This quarter is important because it is the first quarter where they feel the full impact of the new regulations. And I’m looking for signs as to whether the regulations have permanently impaired Alibaba’s economic engine as Mr. Market has priced it to be.

Financials

Let’s dive into the numbers:

- Excluding their recent Sun Art acquisition, revenue only grew 16% y-o-y.

- The number of annual active customers (AACs) continues to climb to 953m in China and 285m overseas, a quarterly increase of 41m and 20m, respectively.

- Cloud computing grew 33%, shrugging off concerns that the loss of their large customer (rumored to be ByteDance) in the earlier quarter would cause a lasting impact.

- International commerce which is made up of Lazada, AliExpress, Trendyol and Daraz drew revenue 34% y-o-y.

- They stated that Lazada grew orders 82% y-o-y. Good growth but they do not disclose enough information to determine if the unit economics is trending towards eventual profitability. Also for context, Shopee grew orders by 123.3% for the latest quarter.

- Likewise, Trendyol, the number one e-commerce platform in Turkey recorded over 80% growth in GMV.

Analysis

Excluding Sun Art’s acquisition, this latest quarter’s growth is disappointing, to say the least.

I also don’t like how they’re using different metrics for describing their e-commerce business performance, for Lazada they reported order numbers growth, for Trendyol they reported GMV growth and for their China’s operations they only mentioned single digit percentage GMV growth.

Why not standardize the reporting?

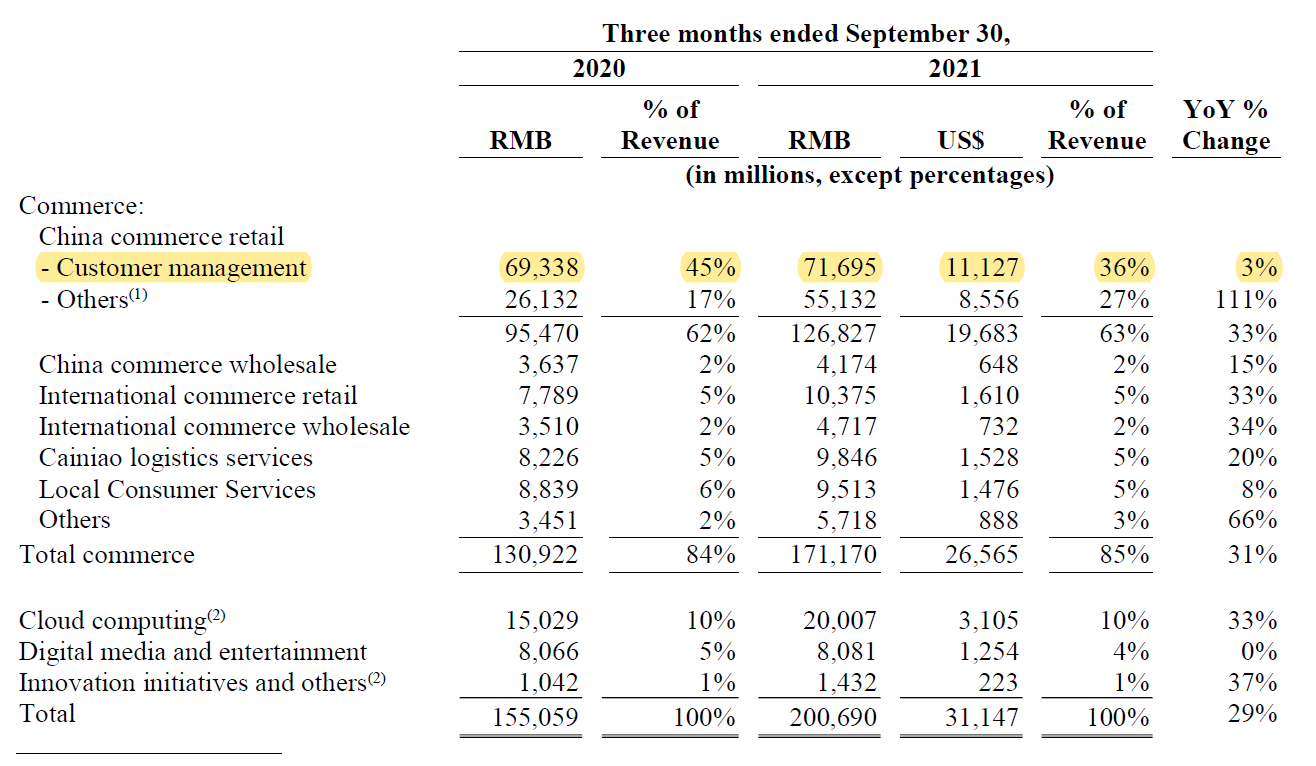

What concerns me is its customer management revenues (CMR) growing only 3% in comparison to its gross merchandise value (GMV) growth. And as we can see from the breakdown below, its CMR forms the bulk of Alibaba’s revenue.

CMR is how Alibaba monetizes through advertisement and charging a commission from its platform Taobao and Tmall.

Let’s take a look at what were the reasons given by management during the earnings call:

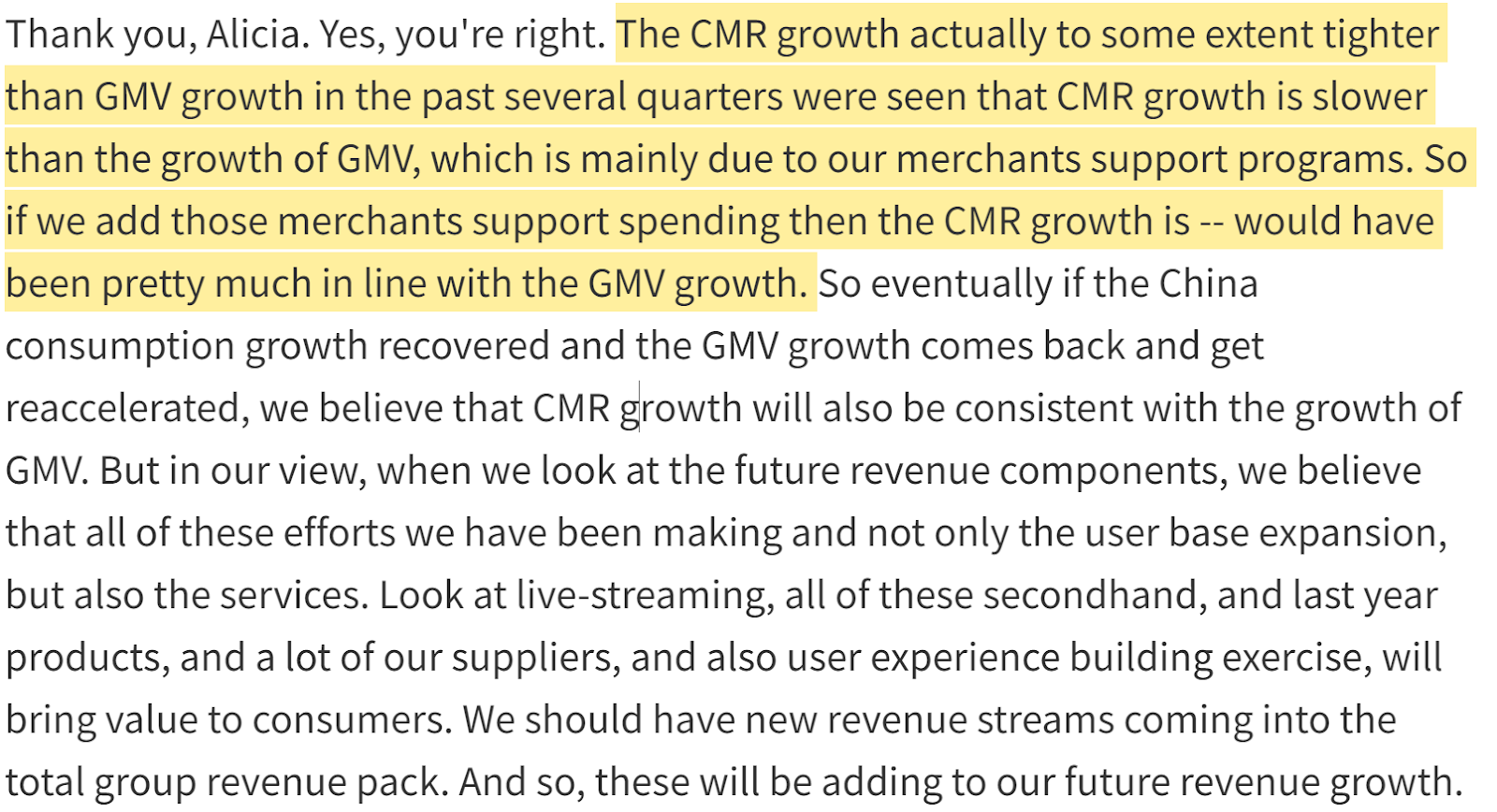

CMR grew slower than GMV largely due to merchants’ subsidies. In other words, they have been providing rebates back to merchants and its unlikely out of kindness due to the pandemic.

This is likely due to regulations prohibiting the “two choose one” practice which prevented merchants who sell on Alibaba to sell on other platforms. The rebates is likely Alibaba’s move to ward off the risk of merchants leaving its platform and disrupting its e-commerce flywheel.

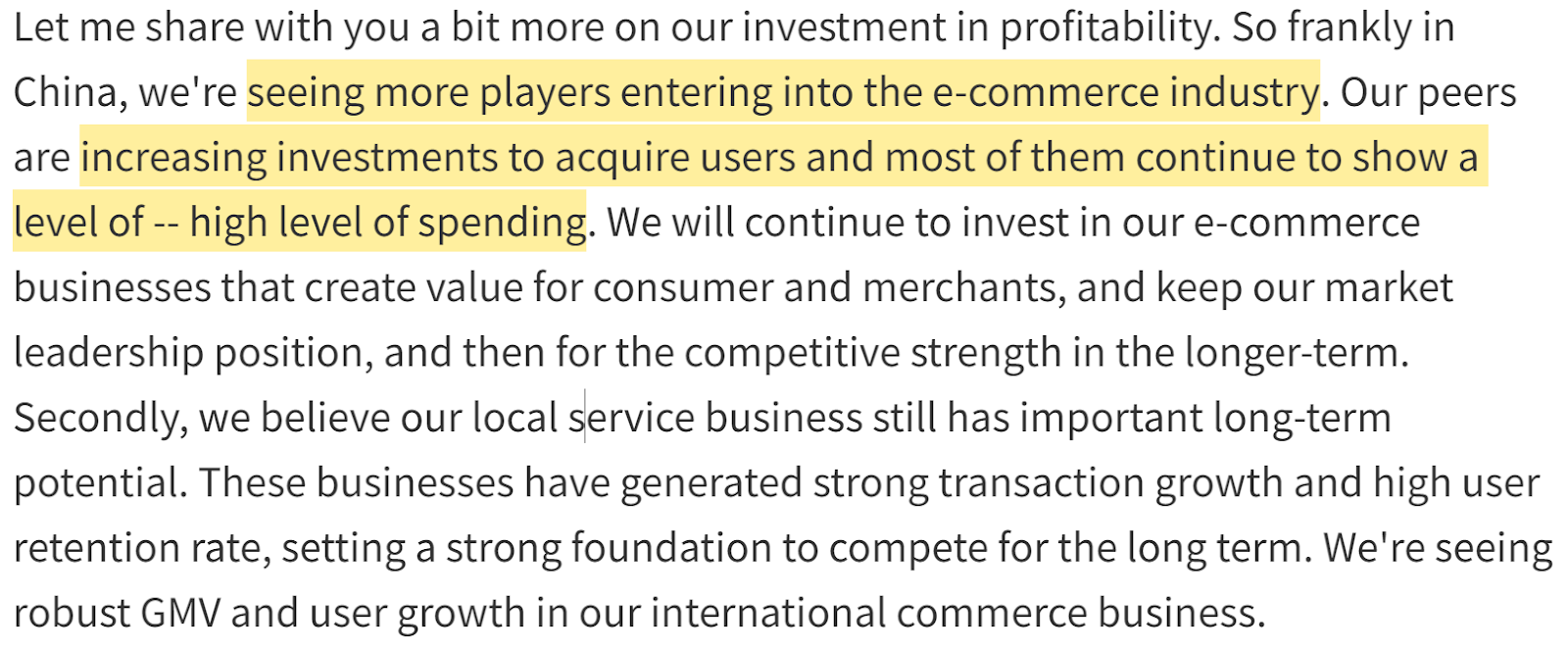

Management has also acknowledge that competition has become intense, ever since the regulations were implemented to equalize the playing field. For some time since Alibaba became the most dominant player, they have been extracting value from the ecosystem. Since the regulations, management have committed to reinvesting more heavily into strengthening its ecosystem.

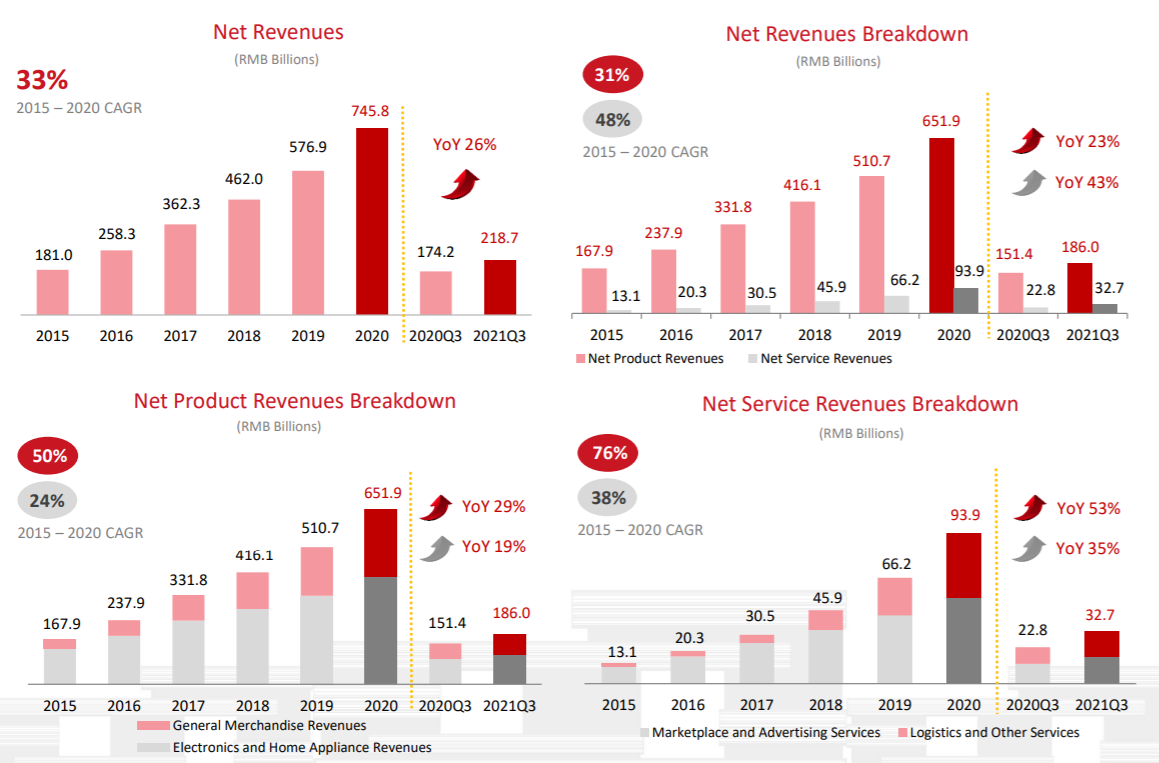

To verify if the slowdown is due to regulatory crackdown, slow down in consumption or supply chain issues (as so many companies have cited), we can contrast that with JD.com, which has shown great resiliency in this environment.

JD.com has spent many years reinvesting heavily into its ecosystem by building up its logistical infrastructure which is second to none in China.

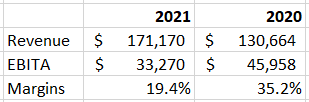

Alibaba is now playing catch up in this aspect and is heavily investing into its logistical infrastructure. Also, it is also investing heavily into its latest initiative—New Retail. We can expect to see margins being compressed for the time being. In this quarter, it’s China’s commerce margins compressed from 35.2% to 19.4%

Conclusion

Investors will have to continue monitoring whether their business fundamentals have been impaired. At today’s prices, a slowdown in growth is acceptable but what we don’t want to see is their flywheel being disrupted.

We will have to monitor if these rebates to merchants and strategic investments is a temporary expense or is their competitive positioning threatened in the upcoming earnings.

We will also have to monitor if their strategic investments in New Retail pay off eventually as they are pouring a lot of capital into this initiative.

Its cloud computing business growth is on track but it contributes to less than 10% of revenues today.

To end off, it is still too early to tell, we will need to continue monitoring if the latest round of regulations have impaired Alibaba’s prospects.

If you like to learn more about Alibaba, consider joining us as a member and gain access to our research report. You will also gain access to other reports on companies such as Twilio, Facebook, Sea Limited, and more!

Thomas,

Thanks for providing your perspective. According to BABA’s earnings release, the decrease in its EBITA was due to its strategic investments (which they had alerted at the beginning of the current Fiscal Year). If BABA were to pick a quarter in which they were to show poor results, don’t you think September 2021 was the best one to pick, given the broader context?

You may have already read Dudley Glen’s analysis of the September Quarter 2021 earnings release. If not, you can read the same at the link below.

https://www.getrevue.co/profile/dudleyglen/issues/making-sense-of-alibaba-s-september-q21-earnings-call-nov-21-887277

Looks like you are an investor in BABA. Are you still holding your position? If so, are you planning to buy the dip? Also, what are your thoughts on BABA’s current intrinsic value? Is there a price point, where you would seriously think that your investment thesis may be wrong? From a portfolio allocation perspective, what is the maximum you would consider allocating to BABA?

Sometime back you started looking at options. Is there an option play here? If so, what would you consider/propose?

Thanks for your insights.

Best,

Sumeet

Hi Sumeet,

Yes, I am still holding on to the position but I’m not adding.

For options play it depends on what your estimated intrinsic value of BABA is. If I don’t have a position today I may consider selling ATM put to buy OTM calls. You should be able to get a pretty nice put:call ratio at today’s prices.

Thanks for the quick response and the option suggestion. What kind of time horizon would you consider for the options you are recommending? Would both options have the same DTEs, or would you recommend different expiries?