I breakdown businesses and share lessons from superinvestors. Join over 10,000 Steady Compounders by subscribing here:

If you enjoy stocks research reports like this, become a member and gain access to all my research on companies such as Amazon, Alibaba, Crowdstrike, Google, Microsoft, Netflix and more.

>> Click here to gain access to all my stocks research

A quick message: A big thank you to Eugene from Vision Capital for helping me out with this research on Tesla. Eugene shares insights into investing extensively. Check it out here: https://visioncapitalfund.co/

Tesla has been a controversial stock for as long as I can remember. With the eccentric founder Elon Musk frequently getting into a battle of words with short sellers such as the infamous David Einhorn of Greenlight Capital.

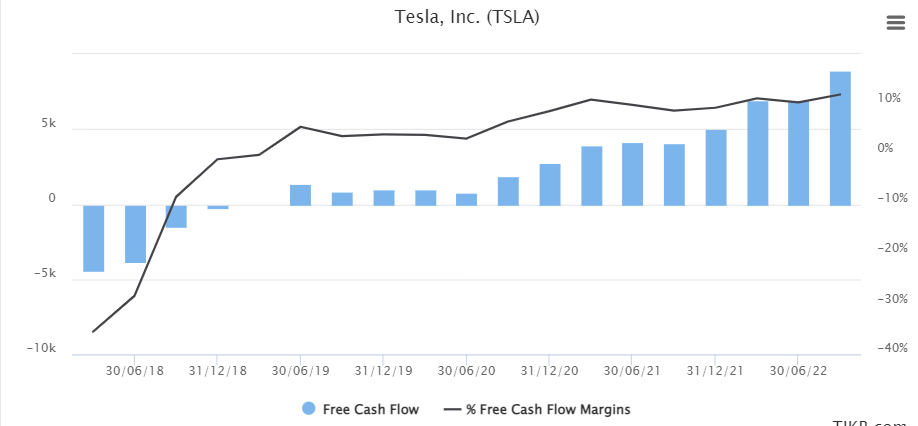

Back then there were many reasons to be concerned about Tesla. It was incinerating cash, they weren’t able to meet production numbers, and were very reliant on the capital markets.

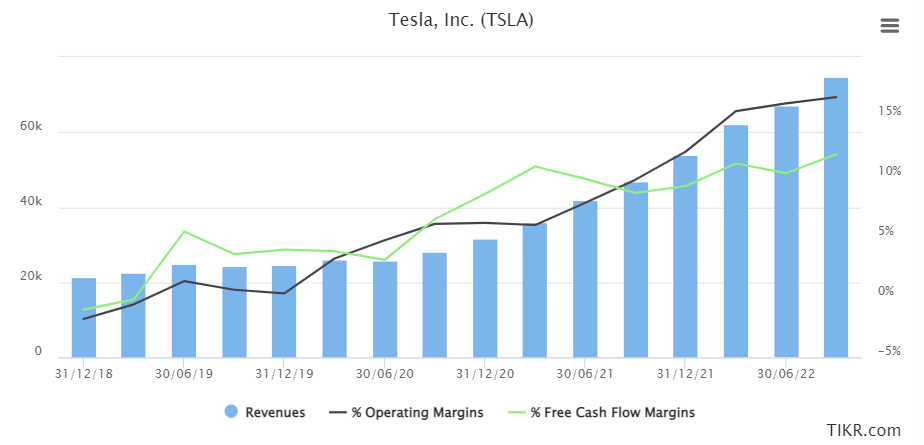

Today, the financial profile of Tesla is drastically different from the Tesla before 2019. At the turn of 2019, the company has turned free cash flow (FCF) positive and has seen both operating margins and FCF margins sky rocket, despite facing supply chain issues like every other manufacturer out there during COVID-19 lockdowns.

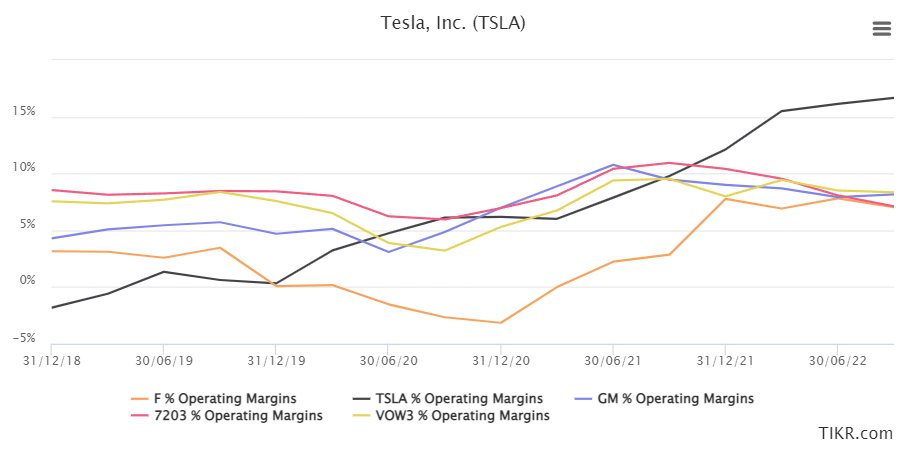

In fact, when pitted against other automotive companies, Tesla appears to be the most profitable car maker out there with operating margins of 16.7% in its latest twelve month (LTM) financials.

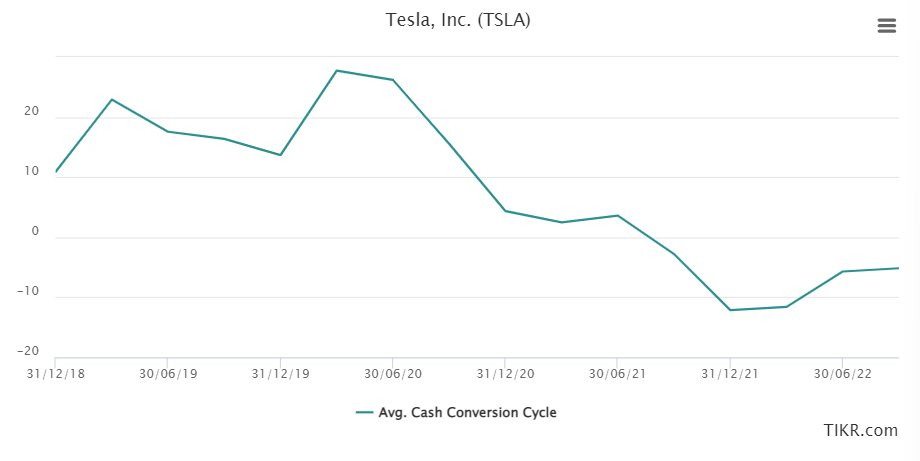

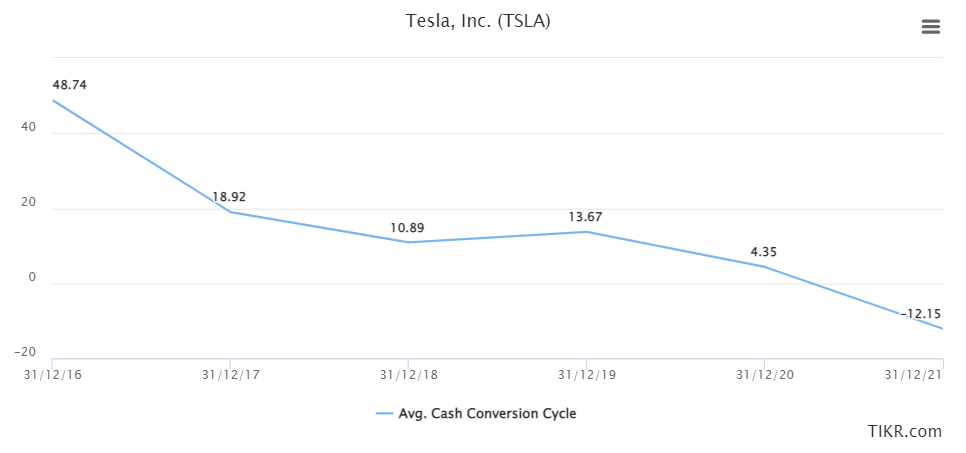

What makes Tesla’s current financials so remarkable is that shortly after mid 2021 onwards, it has achieved a negative cash conversion cycle, which is usually achieved by companies with strong bargaining power, like Amazon and Apple. This means that Tesla is able to sell its inventory and collect cash much faster than they pay their suppliers. In other words, they are able to get interest free financing from its suppliers.

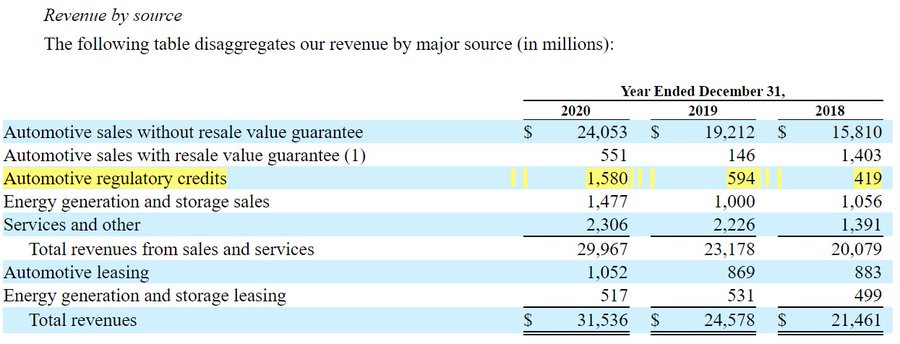

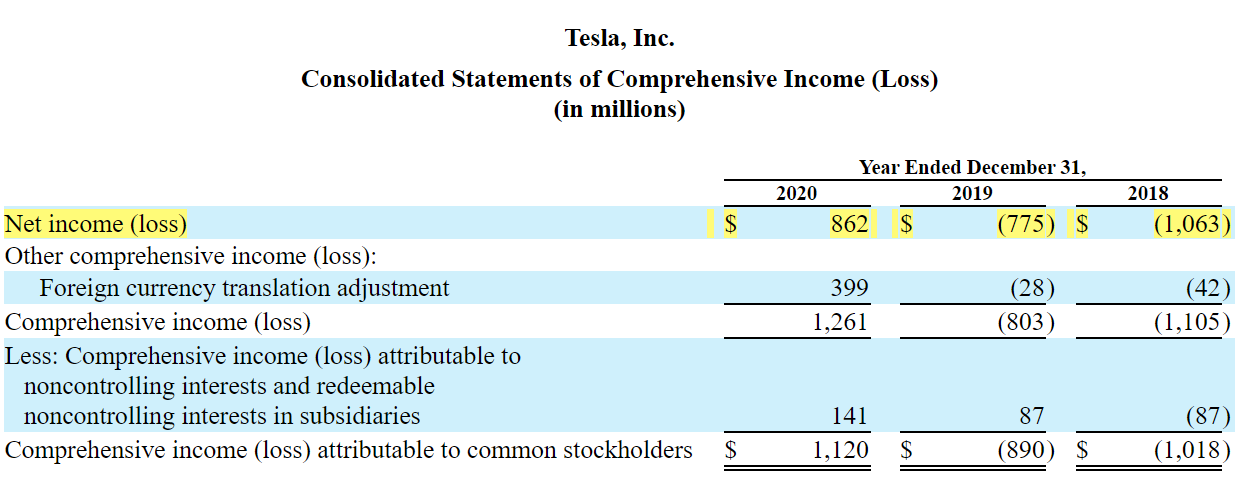

Revenue figures included sale of carbon credits?

While the financials are starting to look good, one thing that irks me quite a bit is that they included sales of carbon credits in their revenue figure. In my opinion, these are regulatory credits given to them and it doesn’t directly come from the sales of EVs or their battery products. If anything, I would rather these be classified under non-operating income.

The biggest pushback I got from making this statement on Twitter is that the carbon credits are a small portion of total revenue, $1.58B on $31.54B of revenue is only 5%. Yes, it is a small portion of revenue but a bigger portion of net income.

With $1.58B in carbon credits sales on $0.86B of net income, Tesla would remain a loss-making company in 2020 if there wasn’t the sales of carbon credits.

It’s not a major concern anymore because the operating metrics show that they are becoming more profitable over time, so much so that carbon credits sales is now just 12% of its net income (trailing twelve months figures).

But as investors, this is something we need to be aware of when analyzing the numbers of any businesses.

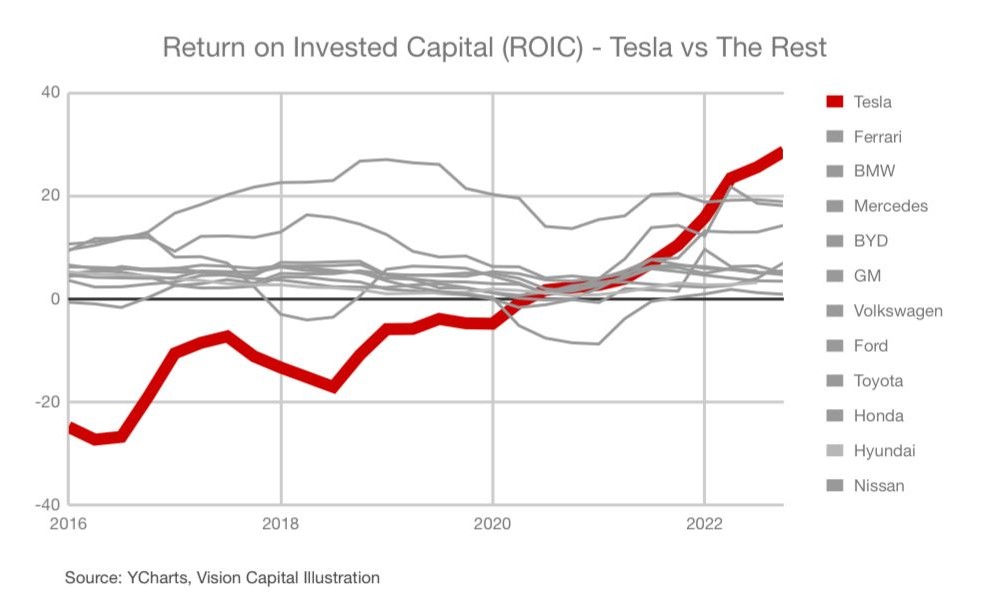

Best-In-Class Return on Invested Capital

It’s tough to compare financial metrics across automotive companies because of the vastly different capital structure, value proposition, etc. But for investors, it always goes back to measuring the return on invested capital (ROIC)—how much returns can a business generate with a given amount of capital?.

And Tesla is at a solid 29%, with its next closest competitor BMW coming in at 18% and Mercedes at 14%.

Given that the automotive industry is a highly cyclical industry, an important question to think about is are they able to sustain this high ROIC (or perhaps even increase it further) over time?

There are good reasons to think that Tesla could possibly pull it off. Because despite being the industry leader in EV, it is still extremely nascent. As of 2021 on a worldwide basis, Tesla has a 0.99% market share of the worldwide passenger cars market. The world is their oyster as we transit from internal combustion engine vehicles (ICE) into EVs.

Hey, I usually don’t start off my research with a whole bunch of numbers but that was the first thing I’m most curious about when I first started researching Tesla—are they still reliant on outsiders’ money for survival?

The company also began to churn out a copious amount of free cash flow since 2019. Another great indication that the company will do well financially and would unlikely be at the mercy of the capital market for funds moving forward (unless sales starts dropping off a cliff).

Enough with the numbers (for now). Let’s take a closer look at Elon Musk’s master plan in 2006 and see how he executed.

Tesla’s Grand Master Plan

Right at the start, Elon understood that the probability of starting a successful car company is extremely miniscule.

“I thought our chances of success were so low that I didn’t want to risk anyone’s funds in the beginning but my own. The list of successful car company startups is short. As of 2016, the number of American car companies that haven’t gone bankrupt is a grand total of two: Ford and Tesla. Starting a car company is idiotic and an electric car company is idiocy squared.” – Elon Musk

With these unfavorable odds against him, this was his grand plan in building Tesla (taken from Elon’s 2006 blog post):

Step 1: Build sports car

Step 2: Use that money to build an affordable car

Step 3: Use that money to build an even more affordable car

Step 4: While doing above, also provide zero emission electric power generation options

And there were good reasons why he thought of building a sports car at first. Elon knew that with his limited capital, there was no way he could build an affordable car on a scale large enough for economies of scale to kick in.

In contrast, sports cars can be manufactured in less sophisticated factories, although most processes will not be automated. With a sports car, they could also charge more, so they could deliver these units profitably, with the ultimate goal of reinvesting these profits into R&D and building up the capabilities needed to deliver more affordable cars.

Step 1: Build sports car

Alas, in 2008, the Roadster, a luxury electric sports car, was born. It was the first EV to use lithium-ion batteries and the first to travel more than 200 miles (321.9km) on a single charge. Tesla sold 2,450 of these bad boys from $109,000 and funneled everything into developing the Model S.

Step 2: Build an affordable car (luxury)

In 2012, the Model S was launched and it became one of the top-selling vehicles in the world, winning multiple awards. The luxury vehicle was priced from $57,000 onwards.

SUV drivers were 50% of the automobile market. Expanding into this space would greatly expand Tesla’s total addressable market. And so Tesla rolled out Model X, a luxury SUV electric vehicle in Sept 2012.

Step 3: Build an even more affordable car

Following the R&D spent on the Roadster, Model S, and Model X, Tesla is now ready to launch Model 3 at a significantly lower price point. At a starting price of $35,000, pre-orders flooded in. Even before Elon presented the prototype in March 2016, more than 100,000 pre-orders were received. By May 2017, there were approximately 500,000 preorders.

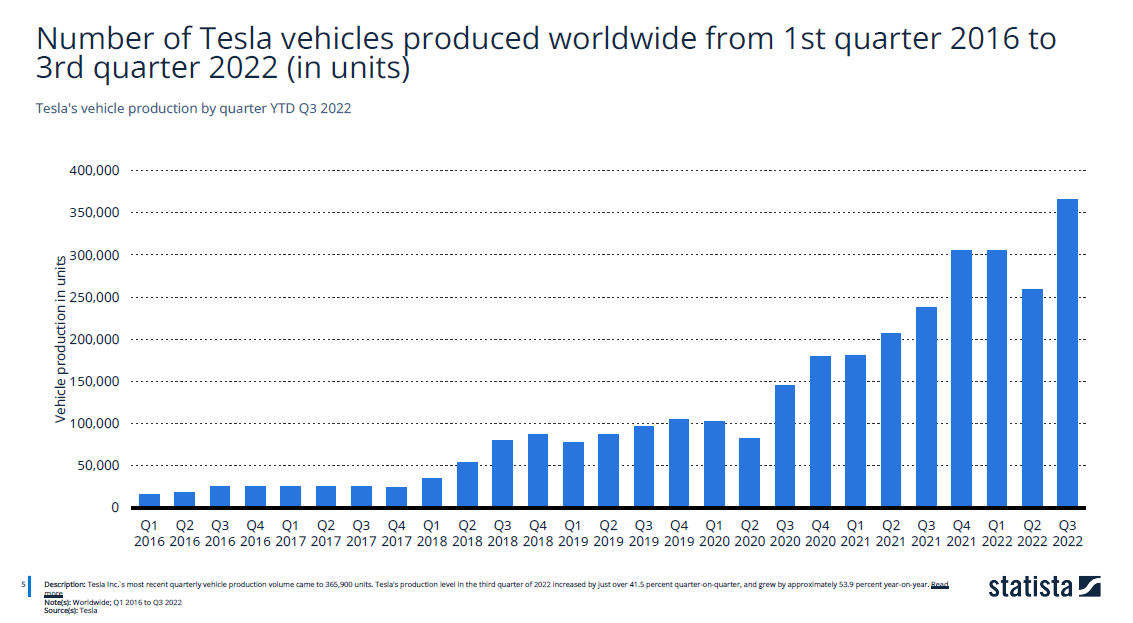

Demand went through the roof and promises were made to customers for delivery with a $1,000 deposit. Elon gets to work with producing the Model 3 on scale.

But this was when the production hell begins

Musk anticipated a production rate of 20,000 Models a month by the end of December 2017. To achieve this feat, he planned an unprecedented investment in factory robots, calling the production line “the machine that builds the machine.”

But it didn’t work out to plan. In the first three months, Tesla only produced 260 Model 3s — about three cars a day, well behind the average auto-industry production pace of about one car per minute.

Musk needed to fix things fast. This period was incredibly stressful as he worked round the clock, seven days a week, wearing the same clothing for several days. There was no time to waste. Likewise, Tesla’s engineers were expected to put in 13-hour days, seven days a week. And they had to tiptoe around Musk because he would go on rampages (similar to what Apple engineers experienced with Steve Jobs).

But despite it all, by the sheer force of Musk’s will and tenacity, Tesla continued to increase production volumes and managed to manufacture over 200,000 EVs in 2018.

From production to delivery logistics hell

After the production issue was resolved, thousands of Model 3s were parked at the Fremont assembly plant and several other remote facilities. Customers were eagerly awaiting Tesla vehicles, but they were unable to obtain them.

This issue largely stemmed from Tesla having a direct distribution model, cutting out all the middlemen in between. This means that they do not have franchised dealers to store their production inventory and manage that “last-mile” distribution to customers.

This was a hassle in the short run but proved to be a massive advantage for Tesla in the long run as they are able to cut out the costs of middlemen, own the customer and experience and be the ONLY automobile company to have a negative cash conversion cycle (CCC).

A negative CCC means that Tesla’s vehicles are sold before the company has to pay suppliers for the raw materials. Or, in other words, Tesla’s suppliers are financing its business operations. An enviable position to be in.

Step 4: Provide solar power

This is where Elon brings in Tesla’s Solar Panels, Roof and the sleek looking Powerwall that stores solar energy for night use or simply as backup protection, so when your grid goes down your power stays on. The Powerwall automatically recharges with sunlight and is able to keep appliances running for days.

The Master Plan was written in 2006 with the objective of achieving a sustainable energy economy. With most of the plan having played out nicely, Elon wrote a sequel to his Master Plan a decade later.

Master Plan, Part Deux

The objective is still the same—achieve a sustainable energy economy—but at a faster pace. And he plans to do this using a four pronged approach:

1. Integrate Energy Generation

This is the reason Tesla acquired SolarCity, to combine energy generation (solar) under one entity.

Here’s what Elon says, “Create a smoothly integrated and beautiful solar-roof-with-battery product that just works, empowering the individual as their own utility, and then scale that throughout the world. One ordering experience, one installation, one service contact, one phone app.”

2. Expand to Cover the Major Forms of Terrestrial Transport

Today, Tesla has premium sedans and SUVs. With the Model 3, a future compact SUV and pickup truck, the company will be able to cover most of the consumer market.

The key to accelerating a sustainable future is to scale up production volume as rapidly as possible. And this is where Tesla engineering has transitioned to focusing heavily on designing the robot factory which automates the production of its EVs.

In addition to consumer vehicles, Tesla will bring to market heavy-duty trucks and high passenger-density urban transport (i.e. buses or rails).

3. Autonomy

Currently, Tesla’s vehicles have partial self-driving capabilities. As the technology matures, all of their fleet will have the hardware to be fully self-driving.

4. Sharing

Once complete self-driving is approved, it means that:

(1) You will be able to summon your Tesla from anywhere and you’ll be able to rest, or do work while traveling to your destination.

(2) Your car is able to be an ‘Uber driver’ and generate income for you when you don’t need it.

With self-driving the value proposition of a Tesla would go up significantly. Because now the vehicle is able to “pay off” itself.

Tesla’s Economic Moat

Tesla was given a big head start due to its competitors’ complacency. Many of the major automakers only recognized the importance of EVs in recent times. Broadly, Tesla’s economic moat can be categorized into the following:

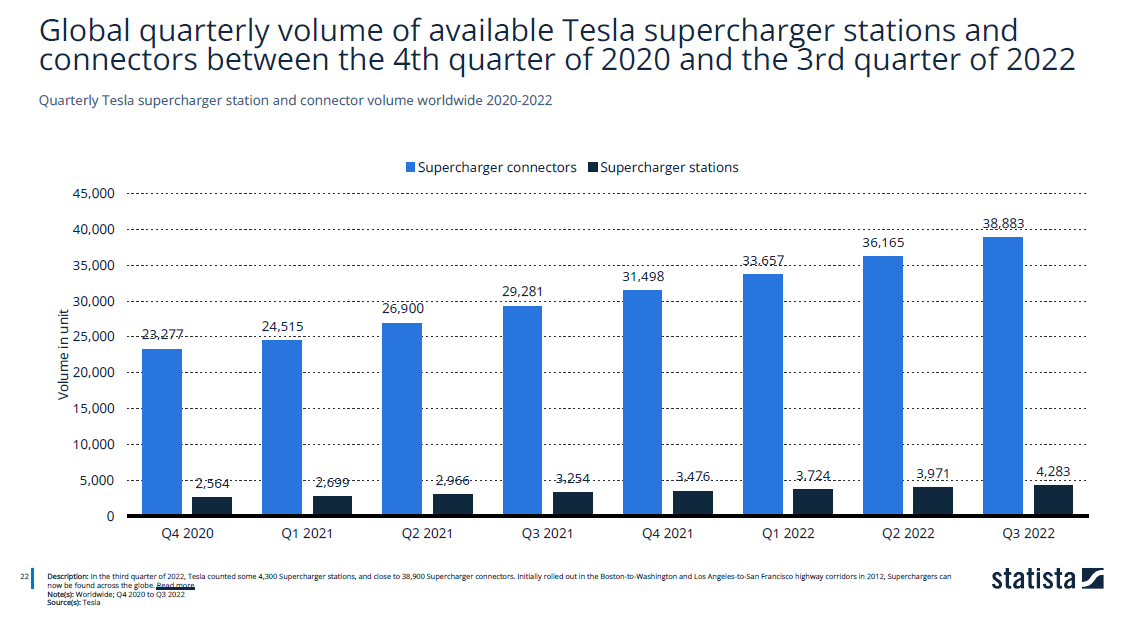

1. Supercharger Network

To charge your Tesla, simply find a Supercharger and plug in. A 15 minutes charge is able to power your Tesla up to 322 miles (or 518 km).

Why do Tesla’s Superchargers charge up so fast?

Tesla’s Superchargers release DC electricity, bypassing the onboard charger and directly charging the battery. The vehicle can be charged more quickly since the electricity is going straight to the battery instead of passing through the onboard charger.

Professor Jeff Dahn from Dalhousie University was hired by Tesla to increase the energy density and lifetime of lithium-ion batteries and to reduce their cost. Thanks to great engineering, a good thermal management system keeps the battery at the right temperature which enables fast charging without damaging the battery.

Close to 40,000 Supercharger stations available globally

As a result of a wide network of Supercharger stations, Tesla drivers can charge on the go, a feat unmatched by any of its competitors. Similar to Amazon’s logistics prowess, competitors like Walmart or Shopify have difficulty replicating Amazon’s capabilities. In order for Tesla’s competitors to catch up, they will need a lot of time and capital.

2. Super brand with a cult like following

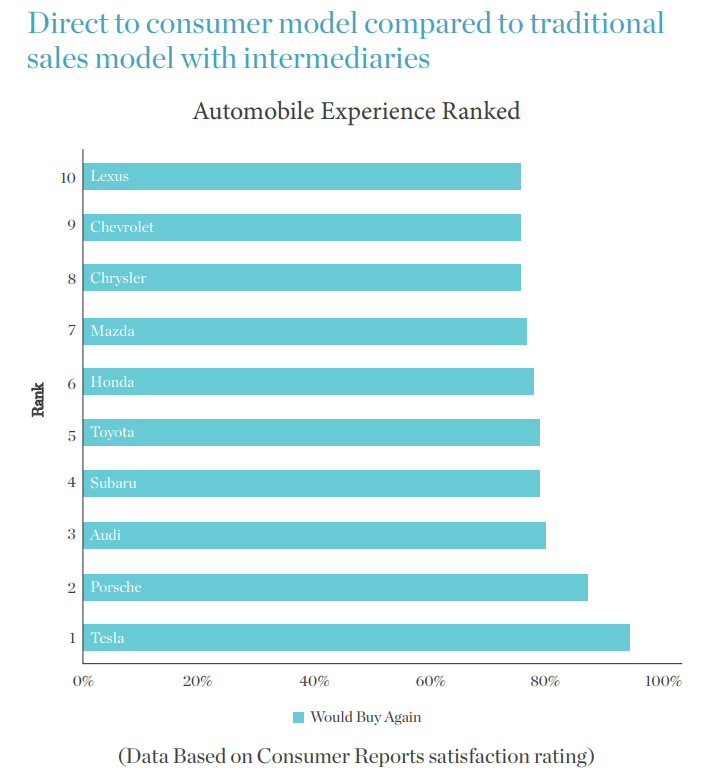

Tesla has an insane loyal customer base. They are committed, passionate, and happy to spread the word. It has one of the highest Net Promoter Score (NPS) of 97 (out of 100). In a survey of 5,000 Tesla owners, 99% said that they would recommend the Model 3 to their family or friends, and 98% said they would buy the vehicle again.

3. Direct to consumer retail model

Tesla doesn’t rely on third-party dealerships at all. The company sells directly from its website and showroom. Other automakers balked at the idea and dealers hated the idea.

The problem with selling cars through dealers is a poorer consumer experience. Buying from a third-party dealer means you’ll have to be ready to negotiate because of the heavy markup they impose, with some as high as 10 to 24% over the manufacturer’s suggested retail price (MSRP).

Many of the traditional automakers like Ford and Toyota have finally come to recognize the benefits of a direct to consumer retail model but it isn’t easy to switch over. Legacy players are worried about offending their dealers if they sell online directly to consumers which would cost them sales in the short run.

Management

Disruptive companies which have become superpowers today often have founders who give their employees a strong sense of achievement while causing severe anxiety. Apple’s Steve Jobs, Amazon’s Jeff Bezos, and Microsoft’s Bill Gates are examples. Elon Musk could probably compete with them for the top spot in driving their employees hard.

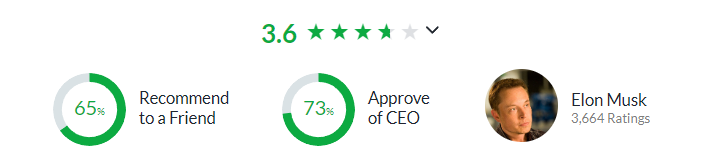

Those joining Tesla know what they are getting into, and the self-selection helps to filter those who are passionate about Tesla’s mission.

Still, most of the negative reviews on Glassdoor complain about the lack of work life balance and long hours in the company.

Compensation

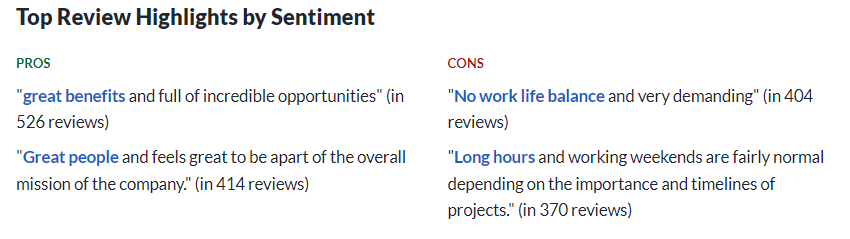

When it comes to compensation, Elon doesn’t draw a salary and their executive officers draw a relatively low base salary as well (vis-à-vis their market cap and revenue).

Even though Elon does not earn a base salary, he earns a large compensation from stock-based compensation, which is a very real cost for shareholders.

2012 CEO Performance Award

In August 2012, the board of directors granted Elon the 2012 CEO Performance Award, comprising of the option to purchase 79,123,515 shares (adjusted for stock split), representing 5% of Tesla’s total outstanding shares at the time of grant.

The 2012 Award consists of 10 equal vesting tranches, each requiring the company to meet a combination of:

- An achievement of operational milestone relating to Model X or Model 3, aggregate vehicle production or a gross margin target, and

- A sustained incremental $4 billion increase in Tesla’s market capitalization from $3.2 billion (at time of grant).

Of the 10 equal vesting tranches, only one operational milestone hasn’t been met, requiring that Tesla achieve a gross margin of 30% or more for four consecutive quarters.

It’s alright to tie compensation to the operational milestones. But when it is tied to an increase in market capitalization it may sometimes lead to perverse actions by management to prop up the stock price, especially right before the deadline.

2018 CEO Performance Award

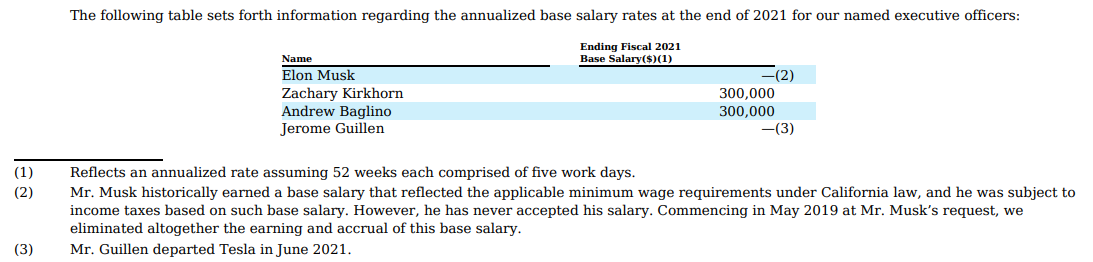

The 2018 CEO Performance Award is a 10-year maximum term stock option to purchase 303,960,630 shares (adjusted for stock split), divided equally among 12 separate tranches that were each equivalent to 1% of the total outstanding shares at an exercise price of $23.34 per share (adjusted for stock split).

The requirements for the award:

- Market capitalization milestone begins at $100 billion for the first tranche and increases by increments of $50 billion, and

- Any one of the following 8 operational milestones focused on revenue or 8 operational milestones focused on profitability, has been met:

There’s a lot not to like about the way the incentives are structured. For starters, it is based on market cap again. Secondly, it is based on revenue growth, and the problem is not all growth creates value and it should always tie back to the return on invested capital. Thirdly, the adjusted EBITDA excludes stock-based compensation which is ridiculous, because it is a very real expense to shareholders. In this case, management would be motivated to artificially boost adjusted EBITDA numbers by compensating employees with shares rather than cash.

Skin in the game

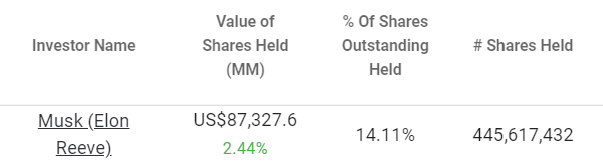

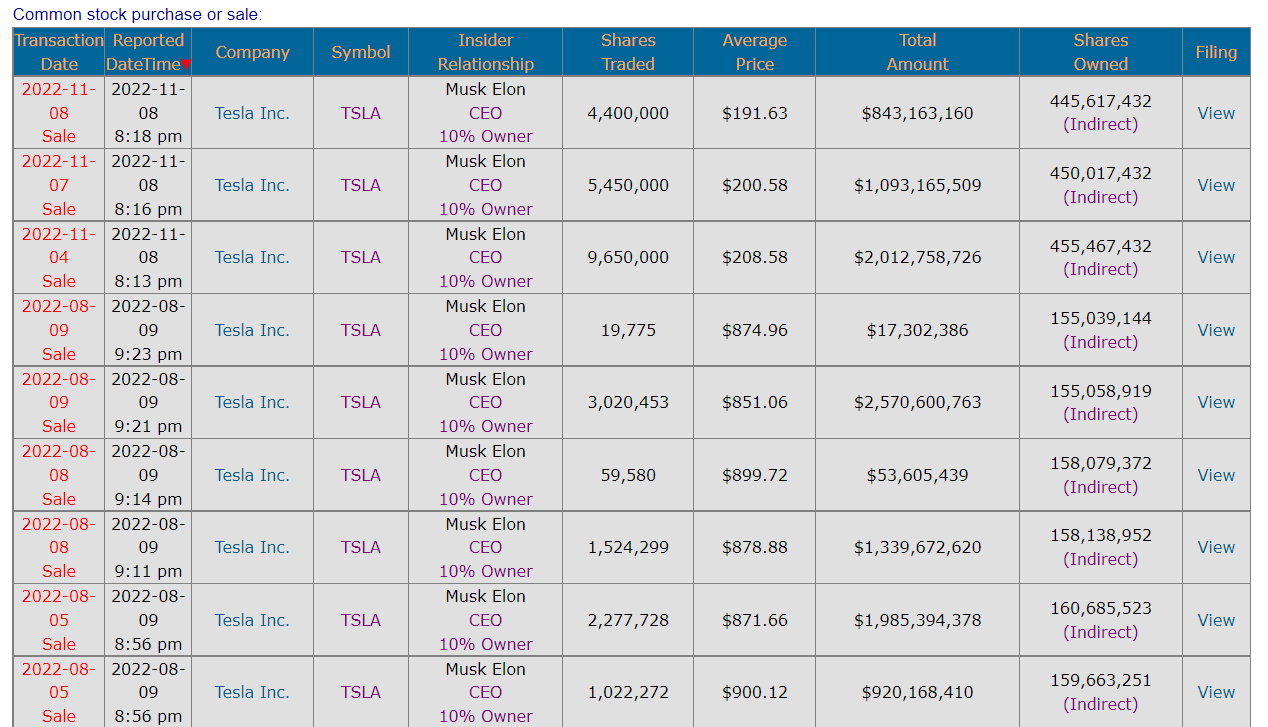

Elon has significant skin in the game, since he owns 14.1% of Tesla shares worth $87 billion.

Elon frequently sells his shares, but it’s normal given that his remuneration is in shares he will have to liquidate them to pay off taxes, for his lifestyle use and… to buy Twitter.

Risks

Competition

Most car manufacturers have finally woken up to the idea that EV is the future and will be devoting more resources to competing with Tesla. Delays in pivoting over to EV have cost many of these traditional automakers to lose market share to Tesla.

Volkswagen (VW) has committed to building 1 million EVs annually and set a 2030 EV target of 50% of vehicle sales. BMW has set a target of 2 million EV sold by 2025, with a longer-term goal of 10 million sold by 2030. Jaguar and Volvo are even more aggressive, targeting 100% EV production by 2025.

This transition into EV will not come cheap, Daimler Benz announced plans to spend US$85 billion on EV-related R&D and VW plans to invest over US$100 billion by 2025.

However, most of Tesla’s competitors are currently saddled with debt which would make it difficult for their transition into EVs. The three leading German automakers Volkswagen Group (VW), Daimler Benz and BMW have over US$450 billion in debt combined. Likewise, US automakers Ford and General Motors (GM) are also drowning with debt of over US$200 billion collectively.

Over in China, leading Chinese automaker BYD has been manufacturing EV for more than 15 years and has announced plans to expand sales into Europe, Australia and the US. Likewise, Nio, an EV automaker, is also planning to spend $10 to $15 billion in capital expenditures by 2025.

The Chinese government aims to achieve 30% EV sales by 2025 and become a global exporter of electric vehicles.

Key man risk

“I frankly don’t want to be the CEO of any company,” — Elon Musk

Elon Musk is an engineer at heart and he’s the heart and soul behind Tesla’s brilliance. Much like Steve Jobs was to Apple. After the passing of Steve, innovation with the iPhone typically consists of more cameras and the iPad failed to sustain its place in most people’s tech inventories. Apple continues to create massive value for its shareholders thanks to Steve Jobs’ brilliance in designing products that consumers love and Tim Cook’s capital allocation skills.

Elon currently dons multiple hats — heis the CEO of both Tesla, SpaceX and more recently, Twitter. Time, energy and attention are limited resources. With competition coming in strong, it might not be the best time for Elon to divert his attention away from Tesla.

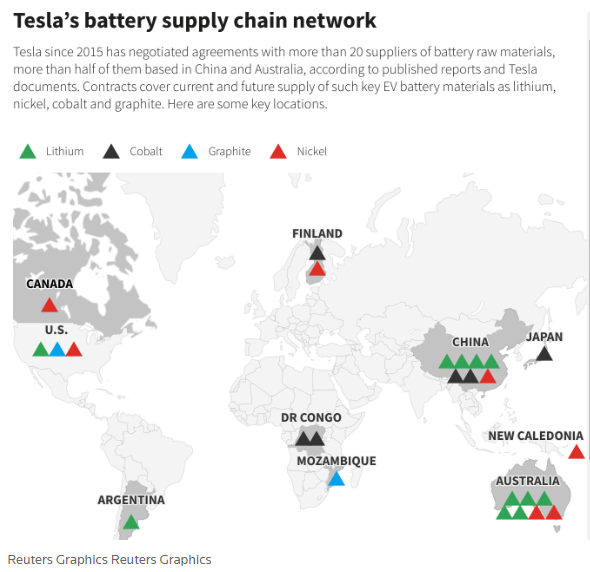

Commodities

The key raw materials required for EV batteries include: Lithium, Cobalt, Nickel, Graphite, Manganese, Copper and Aluminium. While Tesla is vertically integrated, they are still reliant on the suppliers of these raw materials.

Engineers at Tesla believe they can reduce total costs by 30% by changing battery cell chemistry, and substituting cobalt and nickel intensity for alternate anode and cathode materials, along with other manufacturing changes.

Still, any shortage of supplies from surge in demand or political interference would spike EV production costs.

China’s Political Risk

China is both a major consumer and producer of Tesla, with the Gigafactory Shanghai capacity estimated to pass the 750,000 mark this year, surpassing the 650,000 vehicle capacity in California and the 250,000 capacity for both factories in Texas and Berlin, Germany.

In 2021, China accounted for 25.7% of all Tesla sales, and that number is expected to increase as the country’s demand for electric vehicles increases.

Events such as the Shanghai lockdown due to COVID-19 or escalating political tension between US and China could spell trouble for the company.

Back-of-The-Envelope Valuation

For Tesla’s valuation, I’m only going to focus on their automotive sales revenue. Its energy generation, storage and other revenue (and gross profits) miniscule relative to their automotive sales.

Over the past 12 months, Tesla has delivered 1.2 million cars and Elon has stated multiple times his bold goal of selling 20 million cars by 2030 with 10 to12 gigafactories. If achieved, it would make Tesla twice the size of any automaker in history, accounting for roughly 20% of the global vehicle market.

This seems pretty crazy because that would be larger than Toyota and Volkswagen combined. But hey, Elon has a track record of pulling off crazy. To achieve this audacious goal, he’ll have to build another 4-6 gigafactories around the globe. Many governments from countries such as Canada, Indonesia, India and more are wooing Tesla to invest in EV production in their countries.

In the last twelve months, operating margins have hit an impressive 17%, outperforming the industry average by a wide margin.

For our projection, I’m going to assume Tesla falls short of Elon’s lofty goal and deliver 15 million vehicles in 2030 (still an audacious number). With an average price per vehicle of $50,000, revenue will come up to be a whopping $750 billion.

Assuming its operating margins hold at 17%, EBIT will come up to $127.5 billion ($750b x 0.17). If the company trades at a 15x EBIT multiple, its market cap will come up to $1.9 trillion.

Given its current market of $564 billion, a market cap of $1.9 trillion in 2030 represents a CAGR of 16.4%.

This doesn’t accounts for the value that Tesla could bring from:

- Autonomous driving, which brings an autonomous taxi network

- Optimus, Tesla’s general purpose robotic humanoid

- Energy generation and storage business

- Dojo, Tesla’s custom supercomputer

- Tesla Semi, its electric truck

- Insurance

Conclusion

Tesla is no longer that brash young company whose survival depends on Elon’s ability to raise capital, fight fires and push its boundaries to the extreme for survival. The company is currently net cash positive, generating a lot of free cash flow while growing at a 50% clip. Even though Elon’s antics may cause some to roll their eyes, it’s hard not to expect a genius at that level to be eccentric at times.

Disclaimer: This research reports constitute the author’s personal views only and are for educational purposes only. It is not to be construed as financial advice in any shape or form. From time to time, the author may hold positions in the below-mentioned stocks consistent with the views and opinions expressed in this article. Disclosure – I hold a position in Tesla at the time of publishing this article (this is a disclosure and NOT A RECOMMENDATION).

Nicely put across, cutting out all the noise. Its interesting to red.

Just few observations :

1. German car makers are loaded with debt due to big captive car financing operations and working capital. Which needs to be adjusted.

2. Sustaining high ASP may be difficult considering ambitious volume plan.

3. Sustaining super rich margins in increasingly competitive and fast changing battery technology will be difficult.

4. Referring to Damodaran model gives interesting sensitivity and price ranges.

Did you find any red flags in the Op Ex? I’ve read that it’s suspicious that OpEx hasn’t gone up despite churning out more cars and rampant inflation and that this could be fraud.

There is no evidence of fraud except in the heads of Tesla haters who can’t believe how wrong they have been and how much of their life they have wasted telling people Elon can’t do what he has already done.

Losers.

Nope, there is still a mystery why OPEX isn´t rising.

It´s like you can´t sell more eggs, without having more chicken and therefore more chickenfood.

But it all comes to daylight in the future.

Nobody hates Tesla, but Investors hating fake and fraud.

Nobody hates Tesla? There is literally a whole community of people who’s sole purpose is to defame Tesla (TSLAQ).

Improving cost efficiency has been a huge focus for Tesla for some years now. It’s not that big a mystery – things like giga-castings, reduced complexity, removing vehicle Radar, more vertical integration and improved financing all have reduced the cost. These factors are well documented.

Look up Munro Live on youtube if you want more details, and compare their first Tesla-teardown to their latest. So many efficiency improvements.

nice report for casting a bigger picture of tesla future

For me, the reason I have a great impression of this company is also ironically the reason I’m staying out of this company – key man risk.

Elon is the biggest lever. If anything happens to him, no one will know for sure how Tesla will move forward.

Plus it doesn’t help that he’s splitting his time with so many other companies…

15m at 50,000 too high unless they solve L5 hands off autonomy

i see them doing 9-10m by 2030 with ASP of $40,000 and operating margins around 25% = 400B *25%.= $100B in auto income @ 25x op income= 2.5 Trillion (

with FSD (not L5) probably adds another ~100B

solar and insurance = ~100B market cap

Robots ?

could get close to 3 trillion

CAGR will be higher than 16% as they will most likely start doing buybacks.