This marks the second consecutive quarter in which I’m happy with all three segments of Sea Limited’s business—digital entertainment, e-commerce, and digital financial services.

From my earlier article in March 2024 for Steady Compounding Insider Stocks members, Sea Limited: A Turnaround in Sight:

“With Garena and SeaMoney, the company has a twin engine that’s gushing cash, giving it the edge Shopee needs to boost its active users and develop its logistics capabilities. Throughout 2024, we’ll monitor whether users and bookings for Garena pick up and whether Shopee can grow profitably in the second half.”

This quarter, we saw:

- Shopee’s growth is reaccelerating while achieving profitability across All markets.

- Garena’s Free Fire sustained bookings growth since its bottom in Q2 2023

- SeaMoney’s growth is accelerating while maintaining high profitability.

The company is also investing in Shopee’s logistics and enhancing its ecosystem, addressing a concern I raised in my December 2023 report, Sea Limited: The Show Goes On:

“I would have preferred that management had invested more resources in developing logistics capabilities when capital was accessible and cheap, rather than expanding all over the world to drive GMV growth. At this point, management is being cautious with heavy investments, but given that capital is so expensive today and Garena isn’t as prosperous as it used to be, the company is forced to exercise prudence.”

Now, Shopee is demonstrating rapid, profitable growth—something it hadn’t achieved in the past when it relied on a generous capital market and its cash cow, Free Fire, to fuel expansion at the expense of profitability.

Of course, as clarity around its performance has emerged, the share price has soared over 170% in the past year. Cheap valuations and a rosy outlook never go hand in hand. The dark clouds have largely cleared—when Garena’s Free Fire faced steep declines, TikTok Shop and Shein loomed as formidable competitors to Shopee, and many doubted whether the company could achieve profitable growth.

Looking back, the business landscape was evolving rapidly, with intensifying competition, a post-pandemic slowdown in online activities, and a seismic shift from the era of cheap money as the Fed raised interest rates. By late 2022, Garena’s cash cow status was under threat, potentially capitulating its arsenal of capital, which was a big factor in driving Shopee’s position to become the top dog in Southeast Asia.

The company had just US$7.9 billion in cash and a burn rate of approximately US$2.4 billion per annum from its unprofitable Shopee and SeaMoney business segments. This cash reserve could only last the company just over two years. At the time, I thought dilution was inevitable, with management likely needing to raise capital by issuing shares at depressed levels.

Yet, against all odds, they didn’t.

As I put it in my August 2023 report, My Updated Thoughts on Sea Limited:

“Damn. I never expected them to pull it off but they actually did it. In all three of its segments—E-commerce, Digital Entertainment, and Digital Financial Services—they are ALL profitable.”

Yes, I opened that article with a “damn,” though in my head, it was a two-syllable “dayuuummmm!” Management backed up their words with action and pulled off this impressive feat.

However, at that point, growth had slowed to a crawl as the company slashed marketing spend to achieve profitability. The next challenge was proving to shareholders that Sea Limited could grow while maintaining profitability.

In 2024, they’ve done just that—entering their profitable growth arc.

Q3 2024: Firing on All Cylinders

Let’s begin with Shopee, Sea Limited’s e-commerce arm, which continues to shine as a key driver of the company’s growth.

Shopee: Driving Profitable Growth

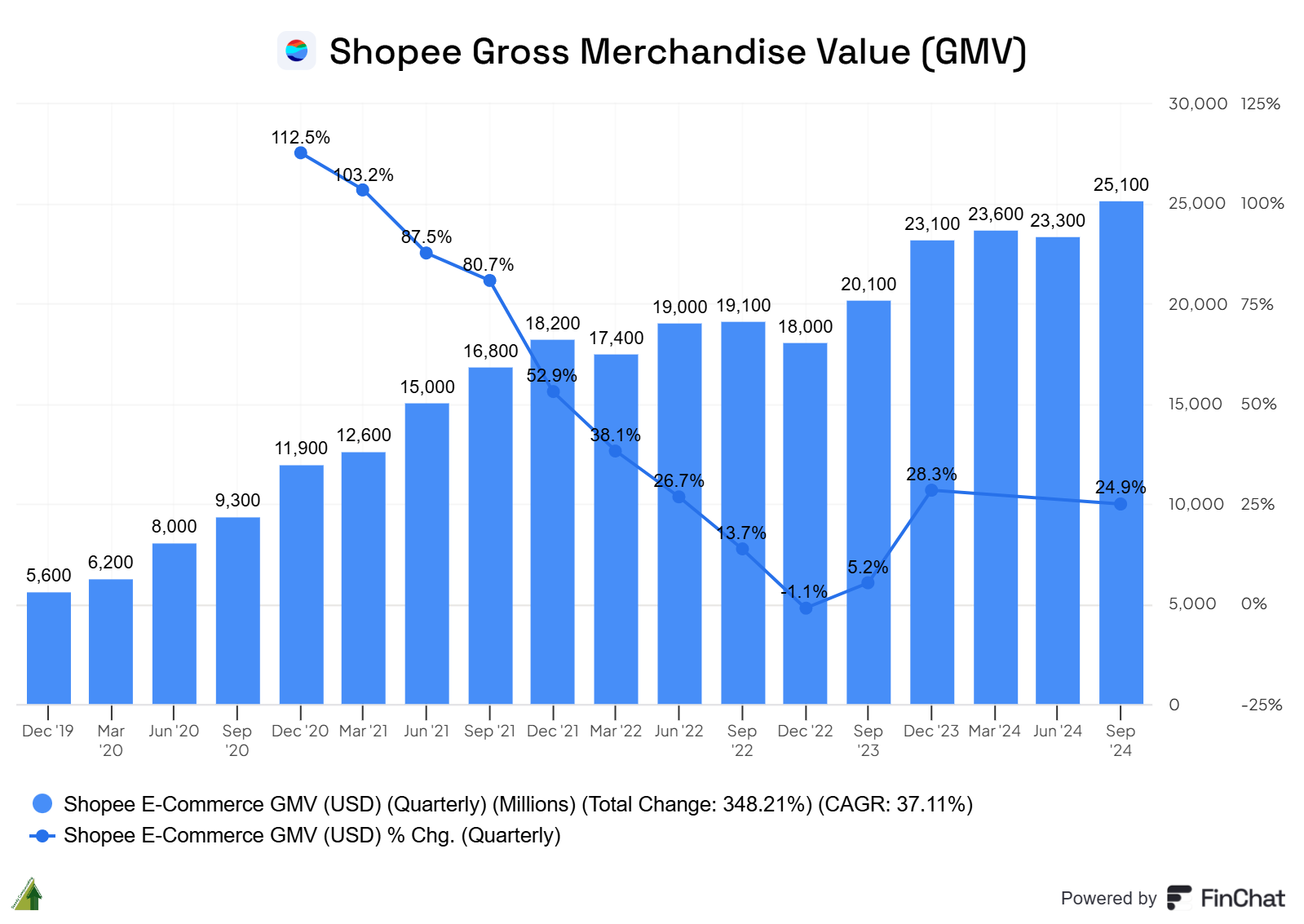

Shopee’s gross merchandise value (GMV) increased by 24.9% year-on-year to reach US$25.1 billion. Gross orders kept pace with GMV growth, rising by 24.2% year-on-year to 2.8 billion orders.

Source: Finchat (get a 15% discount using this link)

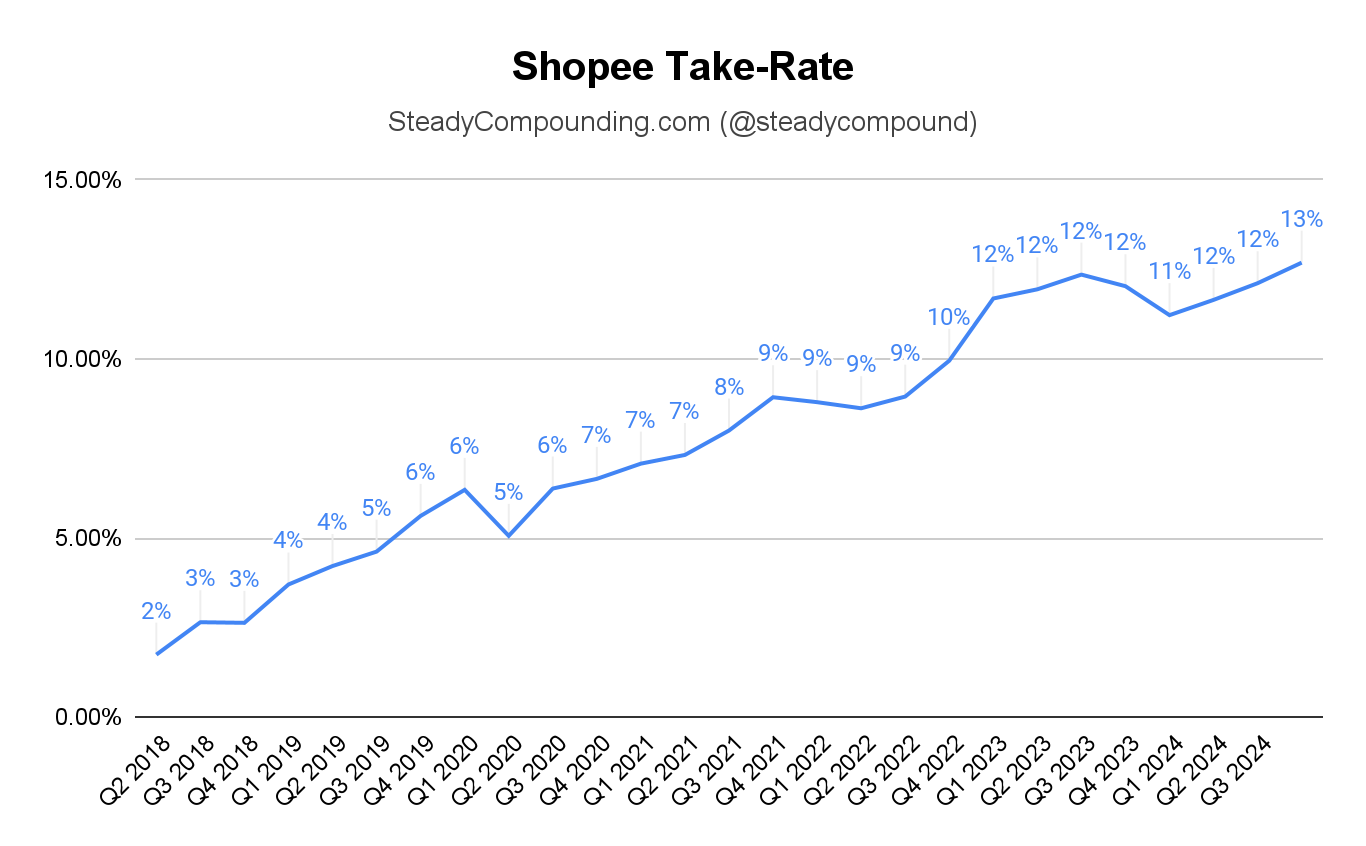

However, what truly stands out is revenue, which outpaced GMV growth by climbing 42.6% year-over-year to US$3.2 billion. The platform’s take-rate reached a record-high 12.7%, up 70 basis points from a year ago, reflecting Shopee’s ability to flex its pricing power.

CEO Forrest Li attributed the rising take-rate to two key factors:

1. Rationalized Competition: The competitive landscape in Southeast Asia has matured, enabling an industry-wide increase in commission rates.

2. Improved Ad Tech: Enhancements in ad technology, including simplified onboarding and ROI-driven targeting tools, have spurred merchant adoption of paid advertising features.

Li added that there remains significant upside potential for monetization through increased advertisement adoption.

When pressed about the possibility of further commission increases, Li stated that management is not in a rush to extract value from its platform partners. Instead, he emphasized the company’s focus on balancing the seller ecosystem and ensuring that any take-rate increases are accompanied by increased value for ecosystem partners.

Core marketplace revenue, which consists mainly of transaction-based fees and high-margin advertising revenue, grew by 49.3% year-on-year to US$2 billion and currently comprises 88% of Shopee’s total revenue.

Driving Growth While Cutting Costs

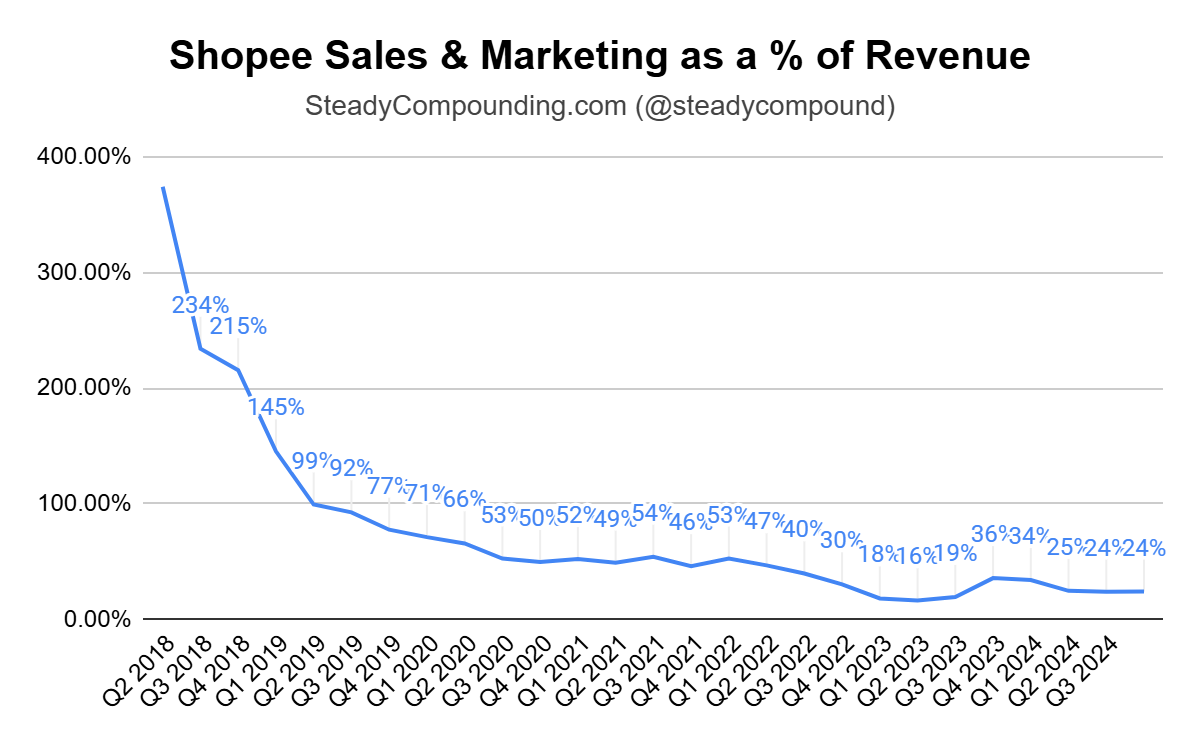

Despite the substantial increase in GMV and gross orders, sales and marketing expenses declined by 11.4% year-on-year to US$763.3 million. Sales and marketing expenses as a percentage of revenue now stand at a healthy 24%, signaling an end to the era of growth at all costs and demonstrating the platform’s ability to drive growth without relying on heavy subsidies.

For the first time ever, Shopee is profitable across all markets, including Brazil. Adjusted EBITDA came in at US$34.4 million, compared to a loss of US$346.5 million a year ago. Li shared that Shopee achieved positive adjusted EBITDA in both Asia and Brazil and is expected to remain profitable going forward.

Operational Priorities: Strengthening the Moat

CEO Forrest Li outlined three key priorities for Shopee to enhance its economic moat:

1) Enhancing Price Competitiveness: Maintain Shopee’s position as Southeast Asia’s largest marketplace, attracting merchants to compete and offer the best value, reinforcing its dominant position.

2) Improving service quality: Investing in end-to-end logistics integration gives Shopee a structural advantage. The company can pass cost savings on to customers and provide better service. In Q3 2024, half of Shopee Express orders in Asia were delivered within two days of order placement. The company is focused on expanding its logistics coverage while reducing costs and delivery times.

3) Strengthening the content ecosystem: Shopee continues to drive live-streaming growth and reap the benefits of its investments in live-streaming capabilities made in the second half of 2023. The company recently partnered with YouTube in Indonesia, allowing creators to embed clickable buttons in their videos that enable viewers to purchase items directly from Shopee. This initiative has also been expanded to Vietnam and Thailand.

Garena: Arresting the Decline

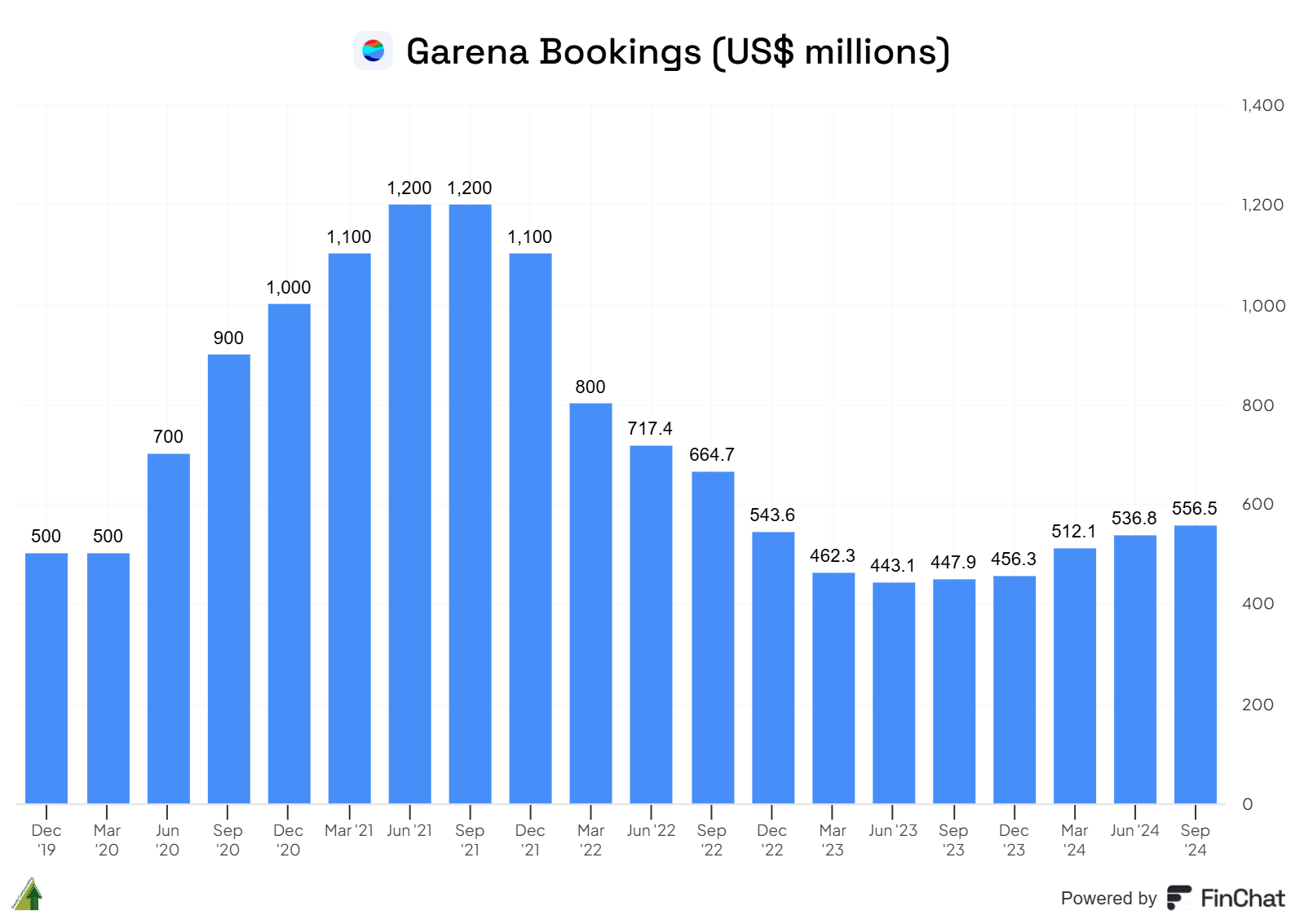

Since hitting its low point in Q2 2023, Garena has continued its recovery with another quarter of growth. Bookings for the segment increased 3.7% sequentially to US$556.5 million.

Source: Finchat (get a 15% discount using this link)

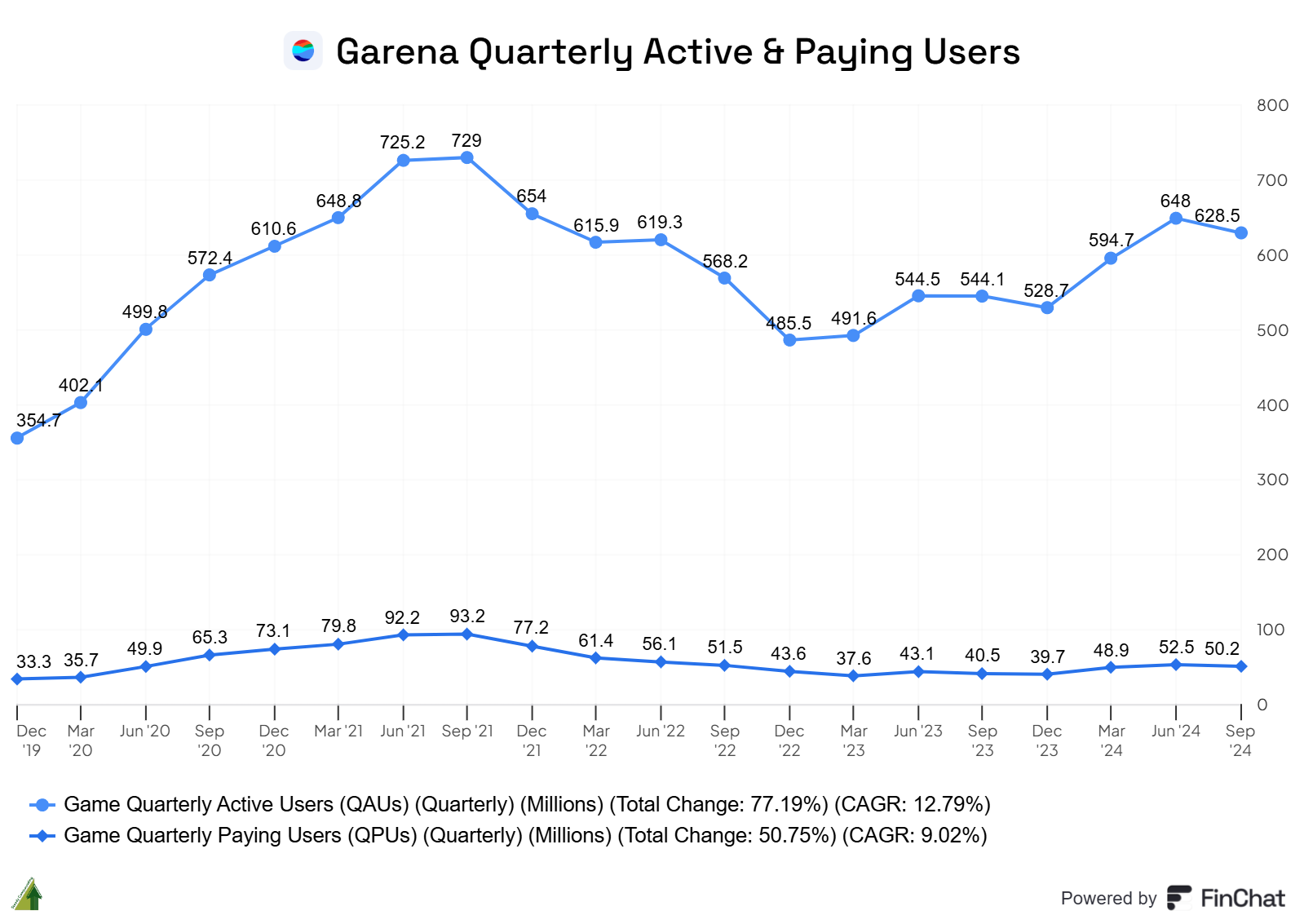

Quarterly active users decreased by 3% sequentially to 628.5 million, and quarterly paying users decreased by 4.4% to 50.2 million, as there will be quarterly fluctuations due to the timing of events or collaborations.

Forrest Li stated that Free Fire consistently had over 100 million daily active users in Q3 2024 and anticipates future growth from Asia, the Americas, and North Africa.

Source: Finchat (get a 15% discount using this link)

Adjusted EBITDA increased by 3.8% sequentially to US$314.4 million. With an adjusted EBITDA margin of 63.2%, Garena remains a powerful cash cow for Sea Limited.

Free Fire continues to grow and maintain its popularity through new content updates, many inspired by local markets and social media trends. One example is the successful collaboration with Moo Deng, which generated user-shared content that garnered over 10 million views.

This ability to stay culturally relevant and engage players through localized content keeps Free Fire evergreen, and the cash flow it brings helps strengthen Sea Limited’s ecosystem.

SeaMoney: A Rapidly Growing Cash Machine

SeaMoney seems to be the cash cow born out of Shopee’s success. This segment turned profitable in Q4 2022 after management pivoted to profitability, and it has been able to grow profitably since then. This goes to show that e-commerce platforms can unlock high-margin revenue streams beyond just advertising.

SeaMoney’s loan book grew by an impressive 73.2% year-on-year, while non-performing loans (NPLs) remained steady at a low 1.2%.

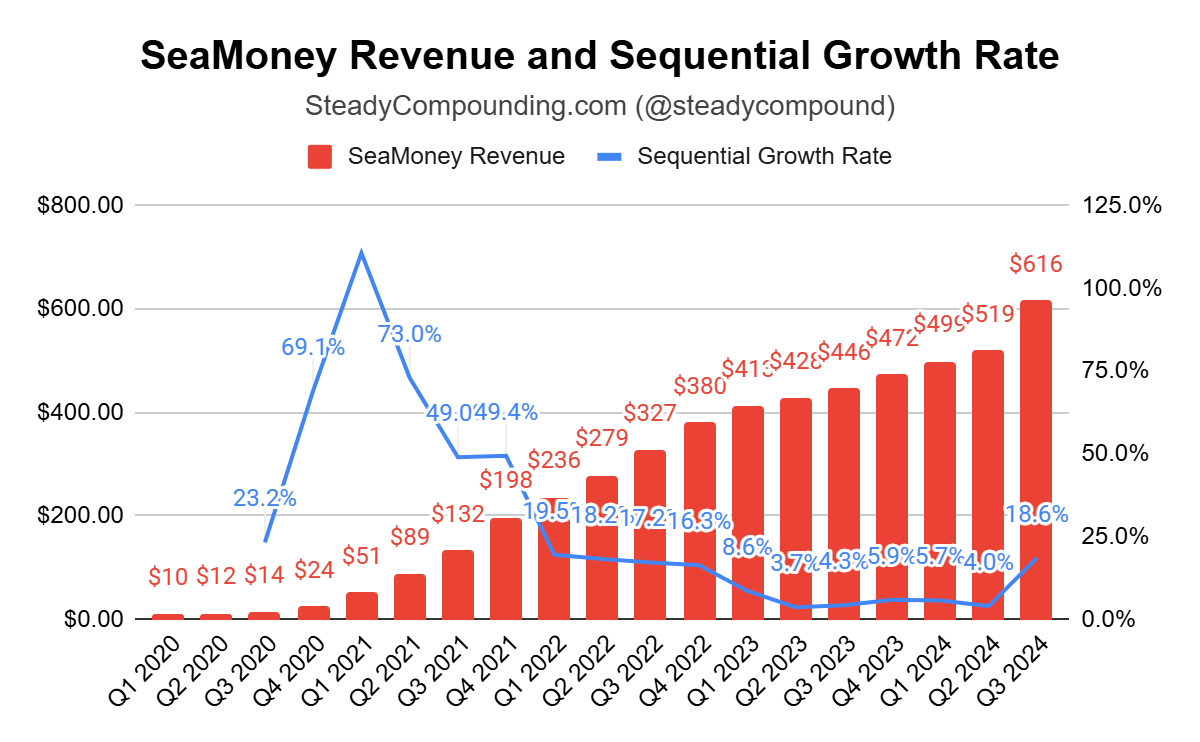

Revenue for SeaMoney saw a strong sequential increase of 18.6%, reaching US$615.7 million.

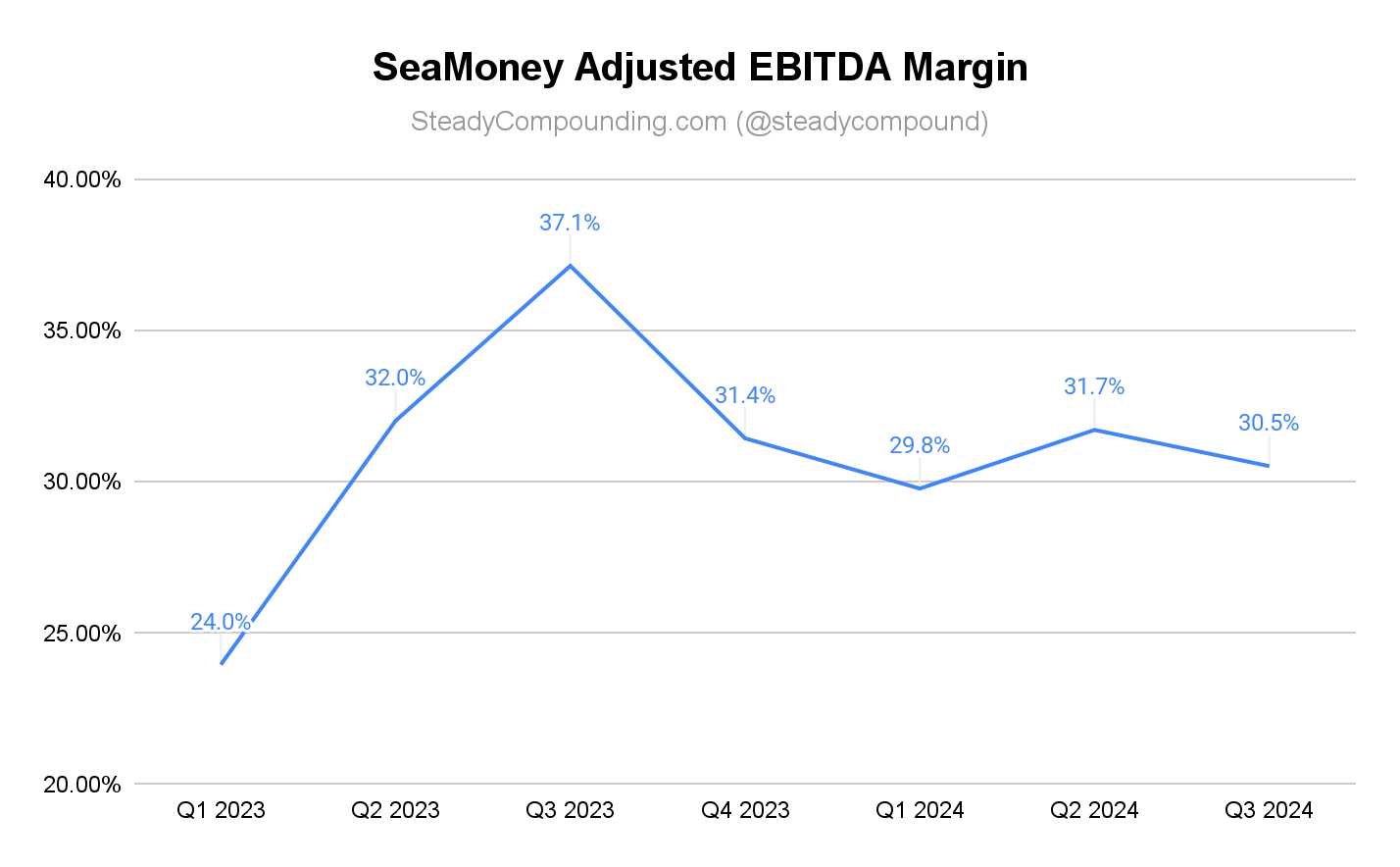

Adjusted EBITDA also exhibited a healthy sequential growth of 14.1%, reaching US$187.9 million, with an EBITDA margin of 30.5%. This profitable growth is possible because of SeaMoney’s synergy with Shopee.

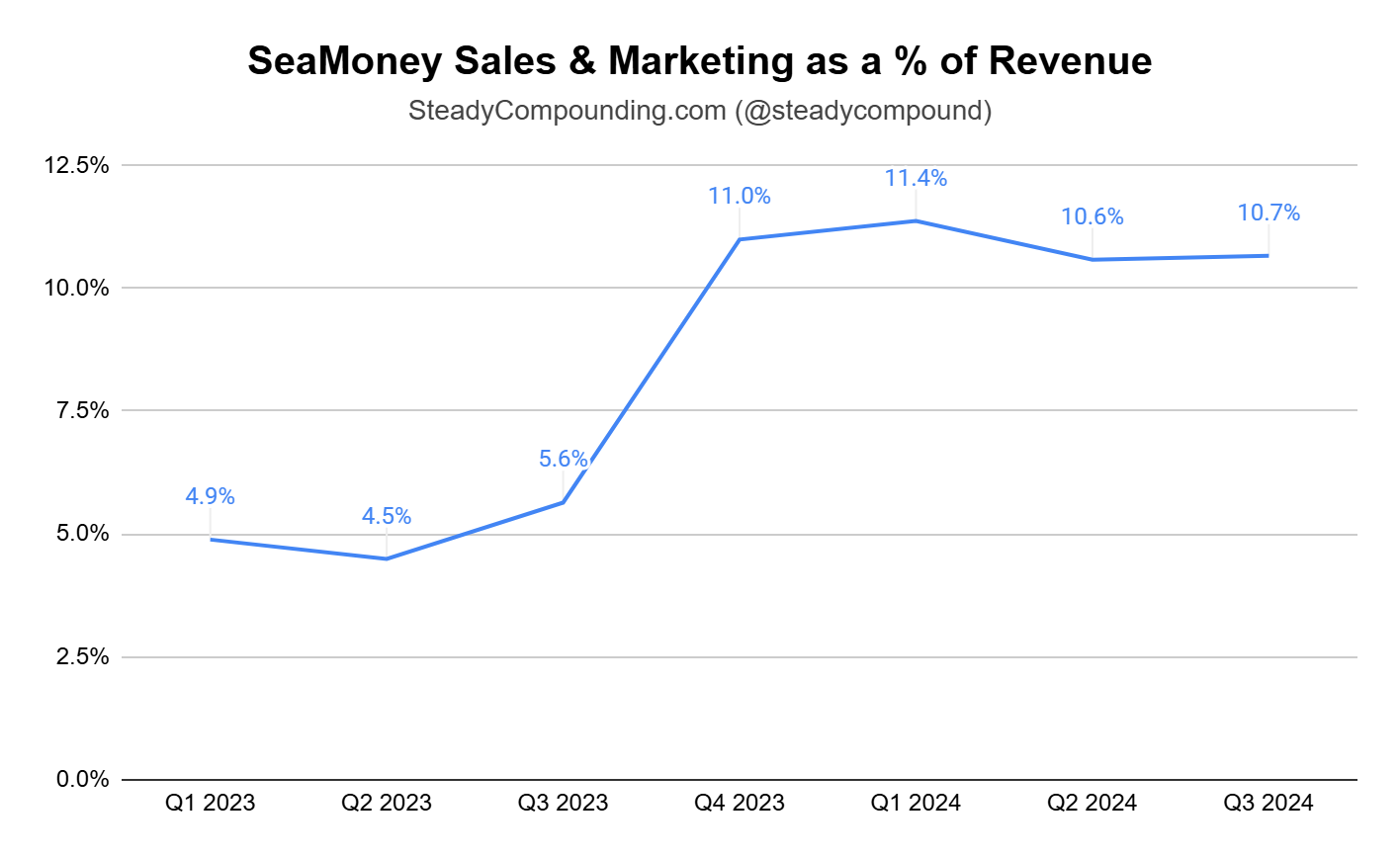

Management maintains a disciplined approach to sales and marketing expenses, holding them steady at US$65.6 million, or 10.7% of revenue.

Prudent Risk Management Drives Healthy Growth

During the earnings call, CEO Forrest Li provided insight into how SeaMoney manages credit risk while maintaining low NPL levels:

“One of our risk management practices is to increase loan size and tenure offerings to users gradually. We typically engage first-time borrowers by offering SPayLater products with small credit limits and short tenure on their Shopee purchases. If the users show a healthy repayment track record, we offer them a higher credit limit, longer tenure options, and other credit products, such as cash loans. This practice underpins our sustainable healthy growth.”

This approach, characterized by a gradual increase in loan exposure based on demonstrated creditworthiness, has proven effective in mitigating risks. Despite the high growth, SeaMoney maintains a conservative lending profile, with loan amounts averaging less than US$200 and tenure periods of just a few months. This prudent strategy and a diversified user base reduce concentration risks.

Going Forward

Forrest Li has reiterated Sea Limited’s commitment to prioritizing profitable growth. He noted that the competitive environment in Southeast Asia has remained relatively stable. Addressing concerns about Shein’s expansion in Brazil, Li emphasized that Shopee remains competitively priced and has not observed significant shifts in buyer preferences among its loyal users.

As Southeast Asia continues its economic ascent, Sea Limited is poised to benefit from the region’s growth. Shopee’s ongoing investments in its logistical network will enhance service quality and expand its total addressable market by reducing delivery costs and times while increasing its geographic reach. These improvements will help unlock further growth opportunities.

For 2024, Shopee is on track to deliver full-year guidance of mid-20s GMV growth. Assuming 25% year-over-year growth, full-year GMV is estimated to reach US$98.2 billion. With US$72 billion already achieved in the first nine months, Q4 2024 GMV is expected to reach US$26.2 billion, a 13.6% increase year-on-year.

For Garena, management now expects Free Fire bookings to grow over 30% year-on-year, taking full-year bookings to an estimated US$2.3 billion (up from US$1.8 billion in 2023). With US$1.6 billion booked in the first nine months, Q4 bookings are projected to hit US$700 million, representing a remarkable 25.8% sequential growth—a clear sign of management’s confidence in Free Fire’s performance.

Li even entertained the idea of share buybacks to create value for shareholders as the company enters its profitable growth arc. This suggests that management is confident in the company’s prospects and is considering various ways to return value to shareholders.

Conclusion

Shopee continues to dominate Southeast Asia in terms of GMV, and this quarter showcased its ability to grow profitably—a feat its competitors have yet to achieve. While Shopee’s margins are currently thin, they will likely increase over time as competition further rationalizes and the e-commerce platform raises take rates through a combination of increased commissions and advertising revenue.

The success of Shopee also gave rise to the highly profitable SeaMoney, where the company applied its proven playbook of leveraging an existing platform to acquire a large user base for a new offering rapidly. This strategy effectively overcomes the cold-start problem in a cost-effective manner. Sea Limited achieved this by encouraging Free Fire users to download Shopee and then use Shopee to drive the growth of SeaMoney.

Furthermore, based on management’s guidance, Q4 will likely be a strong quarter for Garena. It remains to be seen whether Free Fire can regain its momentum and become a growth story once again.

However, as we have seen time and time again, having the largest GMV or the most extensive listings is not a sufficient economic moat for e-commerce platforms. We have witnessed Amazon overtake eBay, Pinduoduo gains significant market share from Taobao, and Shopee surpasses Lazada and Tokopedia in Southeast Asia.

Consumers prioritize three key factors when shopping on an e-commerce platform: selection, price, and service. Shopee is now focused on the final piece of the puzzle—service—by developing its logistical network to reduce delivery costs and times and simplify product returns. This strategic initiative aims to establish a structural advantage over competitors. While this endeavor will require time and significant capital investment, it is crucial for Shopee’s long-term success in e-commerce and I’ll be paying attention to Shopee’s development in its logistical networks.

Disclaimer: This research reports constitute the author’s personal views only and are for educational purposes only. It is not to be construed as financial advice in any shape or form. From time to time, the author may hold positions in the below-mentioned stocks consistent with the views and opinions expressed in this article. Disclosure – I hold a position in Sea Limited at the time of publishing this article (this is a disclosure and NOT A RECOMMENDATION).