No one knew the market would decline more than 30% in March.

No one knew it would recover all its losses by August.

No one knows what it will do the rest of the year.

— The Motley Fool

The year 2020 has been interesting, to say the least, with the market crashing down at an astonishing speed, and then shooting back up within a short period of time.

New winners and market leaders will emerge from every crisis. For the COVID-19 crisis, tech companies have emerged as the clear winner. Early into the crisis, as CEO of Microsoft, Satya Nadella put it, “We’ve seen two years’ worth of digital transformation in two months.”

While Mr. Market is being lazy and pricing all SaaS companies to the moon, not all of them will be worth the rich valuation. Companies are likely to cut costs and non-essential cloud services are likely to be terminated.

Furthermore, if the pricing model is based on per employee subscription, a surge in unemployment would cause some serious pain for some of the SaaS companies.

Drew Dickson of Albert Bridge Capital describes the current environment best in his latest letter:

People shouted about the “new era” in 1972 and again in 1999; and they are shouting about a new era in 2020.

There is no new era. Stocks are still worth the present value of their future cash flows

Alright, enough of my ramblings. Let’s hear what fund managers have to say about the current environment!

P.S. You can access all fund managers letters and learn how to track their buys and sells under Resource.

Nick Train, Lindsell Train

The letter for his UK’s fund can be found here and global fund here.

When Mr. Market’s mood swings sharply in both directions and it’s tough to reasonably estimate business value:

In a market marked by big swings in sentiment and with, understandably, little clarity about the prospects for many businesses we stick to a favoured adage – “when in doubt do nothing.”

While there’s a huge uptick for “virtual” experiences such as e-sports, humans are fundamentally social creatures. Innately, we yearn for “real” experiences:

I have no doubt that human beings both crave & will return to “real” activities & experiences. Clubbing, Disney theme parks, luxury shopping and, yes, attending live football matches will all come again. Because it is human nature.

Fred Liu, Hayden Capital

One of my favorite letters to read, can be found here.

During the second quarter, they generated 93.2% returns for the fund, compared to S&P 500 returning 20% and the MSCI World returning 18.8%.

They attribute their competitive advantage to their ability to stomach volatility. It is an important trait that differentiates the greats. For investing, legend Peter Lynch says the key organ in your body is your stomach, it’s not your brain.

Stock prices moving up and down is not risk. Buffett explains “Risk comes from the nature of certain kinds of businesses. It can be risky to be in some businesses just by the simple economics of the type of business you’re in, and it comes from not knowing what you’re doing.”

The benefit for our partners though, is that there’s very few investors who are set up to tolerate such volatility – which means that we have sparse competition for our strategy & return profile.

Although the fund has generated outsized returns this quarter, the big money lies in the long-run. The ability to stay invested is just as important as identifying the new winners and future market leaders.

Even though our investments have performed well since that capital call a few weeks ago, I firmly believe the real money is going to be made in the next several years, as consumers take their new habits and the increased online reliance developed during this period, into well after this virus subsides.

There’s going to be multi-bagger returns for the winners, far beyond the mid-teens percentage rebound we’ve seen in the indices these last few weeks

On how they achieved two 10-baggers within two years (SEA) and six years (Amazon) respectively:

The takeaway is, we need to find companies that 1) are growing quickly, 2) are capturing more value as they grow (as opposed to leaking that value away into their ecosystem), and 3) buy them at an underappreciate multiple which will (hopefully) expand over time as the company proves itself, and thus providing a tailwind to our stock performance.

Not all sales growth are good:

However, the nuance is that the sales growth must come from value-adding activities, either in the form of direct profits, or by strengthening the business’ network effect with each new customer added.

VIG Partners

The letter may be found here.

They discussed their error of selling Spotify based on their concern that churn would increase due to lower usage from less traveling. Lesson here — Never buy or sell based on short-term issues.

Selling a long-term investment holding based on short-term issues is an error that we rarely make, and we will learn from this bitter experience.

Sell only when growth prospects have diminished, not when the share prices have had a run-up.

There have also been occasions when we have forgone substantial gains by selling high-quality companies which are continuing to growth rather than stay the course. We need to avoid the error of “cutting the flowers and watering the weeds.”

If we have extracted substantially all the value from a situation, particularly in a company that has a relatively modest growth outlook, we need to be disciplined about selling.

Characteristics they look for in a business:

An attractive industry structure, pricing power, a resilient revenue stream, high cash-flow generation, a strong balance sheet and the potential to steadily grow earnings.

Jake Rosser, COHO Capital

A copy of his letter may be found here.

The fund delivered a return of 46.6% for the first half of 2020. The most important takeaway on investing from this pandemic:

While the pandemic pulled forward digital demand, the more important takeaway for us is the notion that a good business model provides the ultimate margin of safety.

On evaluating consumer facing technology companies:

One of the most important considerations in consumer facing technology investing is asking whether the product alleviates pain points, reduces friction or enhances convenience. Whether it is Amazon, Netflix or Peloton, all winning consumer platforms exhibit these attributes.

On investing in platform leaders:

Value investors talk a lot about patience, but typically it is about waiting for the market to rerate a company’s multiple after digesting an excisable problem. Better yet is the patience required for a company achieving global scale in a winner take most market – Facebook, Netflix, Google. The economics of these businesses are rarely apparent when in reinvestment mode, but the dominant strains of their business model often are.

Daniel Loeb, Third Point

You may find the letter here.

Third Point was traditionally an “event-driven, value-oriented” fund focusing on special situations such as spin-offs, demutualization, and post-reorg equities.

Side note: To learn more about this strategy, check out Joel Greenblatt’s book: You Can be a Stock Market Genius : Uncover the Secret Hiding Places of Stock Market Profits.

As markets have evolved, selecting high-quality companies on top of the traditional value plays have become essential.

As markets have changed, I have realized that while event‐driven is still an essential investment lens, today, quality is also an essential screen.

This investment environment is characterized by breakneck technological innovation and sluggish growth which has only been amplified by COVID‐19. Considering this, it is essential to find companies with great leadership and unique products in growing end‐markets in which they are gaining share and achieving high topline growth and strong margins.

It is also important not to make the mistake of overpaying for these “compounder” companies.

However, when investing in a quality or “compounder” company, it is critical to find an entry point at which an investment is attractive since most of these businesses trade at relatively high multiples.

Peter Rabover, Artko Capital

The letter can be found here.

On the recent market’s dislodge between prices and value, from speculative surge of unprofitable firms such as Hertz and Kodak, to sharp increases in prices due to share splits such as Apple and Tesla, which has no bearings on value:

It is the problem of the definition of “the stock market.” At the heart of it, the stock market is a market where participants exchange fractional ownership of 1000s of companies which are called stocks.

While this may seem like an obvious statement, it is not called “fractional ownership of companies market” and for a lot of market participants the term “stock” becomes something of a cognitive dissonance from what it truly represents and takes on a meaning of its own.To put another way, the market has participants that are interested in investing in companies underlying the stocks and for them the stock market is a medium through which they can invest in those companies.

The market also has a speculative arm of those that invest in stocks and for whom the underlying company economics matter less, if not at all and the trading behavior of the instruments matter more. These parties are more interested in the patterns of the stock prices and pay close attention to actions of buyers and sellers.

What we are witnessing today is almost a complete domination of the speculative arm of the market, impervious to the deep recession we have found ourselves in, chasing momentum in stocks.

On their strategy with operating leverage (read more about operating leverage here):

While “old school” value investing involves buying companies at cheap price to book values and hope they revert to the mean, our strategy involves buying companies at balance sheet prices and with the expectation that their fundamental results missed by the market will make them valued as growth companies in the long term.

The market has consistently underestimated the operating leverage of companies on the way up and on the way down, which is where we generally like to find most of our ideas, a lesson we learned early on in our career from Michael Moubisan (formerly of Legg Mason) and have reliably witnessed work a substantial number of times over the last two decades.

David Einhorn, Greenlight Capital

As always, Einhorn disses Tesla again in this quarter’s letter. You may read more about it here.

One thing I learn from his continuous spat with Elon Musk is to never short a company with a cult-like following. It can get really expensive even though your points about their accounting and valuation are spot on.

Einhorn shares the same sentiment as Rabover from Artko Capital on the current market euphoria:

We believe the market groupthink that profitless growth stocks that trade at astronomical valuations, in part on the basis that interest rates are low, will be disrupted by rising inflation expectations even in the absence of a corresponding increase in Treasury yields. Other markets like Japan and Europe have long recognized that artificially-controlled long-term interest rates are no justification for stratospheric equity valuations

Ensemble Capital

I have always enjoyed reading Ensemble Capital letters. They are of the view that the recession has ended as economic activities have started to pick up. You may read more about their thesis here.

As investors, we should focus on what matters and what we can control. Anything else is noise that should be ignored.

While we believe that we have a superior ability to do company analysis and select stocks that will outperform the market over the long term, we also know that we do not have any special ability to guess where the market will go in the near term.

This is one of the most frustrating realizations that we think all investors need to come to terms with. If in fact there was a way to systematically predict short-term movements in the market, we would be happy to adopt this approach. But in the absence of this ability, we know that attempts to guess where the market will go next, is one of the surest ways to ruin your long-term investment returns.

They also highlighted why stocks are not highly correlated with the US economy in the short-term.

I wrote about this back in April as well, stating that, “In performing a discounted cash flow (DCF) analysis, the loss of 12 to 24 months of cash flow due to a complete shutdown would generally reduce a company’s intrinsic value by no more than 5% to 10%.” You may read more about it here.

One mistake we think some investors have made during this unprecedented period, is substituting a forecast of the virus for a forecast about the economy or financial market performance. While clearly the pandemic is a huge negative impact on the economy, they are not the same thing. Stocks are not a direct reflection of the US economy.

The market does not care about the economy today, it cares about corporate cash flows over time.

Today, it seems that the stock market and the economy are totally disconnected. In reality, stock prices are reflecting a view that while the economy is very bad now, it will recover in the years ahead. And in fact, you do not even need to believe the entire US economy will recover to understand the rebound in the market.

Pollen Capital

You may read more about it here.

On focusing on things that matter and capturing the companies that are benefiting from the value migration:

While we do not make macro-economic predictions or claim to know how markets will perform in the coming quarters, we continue to have conviction in the strength and durability of the businesses we own and believe that most, if not all of them, will emerge from this period stronger.

The secular tailwinds that many of our companies enjoy also appear to be strengthening as a result of spread mitigation policies globally… The companies benefitting from these shifts have the largest weightings within our Portfolio.

Robert Vinall, RV Capital

This whole letter is worth a read as he covers on his new investments such as Tencent and offers good insight on analyzing businesses in their early stages. You may read more here.

Robert gave an honest review of his feelings during the crash, which is something most of us have to battle with during a sharp drawdown:

I would rate my own performance during the panic as, at best, average. I was tentative when I should have been bold. I preferred to add to existing holdings rather than make new investments. I held back some cash when I should have been all-in (whereby in my defence, I wanted to have cash available to be able to support our companies though ultimately it was not needed).

He also argues why investors shouldn’t only look at digital-first companies due to tail-end risk. Just as nobody expected a pandemic to take down the economy, it is hard to imagine a computer virus that would take down these companies.

In fact, in January I wrote that the greatest longtail risk to the economy was from a virus… of the computer variety (so near to glory, and yet so far). I still believe a computer virus is a major risk and strongly recommend reading “Sandworm” by Andy Greenberg to get up-to-speed on how fragile the Internet is.

The big lesson from this crisis, or any crisis, is that the unexpected sometimes happens. The correct investment strategy is not to try to predict the unpredictable (which is futile), nor is it to just own Internet companies (which is simplistic). It is to own companies that have sufficient reserves of strength to weather any crisis.

Bill Miller, Miller Value Partners

You may read the letter here.

On the disconnect between economic reality and stock prices:

The biggest problem with those who believe the market is disconnected with economic reality because the economic numbers still to come will be dreadful (and they will be) is that those numbers report the past and the market looks forward. The market predicts the economy; the economy does not predict the market.

My Final Thoughts

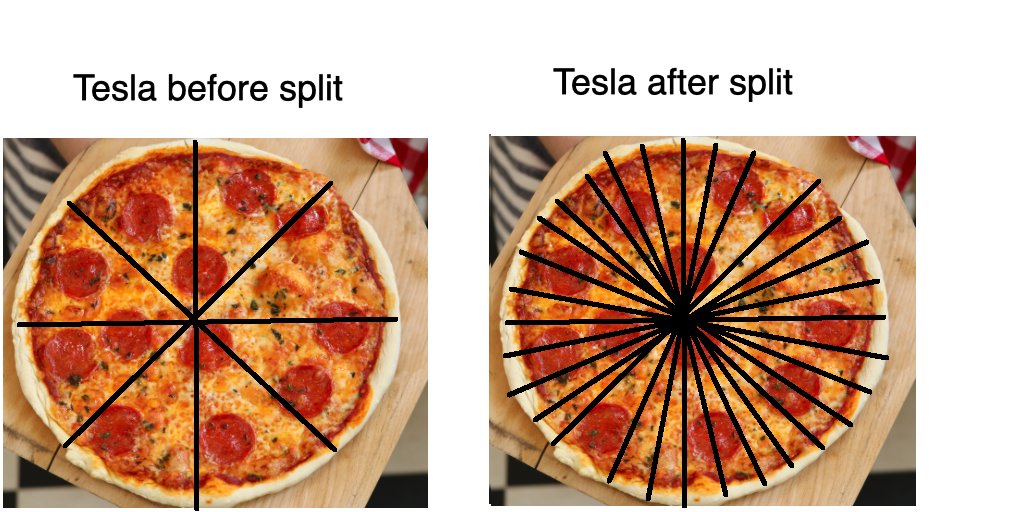

A few of my friends have talked to me about stock splits, given Apple’s and Tesla’s recent stock splits and its impact to intrinsic value.

TL;DR — There’s no impact on intrinsic value. Don’t invest because of the hype surrounding it.

The best way to explain stock splits is using pizzas. Cutting a 12-inch pizza into eight slices or 40 slices doesn’t change the size of the pizza.

It is still a 12-inch pizza.

Thank you for taking the time to read my blog.

3-Bullet Sunday is a free, weekly email, that hones your mind and keeps you growing. It is full of timeless ideas on life and finance.

Subscribe today to get weekly insights and receive a free investment checklist!