It has been an exciting and impactful year, to say the least.

It is the year I quit my job and plunged waist deep into entrepreneurship full-time. The experience reminds me of an ancient Chinese saying that goes “break the kettles and sink the boat (破釜沉舟)”, which refers to Xiang Yu’s order for his troops to sink their boats and destroy all but three days worth of rations in order to force his men to choose between prevailing against overwhelming odds within three days or die trapped before the walls of the city with no supplies or any hope of escape.

Despite being heavily outnumbered against the Qin forces (20,000 versus 300,000), this act of destroying their alternatives for escape committed his troops and they emerged victorious.

As soon as I resigned and committed to doing this full-time, I started executing my blueprint.

My business blueprint was built around three constraints:

(1) It must be scalable with a one-man operation

(2) Low burn rates

(3) Do what feels like play to me but is work to others

The internet gave me the opportunity to scale while minimizing fixed and incremental costs (exactly the type of companies I invest in), and analyzing companies has always been my passion. Therefore, I decided to launch an investment research service.

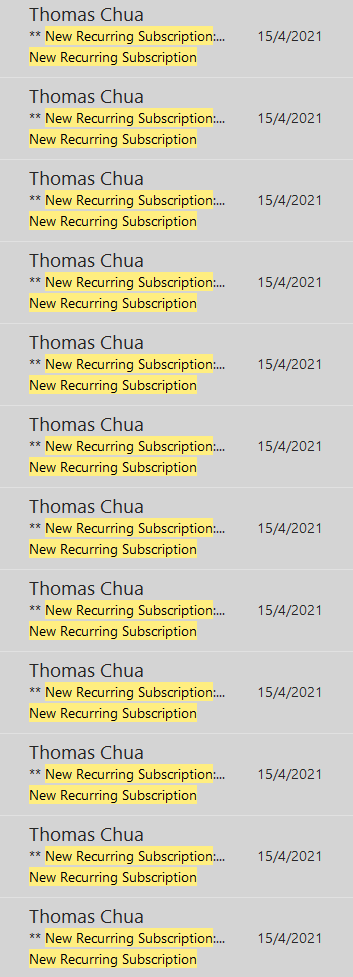

The day I launched my subscription on April 15, 2021, it was nerve wracking as hell.

There were plenty of doubts in my head, “will people actually bother to take out their credit card and pay for my content?”

For one year, I published one to two articles weekly with the goal of sharing the investing frameworks that I learned from the world’s best investors.

At this point, I hadn’t published any research reports yet, had no testimonials, and had done very little marketing (seriously, I just sent an email to my subscribers informing them I was launching an investment research service).

When subscriptions started coming in, I took a deep breath of relief. The fact that readers found my content beneficial was more important than anything.

Now, eight months later, I am grateful for the growth of my subscriber base and for the trust my early readers had in my work.

Join hundreds of readers and get access to in-depth research reports on high-quality businesses by registering today.

With that, let me share with you the top five articles, tweets, and books I re-read for 2021!

The Five Most-Viewed Articles

The five most-viewed articles on Steady Compounding according to page views:

- Mohnish Pabrai’s Spawners Framework — Five paths that could lead us to the next 100-bagger.

- Lessons From Nick Sleep of Nomad Investment Partnership — Scaled economics shared allows companies to become stronger as they grow.

- Sea Limited Deep-Dive Part 1: Garena — The gaming behemoth sitting in Sea Limited.

- Has The Investment Thesis for Alibaba Turned Sour? — Reviewing regulatory impact on Alibaba’s latest earnings.

- Figured out a Company’s Intrinsic Value with PE Ratio — This article has been top five for the second year now. Valuation is important but it doesn’t have to be complex.

Top Five Twitter Threads

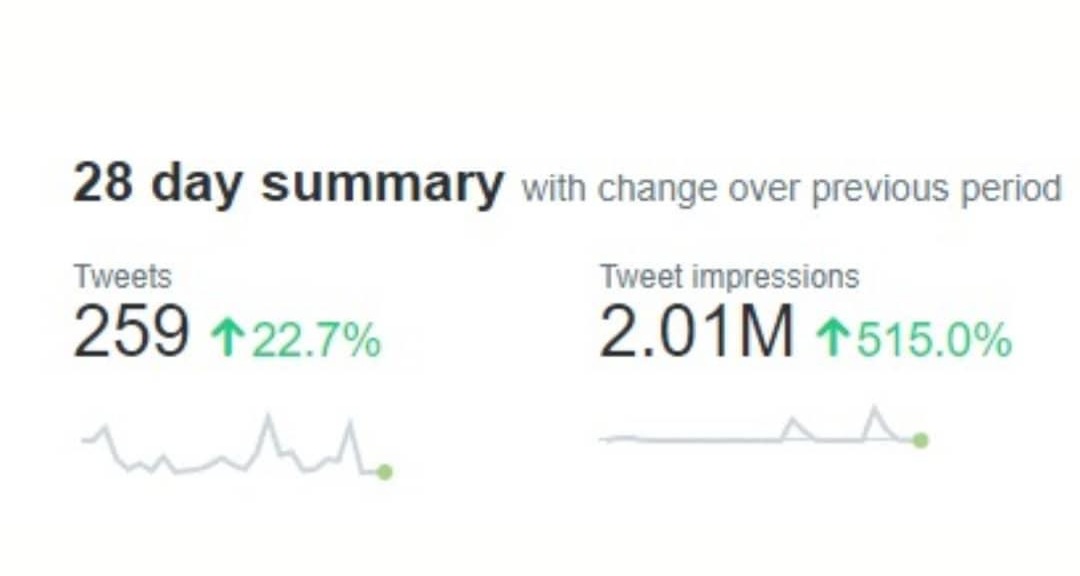

I started becoming active on Twitter this year after some friends advised that it’s a great platform to network and grow my reach.

Here are my most viral threads:

- Top five threads from Twitter University

- Lessons from top fund managers

- Top five Youtube videos on investing

- Lessons from Terry Smith’s Investing for Growth

- Lessons from Marathon Asset Management

Top Five Interviews/Webinars

Here are the most popular interviews/webinars I have been on:

- The Financial Coconut: Sea Limited breakdown

- Webinar: Value vs Growth

- MoneyFM: Finding High-Quality Compounders

- Compounding Curiosity

- Growth Investing Secrets — Life as a full-time investor

Five Books I Re-read This Year

Great books are worth reading multiple times. I found that I get different insights when I read them at different stages of life.

Five books I’ve re-read:

- The Essays of Warren Buffett: Lessons for Investors and Managers

- Capital Returns: Investing Through the Capital Cycle: A Money Manager’s Reports 2002-15

- Tools of Titans: The Tactics, Routines, and Habits of Billionaires, Icons, and World-Class Performers

- Tao Te Ching

- Poor Charlie’s Almanack: The Wit and Wisdom of Charles T. Munger, Expanded Third Edition

Research Reports [Paywalled]

- Twilio — The leader in communications software

- Starbucks — An internet company selling coffee?

- Facebook — “Evil” empire or misunderstood opportunity?

- Chinese regulations dossier

- Sea Limited: Garena — The cash printing machine

- Sea Limited: Shopee — The gamified shopping platform

- Sea Limited: SeaMoney — Becoming a superapp

- Should investors be worried about common prosperity?

- Crowdstrike — Protecting endpoint devices

- Alibaba: Part I — ecommerce and cloud

- Alibaba: Part II — Ant Financials and regulations

Fantastic work this year Thomas.

I couldn’t be happier to see your successes!

Thanks buddy!

Congratulations on your bravery and your success this year.

Thanks fellow Thomas!

i like the 三国演义 analogy 🙂 deep respect for your courage and determination

Hi Si Min! Thank you for always being so encouraging 🙂

Appreciate your readership!