“Bull markets are born on pessimism, grown on skepticism, mature on optimism and die on euphoria. The time of maximum pessimism is the best time to buy, and the time of maximum optimism is the best time to sell.”

– Sir John Templeton

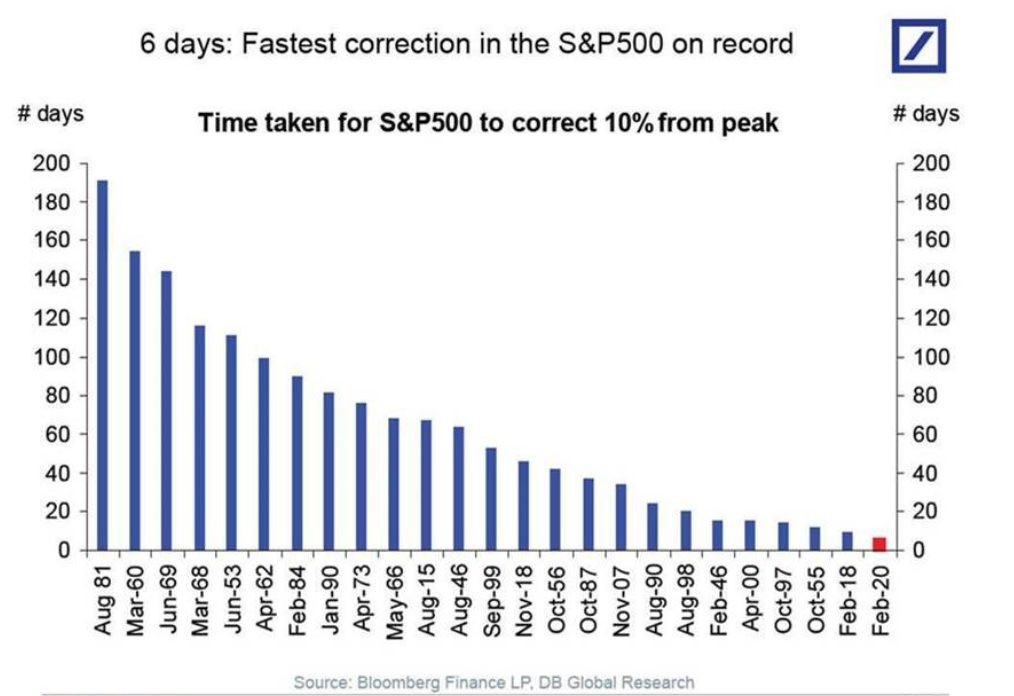

In the two months after Feb 2020, the S&P 500 has been trading like a penny stock, making extremely volatile movements of more than 5% on many trading days. It took only six days to reach correction (a decline of 10%) and 16 days to become a bear market (a decline of 20%). It was one of the fastest drawdowns in the market since its inception.

The upswing was as intense as the downswing, with the market rebounding 28.5% since its bottom on 23 Mar 2020.

“In fact, you can argue that if you’re not willing to react with equanimity to a market price decline of 50% two or three times a century you’re not fit to be a common shareholder, and you deserve the mediocre result you’re going to get compared to the people who do have the temperament, who can be more philosophical about these market fluctuations.“

– Charlie T. Munger

A Look at Previous Crises

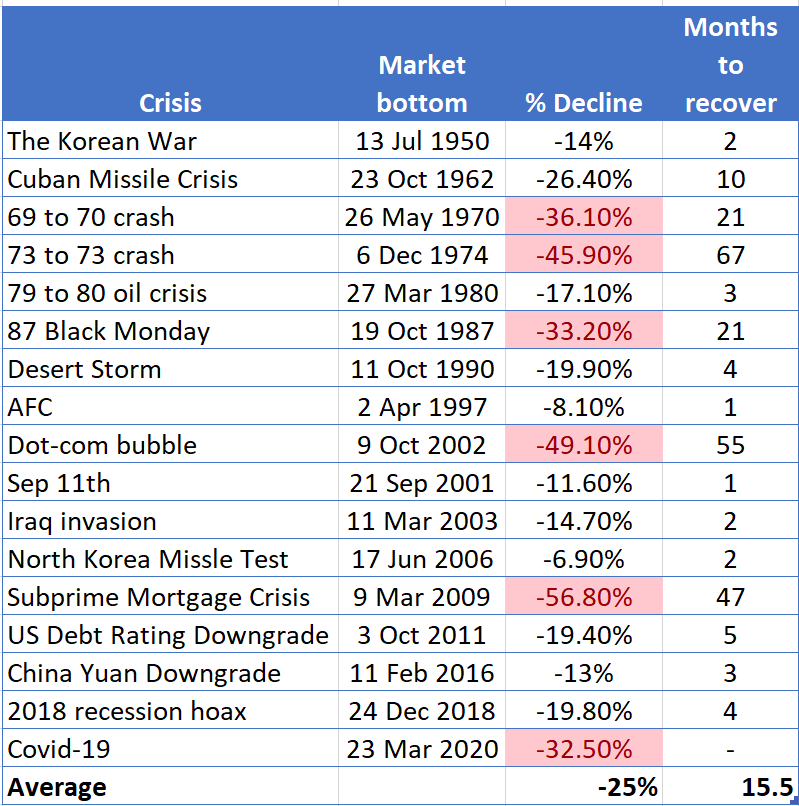

Historically, we experience a 10% market drop every two years. Since the 1950s, stocks have fallen 20% or more only 11 times (about once every six years). Including now, a decline of 30% or more has only happened six times—an opportunity that happens once every 12 years.

“The time to buy is when there’s blood in the streets.”

Investors should always expect the market to move up, down or sideways. We should not be surprised when the market has a sharp drawdown. However, when something this drastic happens, it will freeze most investors. Some of the most common statements I heard amidst this COVID-19-induced downturn included:

- I may be catching a falling knife

- Unemployment claims have never been so high before, there is too much uncertainty

- Globally, the number of infected cases is still rising exponentially and we don’t see anyone travelling or dining out soon

These are all legitimate concerns, but in investing you either get a cheap valuation or a rosy outlook; you will never have both at the same time. You pay a very high price in the market for a cheery consensus. The important question investors should be concerned about is,

“Which companies will survive and do even better coming out from this crisis?”

Someone once said that the best time to buy is when your stomach starts to churn. And it is important for us to prepare a watchlist of high-quality companies so that we may take advantage of the downturn. As Howard Marks put it best in his recent memo: “The most important thing is to be ready to and take advantage of declines.”

The Market Has Emerged Higher from Every Crisis

COVID-19 is going to leave a mark, but it is going to come and go. If history is a good indicator, the stock market will increase over time as corporate profits rise. Despite ‘unthinkable’ disasters happening, America’s markets have displayed their resilience and it would be unlikely that COVID-19 will destroy their economic engine permanently.

As the saying goes, this too shall pass.

On average, US corporate profits rise 8% annually. But bear in mind that companies do not increase profits on a straight-line. There will be down years and up years, and what’s most important that we understand our companies to have the conviction to hold through downtimes.

Equally important is that we must not invest in cash that we need within the next 5 to 10 years and we must not invest our emergency savings. The market can sometimes stay irrational longer than you can stay solvent.

What Do I Do During a Crisis?

I buy.

More specifically, I buy companies on my watch-list in tranches. There is no rule to this and I deploy my available funds based on probability of these events happening:

- 20% market decline: Likelihood of occurrence is 15%, I will deploy 50% of my available funds at this stage

- 30% market decline: Likelihood of occurrence is 8%, I will deploy 30% of my remaining funds at this stage

- >40% market decline: It has only happened 3 times since 1950, I will be fully invested by this point.

Apart from deploying my available cash, I would also be selling lower-quality stocks in my portfolio and buying high-quality companies as the market throws them out. High-quality growth companies and cheap/ reasonable valuations seldom come hand-in-hand. So when the market gives you the opportunity to be an owner of these companies, pounce on them!

As you sell your companies to buy high-quality companies in a downturn, it will inevitably be painful as you will likely have sold it at a discount. In moments like these, it is helpful to remember Warren Buffett’s saying:

“I’d committed the worst sin, which is that you get behind and you think you’ve got to break even that day. The first rule is that nobody goes home after the first race, and the second rule is that you don’t have to make it back the way you lost it.“ – Warren E. Buffett

Conclusion

To sum it up, markets will go up in the long run and during a crash, there will be a lot of commentators predicting what will happen next. The most important thing is to have a watch-list beforehand and follow your game plan as the market provides you with opportunities to own great companies. Never invest in cash you would need in the next 5 to 10 years, you must stay in the game for this to work.

You can also follow my Facebook page for updates here!