I recently watched John Huber’s presentation at the FinTwit Summit on the three engines that drive stock returns.

Here are my notes!

The three main engines that drive stock returns:

– Earnings growth

– Change in P/E multiple

– Change in shares outstanding

Companies that benefit from all three engines score the biggest home runs.

In other words:

– Earnings grew over time

– P/E multiple expansion

– Buy back shares

Here’s an example 👇

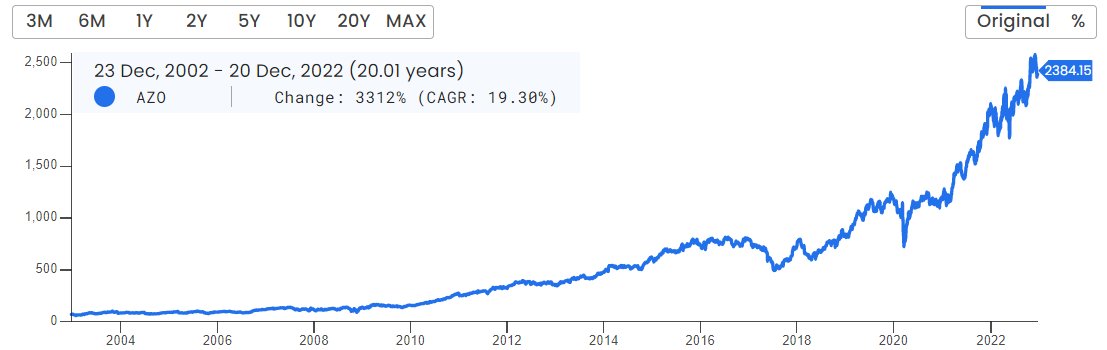

Autozone the buyback monster

Over the last 22 years:

– Autozone earnings grew 8.9x (10% CAGR)

– P/E increased from 13 to 19 (2% CAGR)

Combining earnings growth and P/E expansion, it comes up to 12% CAGR over 22 years.

BUT! It was a 76-bagger since 2000.

Compounding at whopping 22% CAGR.

Why?

Share buybacks.

The company had a huge appetite for buying back its own shares.

Since 2000, Autozone bought back 83% of its shares.

Existing shareholders 6x their ownership without having to buy an additional share.

This was possible because Autozone has 30% ROIC & gushing with FCF

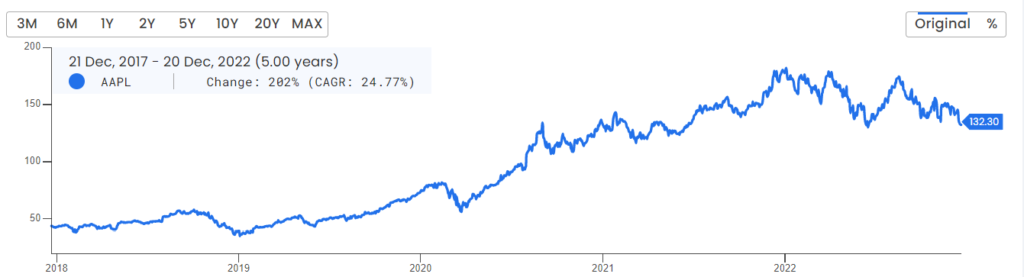

Similarly, Apple repeated Autozone’s playbook

Since 2016, Apple has also enjoyed 3 engines.

– Earnings engine: 8% CAGR

– P/E engine: 20% CAGR (from 10x to 30x)

– Buyback engine: 6% CAGR (share count declined 28%)

All 3 engines produced a 37% CAGR over the past 6 years!

The 10 year test

A key criteria to applying this mental model:

10-year test Is this company durable enough for you to forecast 10-years into the future?

Otherwise, move on to the next one.

Summary:

– Build a list of durable companies that pass the 10-year test

– Estimate earnings in 10 years

– Estimate P/E in 10 years

– Estimate shares outstanding in 10 years

Buy if it passes your hurdle rate.