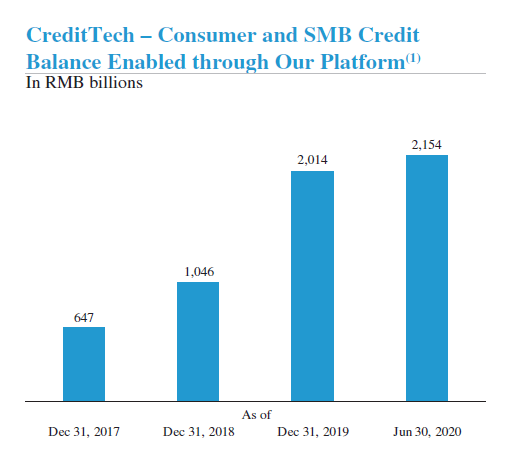

The growth of its CreditTech has exploded over the years, from RMB 647B in 31 Dec 2017 to RMB 2,154B in 30 Jun 2020, largely due to three reasons:

- Alipay has a huge reach of 1 billion users and is able to help partnering banks reach underserved consumers.

- China’s younger generation consumes more and takes on more debt.

- Due to a frictionless interface and a large amount of data points, they were able to market credit products more effectively.

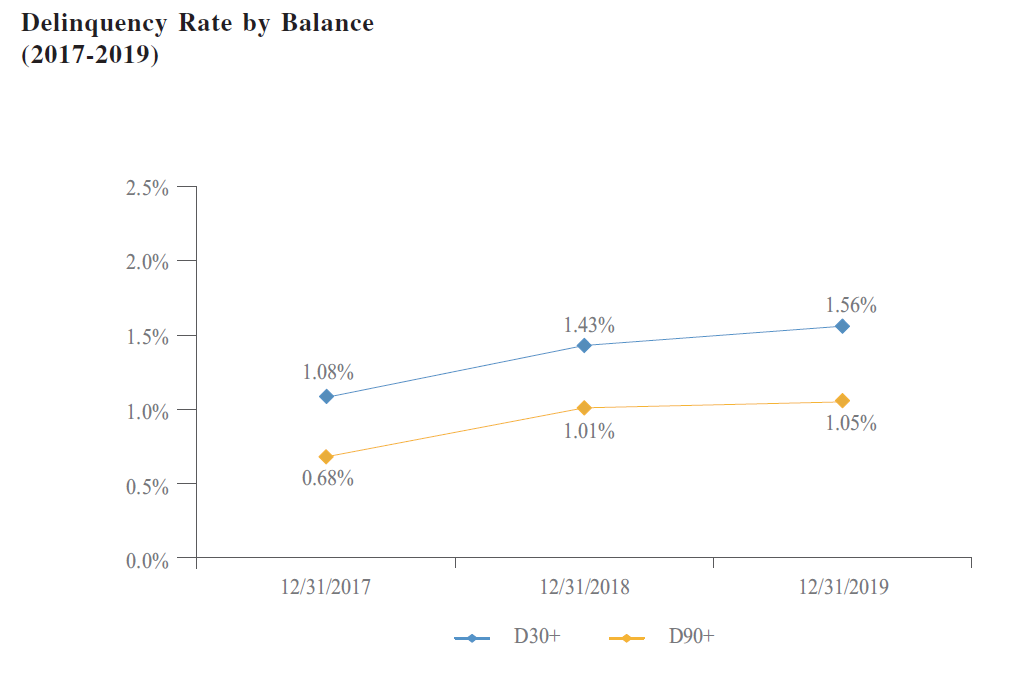

Since its loan portfolio has grown rapidly, its delinquency rate has increased, which may be why the government is concerned. However, this is far below America’s delinquency rates of 3% to 5%.

Before we move on to other InvestTech and InsureTech, I would like to take a pause here and talk about regulations and its piff with Ant’s CreditTech

The Problem With CreditTech

Ant got into trouble over CreditTech. Below are some headlines from Baidu: “Huabei advert, you can’t get people to spend borrowed money like this.”

Here’s what the advert says, “A family of three, no matter how thrifty you are, when it comes to your daughter’s birthday, you have to put up a good celebration. With Huabei, you can.”

It’s not unusual for advertisements such as this to encourage young consumers to live beyond their means, to remind them that time is short, moments are precious, and to live out their passions by borrowing money.

An average loan size of USD $300 on Huabei may not sound like much, but we need to put this in the context of China, where having a USD $295 monthly salary would put them in the middle class. There is a growing concern that Ant’s products target uncreditworthy, vulnerable consumers.

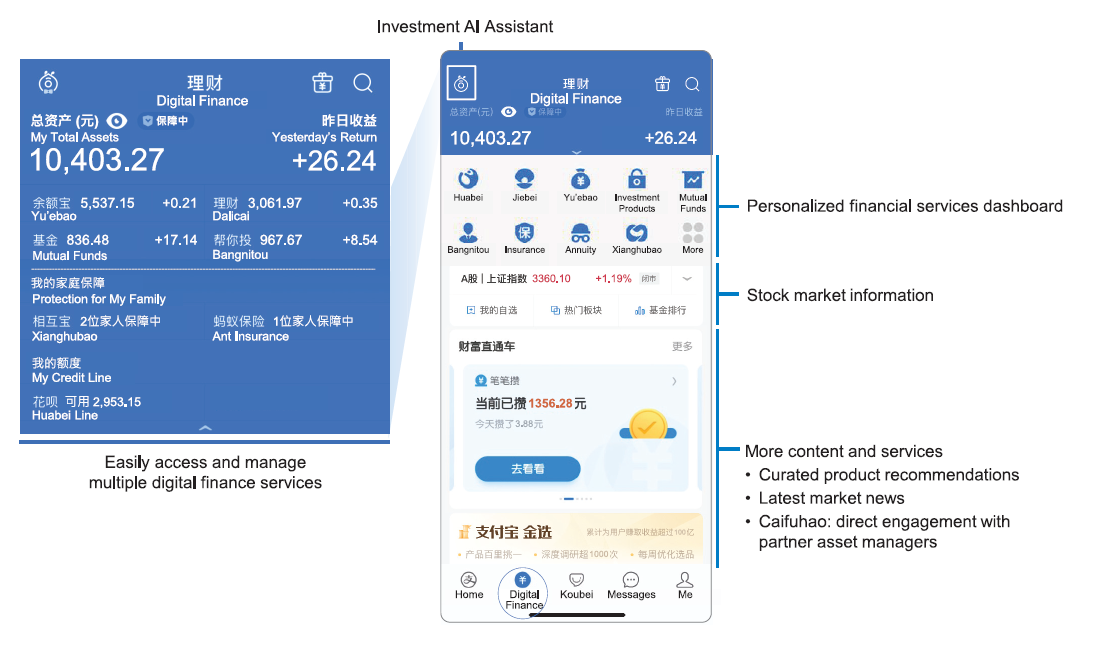

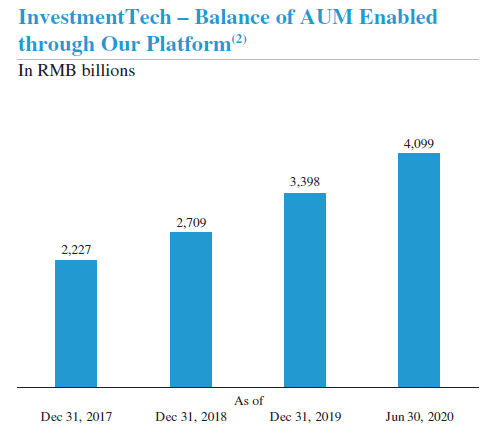

(2) InvestmentTech

Historically, most Chinese households invested their savings in bank deposits and real estate. This was when Alipay identified an opportunity to allow consumers to generate returns on their account balances by creating Yu’ebao (餘額寶), the largest money market fund product in China that allows consumers to earn a return while allowing the funds to be instantly used for everyday purchases.

Yu’ebao was designed with inclusivity in mind, so low income users can participate in growing their wealth. The minimum investment threshold is RMB 1 and there’s an instant redemption feature, enabling consumers to pay with their Yu’ebao instant redemption feature or redeem funds on the same day.

There’s also Yulibao (餘利寶), which is a one-stop investment management product for small businesses. It features a low investment threshold, free fund transfer and a speedy deposit and withdrawal process.

Beyond money market funds, Dalicai (大理財) is a marketplace that connects over 6,000 investment products from insurers and banks. It offers products such as mutual funds, fixed term products amongst others.

To further value-add and make its platform stickier, Ant Financial launched Caifuhao (財富號), a communication tool for asset managers to engage customers and provide value-added services such as investor education and customized investment services.

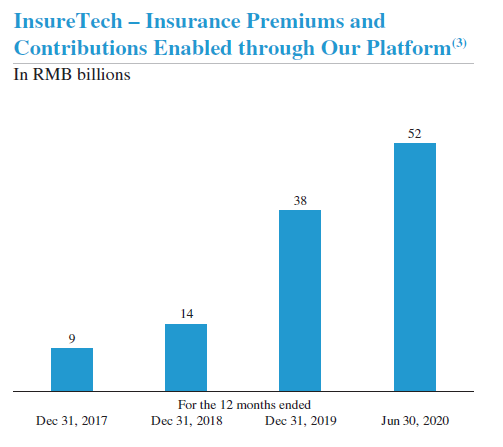

(3) InsureTech

Similarly, InsureTech is a platform for insurance companies to reach consumers. The aggregation of demand and supply provides convenience, a low minimum policy size, transparency, and competitive pricing.

Revenue Mix

In its beginnings, Ant Financial focused on payments, but in recent years, the company’s credit technology has become its biggest source of revenue, and it is still growing rapidly.

Regulations

What Will Happen To Ant Financial?

Regulations are aimed at Ant’s CreditTech segment in order to curb excessive debt among millennials who are choosing lifestyles they cannot afford. While China understands the importance of debt financing, when it is taken to extremes for frivolous consumption, they are less likely to welcome it.

Here are the draft rules that regulators came up with:

- Individuals: Max loan amount of RMB 45,000

- Businesses: Max loan amount of RMB 150,000

- Online microlenders should fund at least 30% of any joint loan with financial institutions

It’s the final rule that kills. Now, Ant Financial needs to set aside a lot of capital for growth instead of just being a tech company that collects platform fees.

At the end of June 2020, the outstanding consumer credit balance enabled through Ant Group’s platforms amounted to RMB 1.73T (USD $258 billion) and approximately 98% was either underwritten by its partner financial institutions or securitized.

Ant will restructure into a financial holding company regulated by China’s central bank. Alipay will resume focusing on payments and likely will not display financing options in its app.

The hypergrowth of CreditTech will most likely slow down.

Common Prosperity

Alibaba and Tencent have come forward to pledge an investment of more than USD 15 billion each by 2025 in common prosperity related projects.

The biggest misconception I see on the internet is that this is a donation.

It is not.

It is far easier for the Chinese government to raise taxes or levy fines if they just wish to extract money from its tech giants’ coffers.

In Xi Jinping’s speech on common prosperity titled 扎实推动共同富裕, the essence of Xi’s speech was to equalize the playing field for the less well to do and to grow China’s middle class.

He was particularly concerned about China’s youth “lying flat philosophy” and this wasn’t a Chinese phenomenon only. Young people in South Korea and Japan are also increasingly losing motivation since they seem to be at the losing end of life, no matter how hard they work.

He was also concerned about the rural areas of China not being able to keep up with China’s growth. His leadership position would be threatened by the widening income gap.

Technology giants have been allowed to flourish and grow for far too long. Alibaba & Tencent have built extremely strong moats in the process, and their innovation has made China a better place overall.

However, there were negative spillovers that the government is trying to address.

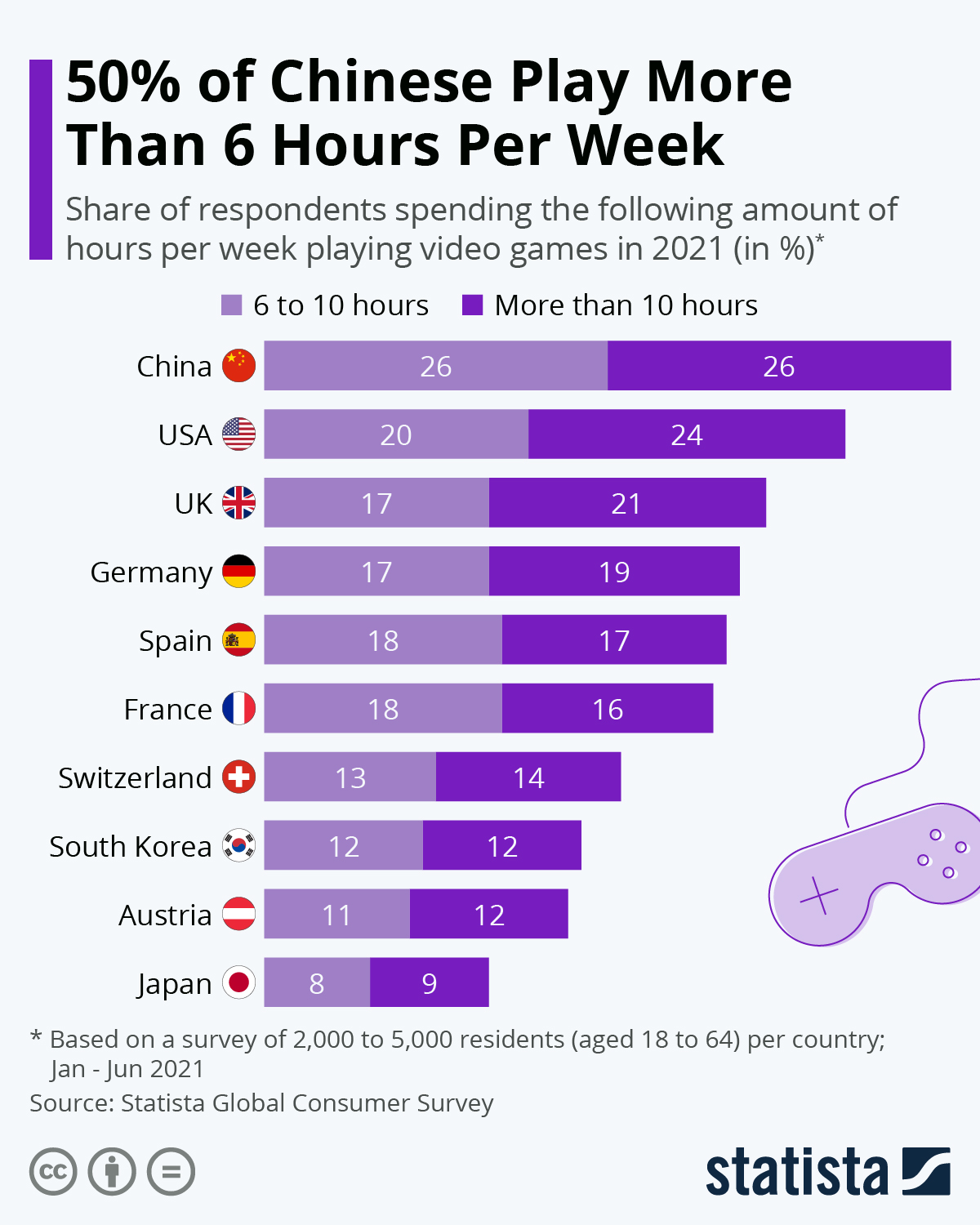

Tencent, for example, makes games that are so addictive and good that the Chinese outplay every other country.

For Alibaba, increasing domestic consumption is good but driving up sales of frivolous products by taking on credit is unwanted.

Instead of investing in projects that maximize profits alone, the giants should also consider other factors.

Alibaba will, for example, invest in digitizing rural villages and encouraging them to participate in ecommerce, both domestically and internationally. Tencent will create games that encourage children to aspire to be scientists, astronauts, doctors, etc.

Even though these projects might be less profitable, that doesn’t mean they will be unprofitable. China’s government did not set a rule that tech giants had to be unprofitable for these projects. They are aware that tech giants are an important chess piece for innovation and to win the tech war for China.

This would actually lead to more sustainable growth. Because of the competitive nature of people and businesses, if the government didn’t intervene, individuals and businesses would always push boundaries. In my opinion, the government steering tech giants in the right direction is a net plus.

This might seem to create unnecessary costs for China’s tech giants. No doubt, there is an increased cost. But to put this USD 15 billion commitment to the common prosperity projects by 2025 in perspective, Google is rumoured to pay Apple USD 15 billion in 2021 alone just to remain the default search engine. This isn’t a one-off expense, Google is estimated to have paid USD 10 billion in 2019 and USD 12 billion in 2020.

Now the common prosperity fund probably seems to be a cheap price to pay to maintain its monopolistic status in China.

Update on Opening Up of Ecosystem

The Alibaba Deep Dive: Part I revealed that WeChat will need to integrate the Alibaba suite of apps into its mini-programs and let users share Taobao links in WeChat.

However, it is not without problems. Prior to the 11.11 mega sales, Tencent made it extremely difficult for Alibaba to set up its mini-program in time.

Even though Taobao’s link can be sent via WeChat, the interface quality is drastically different.

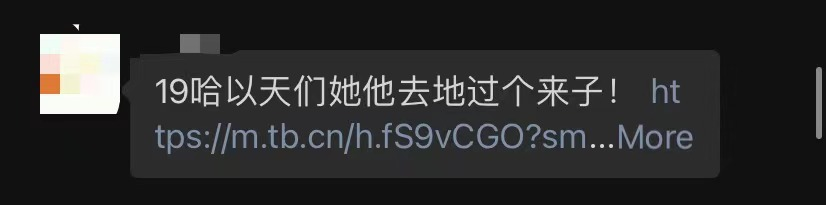

Here is Taobao’s link on WeChat which looks hideous from a UX perspective:

Image from Tech Buzz China

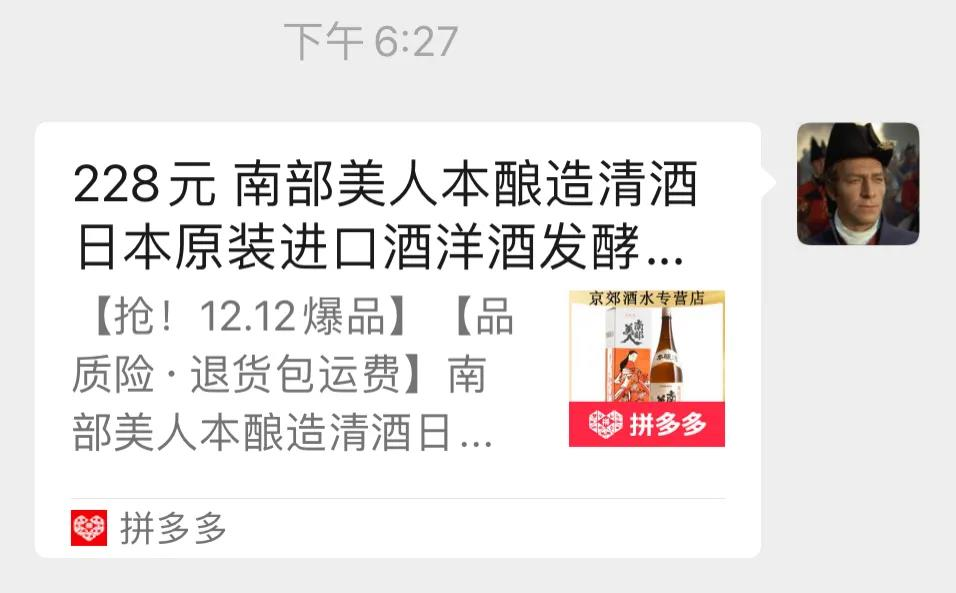

And here is Pinduoduo’s link on WeChat:

Image from Tech Buzz China

It is no secret that Jack Ma and Pony Ma are nemesis, and here is a meme that went viral in China a few years back where Pony’s thought bubble is “Guy (Jack Ma) who makes money off women” and Jack’s thought bubble is “Guy (Pony Ma) who makes money off children”.

That is because the bulk of Alibaba’s revenue comes from women’s fashion products and the bulk of Tencent’s revenue comes from gaming.

Geddit? 😂

Opening up ecosystems won’t be easy, but with time it will be sorted out because it won’t be worth it to keep playing gangster with the government looking over their shoulders.

Valuation

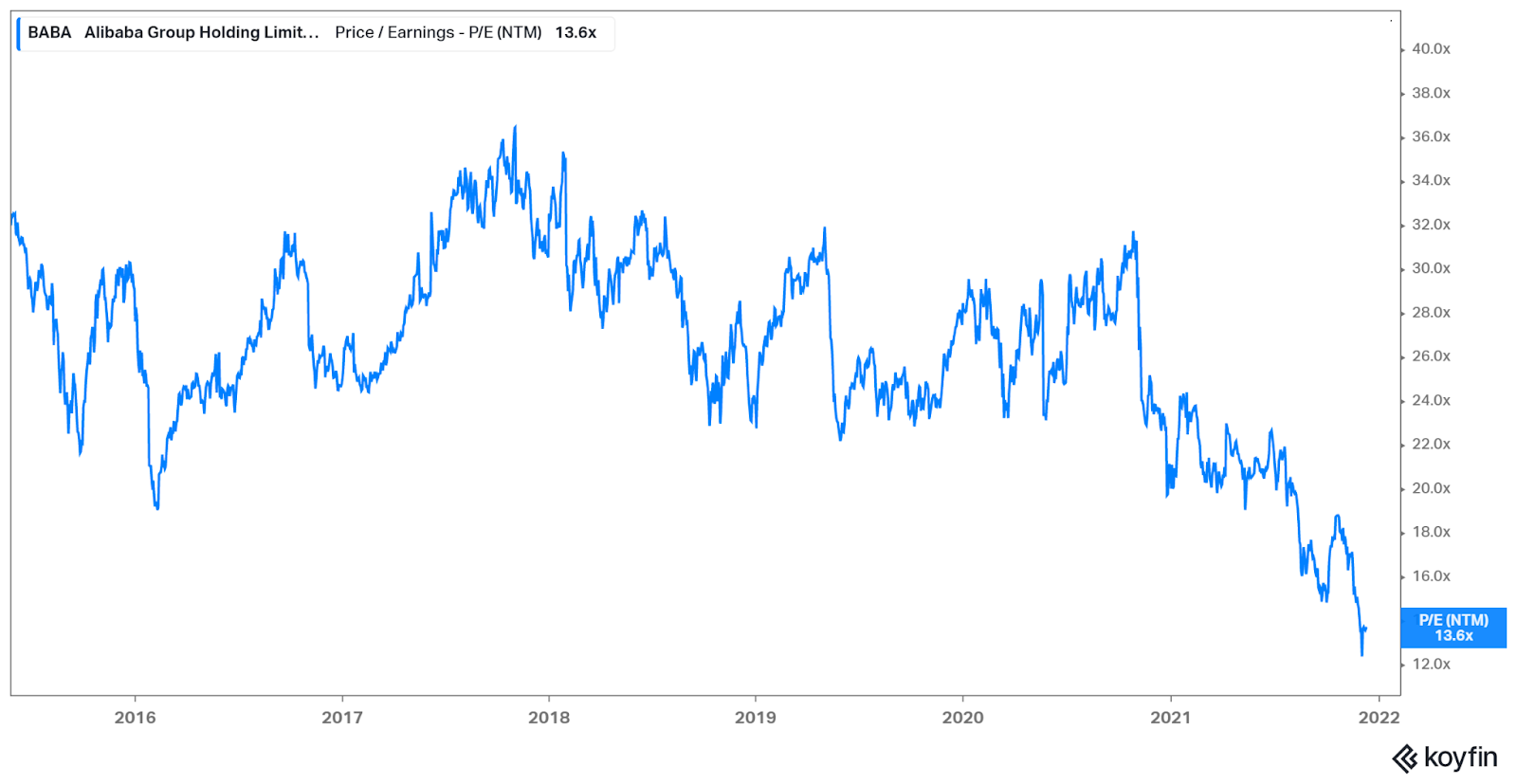

When we examine Alibaba’s valuation using the PE ratio, it’s clear that they are extremely cheap regardless of how we compare it (against itself historically, against other ecommerce players or against the market).

As a result of a PE multiple of 13x, the market is sending a message that Alibaba will lose its competitive advantage and will become a commodity business with little to no growth.

Investing requires us to think probabilistically and consider the risk/reward of our investments. In my opinion, the Chinese government is unlikely to destroy Alibaba’s economic engine (but that doesn’t mean that it can’t happen). Alibaba should command a multiple of at least 20x over time, if fear and pessimism subside. To provide context, the multiple for the S&P500 is currently 29x.

Here’s my back of the envelope valuation of Alibaba:

Assume the company’s revenue of USD 126.4 billion grows at 15% CAGR to USD 254.2 billion over the next five years. Based on a 15% net margin, net income in 2026 will total USD 38.1 billion.

Additionally, Alibaba has committed USD 15 billion to buying back shares by 2022 and has spent USD 3.7 billion since April 2021. Based on today’s share prices, USD 12.3 billion represents 3.6% of outstanding shares.

With 2.6 billion shares outstanding, its EPS will be $14.45 per share. With a 20x multiple, its projected share price is USD 288.90.

The current share price of USD 126.58 represents a CAGR of 17.9%.

Conclusion

If Alibaba’s narrative isn’t as bad as Mr. Market thought, Alibaba’s valuation seems conservative and investors would be rewarded well.

Investing requires us to think in probabilities and determine if the narrative is actually as negative as the market assumes. In my article, “Has the Investment Thesis for Alibaba Turned Sour” investors have to monitor if the regulations have truly impaired Alibaba’s economic engine by monitoring its ecommerce and cloud business segment.

Disclaimer: This research reports constitute the author’s personal views only and are for educational purposes only. It is not to be construed as financial advice in any shape or form. From time to time, the author may hold positions in the below-mentioned stocks consistent with the views and opinions expressed in this article. Disclosure – I hold a position in Alibaba at the time of publishing this article (this is a disclosure and NOT A RECOMMENDATION).

Become a member and gain access the entire archive of reports including Facebook, Twilio, Sea Limited, Crowdstrike, Starbucks and more!

This research report comes as a breath of fresh air. Most reports on platforms like Seeling Alpha are usually a “cut paste” of the investor presentation. This one is packed with information and at the same time does not get too technical or boring.

The point on the “donation’ was a revealation as i had read i multiple places that it was indeed a donation in lieu of tax.

Thanks Sudharshan.

The common prosperity is a tricky one. Based on what they have publicly put out in terms of what they have been investing in, it seems to suggest that they’re investing for growth, but those projects must benefit society at large.

It doesn’t mean that these projects will be unprofitable, although it is definitely less profitable than if they were left freely to reinvest on the highest ROIC projects.

hi Thomas, what is your take regarding the news that Charlie Munger recently sold half of his holding in Alibaba ? Do you hold any BABA shares and will you recommend following CM’s latest action ? Thanks, BK

I don’t do recommendations. But here’s my guess on CM selling half his holding in BABA.

If the company isn’t a good investment he would have sold everything. He might have:

1. Converted to HKEX

2. Liquidated to reduce leverage

3. Use some of the proceeds to buy another foreign company

Hi Thomas,

I’ve just become a recent subscriber to your newsletter and came across you from the TIP podcast I’ve been listening to for years. I want to tell you that your analysis and summary on Baba is the best I’ve come across, and everything you’ve laid out is completely aligned with my own analysis and investment thesis on Baba and Tencent. I’ve been managing my own investment portfolio for a little over 5 years now but I delved into it since Covid and that’s when I started reading tons of books on Buffett, Pabrai, Guy Spier, Munger, and all the value investors I came across. This is now a passion and hobby of mine and I spend all day reading and learning. I just want to say that I am very glad that I’ve found you and I look forward to reading more of your writings

Thanks Jerry! Glad this is helpful 🙂