In my Q1 2025 analysis PayPal: Let Alex Chriss Cook ($), I wrote:

“Branded checkout is a two-sided network—the more users it brings, the more merchants will accept it, creating a powerful flywheel effect. That’s precisely what’s happening now. If management is right about Braintree—which is expected to return to growth by late 2025 or early 2026—perhaps the market will finally wake up to PayPal’s potential. That’s when we’ll see multiple engines working together for shareholders.”

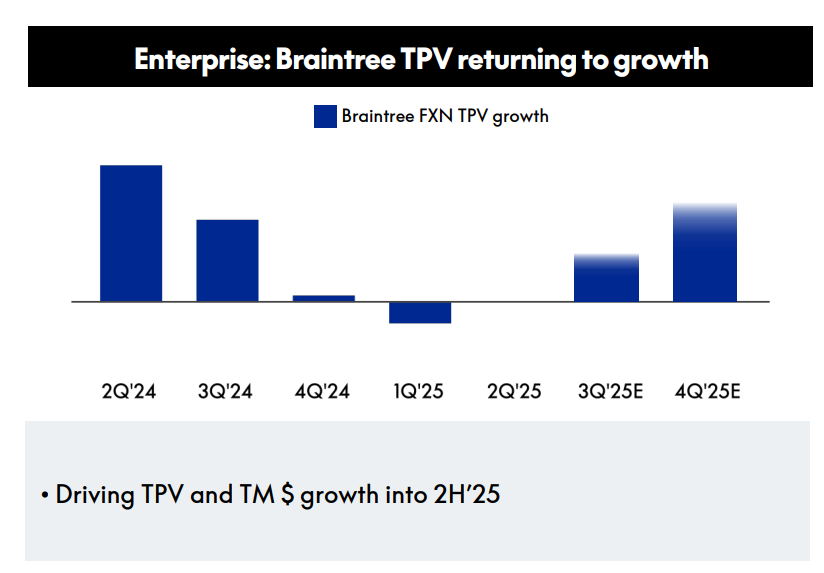

I expected PayPal’s unbranded processing business to remain a drag through 2025. This quarter proved me wrong—in a good way. Braintree is at the cusp of returning to growth while improving transaction margins. Combined with 8% growth in transaction margin dollars (excluding interest on customer balances) and expanded operating margins, the Alex Chriss turnaround is gaining momentum across all strategic priorities.

Let’s Talk Numbers

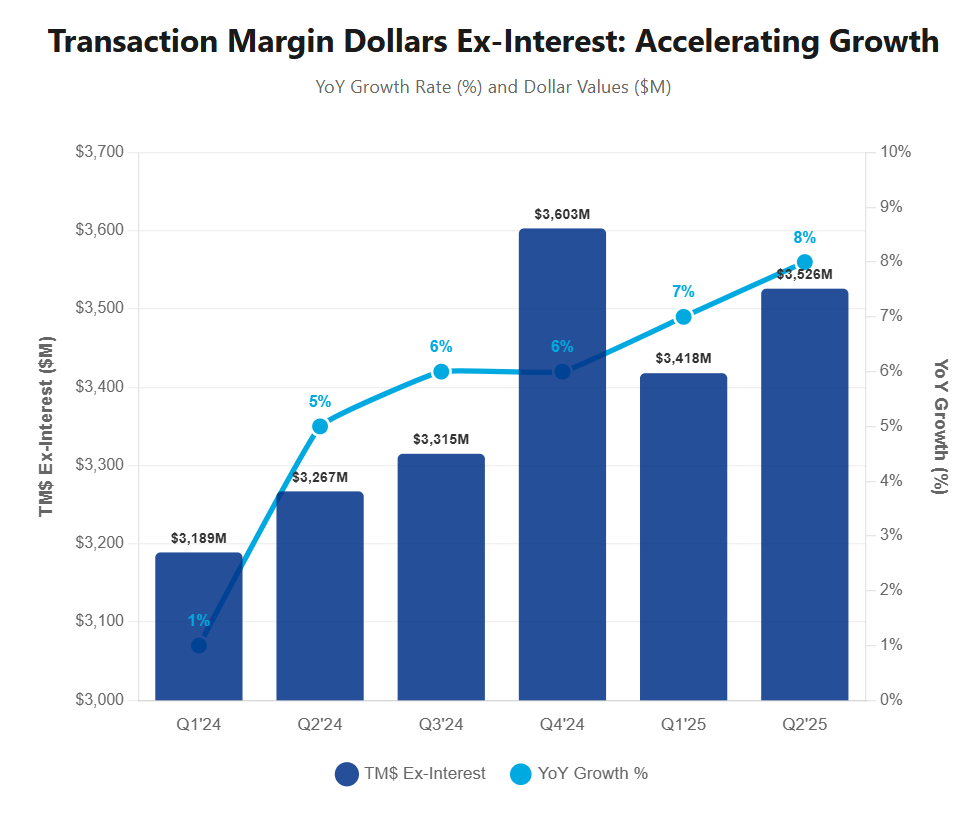

Transaction margin dollars (TM$) excluding interest on customer balances grew 8% to $3.5 billion, accelerating from Q1’s 7% growth. This metric strips out interest earned on customer cash balances, revealing the core earnings power of PayPal’s transaction business.

Second quarter results:

- Revenue: $8.3 billion (+5% year-over-year)

- Operating margins: 19.8% (+132 basis points)

- Non-GAAP EPS: $1.40 (+18%)

- Total Payment Volume: $443.5 billion (+6%)

Updated full-year guidance:

- Transaction margin dollars: $15.35-15.5 billion (previously $15.2-15.4 billion)

- Non-GAAP EPS: $5.15-5.30 (previously $4.95-5.10)

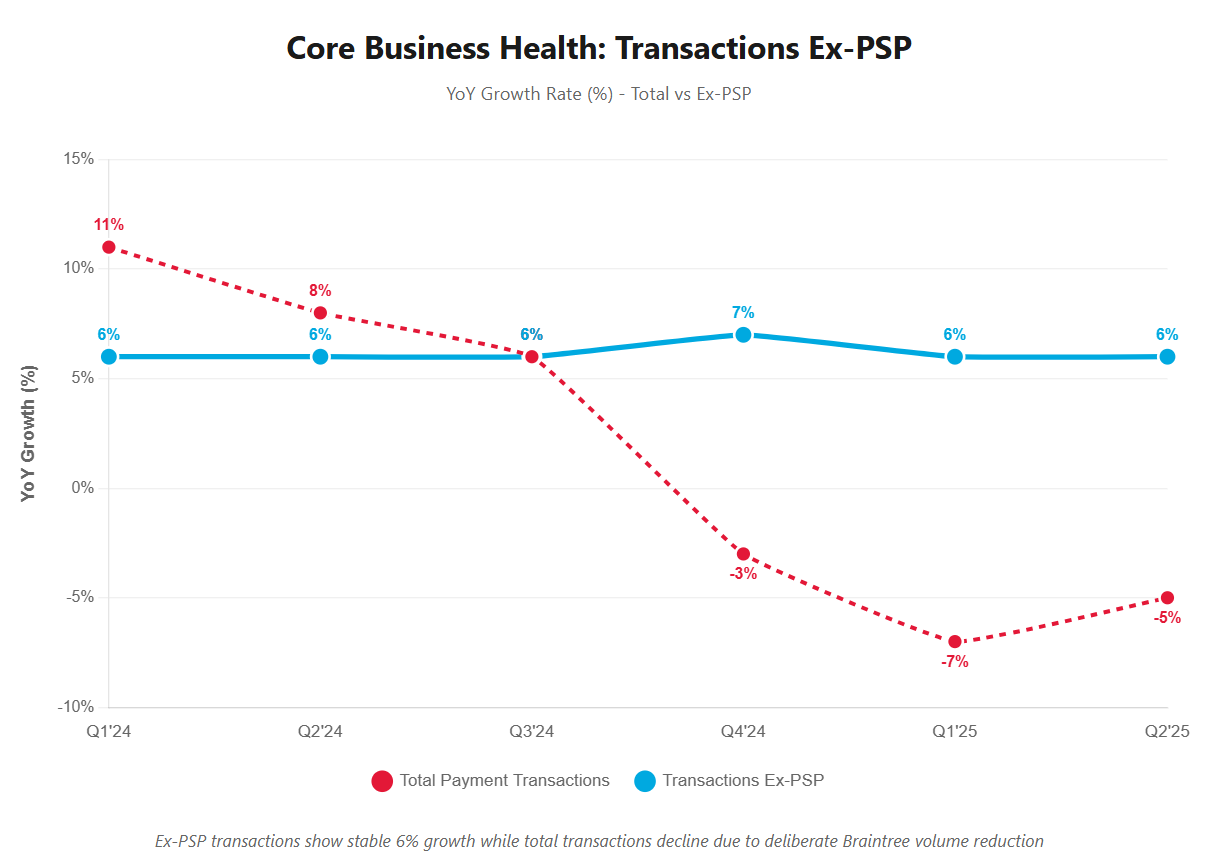

Total transactions declined 5% to 6.2 billion, with transactions per active account (TPA) down 4%. This decline was intentional—management executed deliberate price-to-value actions in the Braintree business, reducing unprofitable payment service provider (PSP) volume. Excluding PSP transactions, payment transactions actually grew 6%, demonstrating strength in branded experiences, Venmo, and peer-to-peer payments.

The 8% transaction margin dollar growth came from multiple sources: credit products, branded checkout, Venmo monetization (over 20% revenue growth), and improved PSP margins despite lower volume. This included a ~1.5 point one-time benefit from a key payment partner relationship renewal.

CFO Jamie Miller noted they “drove operating leverage through a combination of top line growth and cost discipline.” Non-transaction operating expenses grew just 2%, enabling the company to drop more revenue to the bottom line. Combined with a 7% reduction in share count over twelve months, this drove 18% EPS growth.

Branded Checkout: The Flywheel Gains Speed

Branded checkout TPV grew 5% year-over-year, but this understates the underlying momentum. Management disclosed that without tariff headwinds—primarily from Asia-based marketplaces with “higher exposure to goods sourced from China”—growth would have been closer to 6%. CFO Jamie Miller noted “a slight deceleration really in those Chinese to US corridors” following tariff implementation.

Despite these headwinds, the new checkout experience is delivering meaningful conversion improvements. Now deployed to over 60% of U.S. checkout transactions and mid-teens percentage globally, the upgraded experience features improved UI/UX, better BNPL presentment, and a payment-ready API that identifies customers upfront for personalized experiences.

Alex Chriss emphasized the strategic importance: “In the first quarter, users who adopted the PayPal debit card transacted nearly 6x more and generated more than 2x the average revenue per account, compared to those who used online branded checkout only.”

Key branded experience metrics:

- Branded experiences TPV (online & offline): +8% growth

- BNPL TPV: +20% growth with 80% higher average order values

- First-time PayPal & Venmo debit card users added in Q2: 2 million

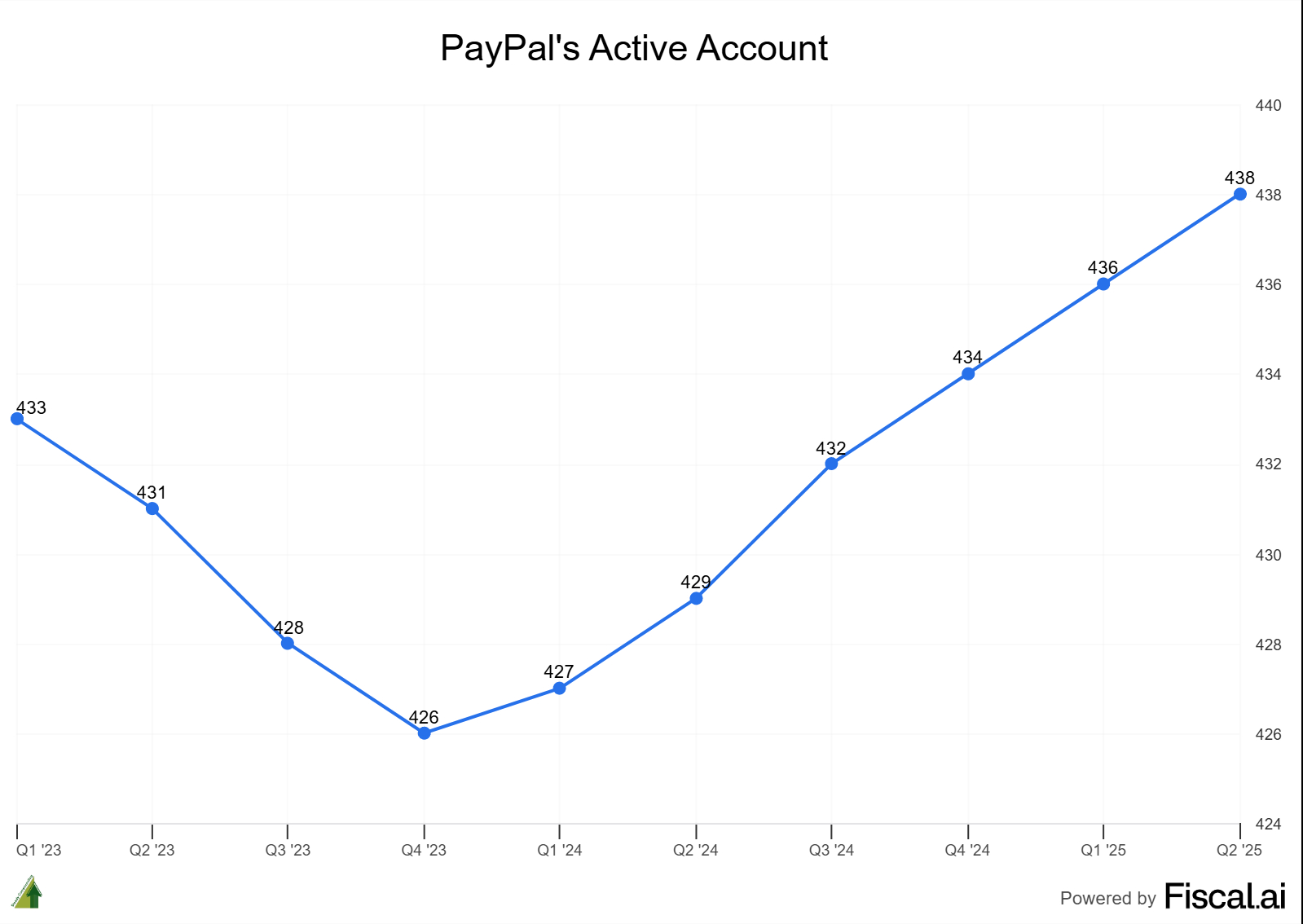

- Active accounts: 438 million (+2% YoY)

Source: Fiscal AI (get a 15% discount using this link)

The Taco Bell partnership exemplifies the omnichannel strategy. PayPal and Venmo can now be set as default payment options in the Taco Bell app and website, with PayPal users earning 20% cash back through July 31. These partnerships embed PayPal into daily spending habits beyond e-commerce.

Chriss acknowledged the scale challenge: “Bending the growth curve takes time for a company of our scale, but we remain confident that the actions we are taking today position us well to accelerate over time.”

Venmo: From Social Payments to Commerce Platform

Venmo delivered its strongest performance in years. Revenue grew over 20% (31% including a one-time payment partner benefit), while TPV accelerated to 12% growth—the highest rate in three years.

The transformation strategy is clear: target merchants that appeal to Venmo’s younger user base, make it easier for users to spend their Venmo balance wherever they shop, and drive the transition from P2P payments to everyday commerce. CEO Alex Chriss emphasized these are “leading brands that resonate with Venmo’s valuable demographic.”

Key performance metrics show the strategy is working:

- Pay with Venmo TPV: +45% growth

- Monthly active accounts for Pay with Venmo: +25% growth

- Venmo debit card monthly active accounts: +40% growth with redesigned onboarding

- Total Venmo TPV: $82 billion in Q2

New merchant additions like Sephora, KFC, and Pizza Hut aren’t random—they’re carefully selected to match where Venmo users already shop. This merchant expansion enables users to spend their Venmo balances on everyday purchases rather than just P2P transfers.

The Big 12 co-branded Venmo debit cards launch, combined with the existing Big Ten partnership, positions Venmo as the default payment method for college students. These partnerships now enable student-athletes to receive revenue share payouts via PayPal and Venmo—embedding the brands into the new economics of college sports.

Management’s international ambitions for the omnichannel strategy were clear. “Our omnichannel strategy is showing early success in the U.S., and we are excited to replicate it internationally,” Chriss stated, confirming NFC capabilities launching in Germany this quarter and PayPal Everywhere coming to the U.K. in Q3.

The broader branded experience strategy validates the shift from commodity payment processing to branded commerce experiences. Higher engagement, expanded use cases, and improved margins demonstrate why this transformation matters for long-term value creation.

Braintree’s Strategic Pivot Bears Fruit

CEO Alex Chriss reflected on the transformation: “I want to reflect on one of my first earnings calls, where we shared our plan to reset our largest merchant relationships to price our services to the value we deliver. The consequence of that reset was pressure on growth in exchange for long-term profitability. Now we are on the other side of that, and can confidently say that our strategy worked.”

This statement encapsulates Braintree’s journey. After deliberately shedding unprofitable volume and accepting growth headwinds, the business appears to be stabilizing—roughly flat in Q2 with growth expected in Q3. This is happening six months ahead of management’s original timeline, suggesting the strategic reset is gaining traction.

Frank Keller, General Manager of PayPal’s Large Enterprise & Merchant Platform Group, explained the repositioning: Braintree is transitioning from a standalone brand to “enterprise payments for PayPal Enterprise payments.” This represents a fundamental shift in how PayPal aims to approach the enterprise market.

From Commodity Processing to Business Solutions

The PSP transformation centers on a simple insight: stop competing on price for commodity processing and start solving real merchant problems.

Before the reset, Braintree was trapped in a race to the bottom—cutting fees to win volume, making the business increasingly unprofitable. Now, PayPal charges premium prices for solving complex operational challenges:

Payouts via Hyperwallet addresses how merchants pay thousands of people globally. Leading travel, mobility, and social commerce platforms use this for instant payment distribution. The same technology powers Big 12 and Big Ten athlete revenue share distributions—turning a commodity service into a strategic enabler.

Fraud Protection Advanced targets a critical merchant dilemma: preventing fraud without blocking legitimate customers. PayPal leverages its global data advantage to help merchants find the right balance.

Multi-channel integration provides one solution for accepting payments everywhere—online, in-app, in-store, internationally. PayPal becomes the single partner handling this complexity, rather than merchants managing multiple processors.

Chriss expressed optimism about the direction: “These services are helping position PayPal as a trusted innovative partner in this evolving commerce landscape and have transformed the margin profile of our PSP business.”

Integration Drives Differentiation

Braintree’s integration into the broader PayPal ecosystem creates unique value propositions for merchants. When Chriss meets with merchant CEOs, he discusses “unbranded, buy now pay later, branded opportunities in PayPal, in Venmo”—offering comprehensive solutions that address multiple merchant needs simultaneously.

The pending Fastlane integration, once multiprocessor support enables compatibility with providers like Adyen, should further enhance the value proposition. PayPal World expands merchant reach globally. These work as an integrated platform solving increasingly complex commerce challenges.

Dual Market Strategy

PayPal is pursuing value across the merchant spectrum through two distinct approaches:

Enterprise (Braintree): Targeting margin-accretive large merchants who may value comprehensive solutions over lowest price. Early signs are encouraging—meaningful TM dollar improvement despite lower volume suggests some merchants are willing to pay for these solutions.

SMB (PayPal Complete Payments): The expanded Wix partnership exemplifies the SMB approach—focusing on seamless integration and ease of use. This targets the underserved middle market between Stripe’s developer focus and traditional processors’ enterprise orientation.

Forward Momentum Building

CFO Jamie Miller’s guidance was clear: “Q3 2025, expect Braintree volume to return to growth.” After quarters of deliberate volume reduction, this projected inflection point would mark an important milestone. The strategy remains consistent—”drive profitable front book business, support our existing merchant base, and continue to lean more into value-added services.”

The attempted transformation from commoditized processing to solutions provider could become PayPal’s most underappreciated strategic shift. While investors focus on branded checkout and Venmo, the ongoing professionalization of the enterprise business aims to create a higher-margin, stickier revenue stream that could drive significant value by 2026.

PayPal World: Solving Global Wallet Fragmentation

PayPal unveiled its most ambitious initiative yet: PayPal World, launching this fall. The platform addresses a fundamental problem in global commerce.

CEO Chriss explained: “Among those billions of users, there are hundreds of regional wallets represented. This fragmented system of wallets poses tremendous challenges and immense friction in a global commerce ecosystem.”

Today’s reality is stark: digital wallets operate in silos, limiting where consumers can shop and how merchants can sell globally. PayPal World becomes the “universal adapter” connecting five major payment systems—PayPal, Venmo, Mercado Pago, Tenpay Global, and UPI—representing nearly 2 billion users.

The Strategic Impact:

- For PayPal: Expand reach from 400 million to 2+ billion users without requiring new merchant integrations

- For Merchants: Accept billions of new customers through existing PayPal integration

- For Consumers: Use preferred wallets anywhere globally

The platform enables both commerce and P2P transfers across wallet ecosystems. The fall launch starts with connecting partner wallets to PayPal and Venmo, with more wallets expected to join. Since the announcement, PayPal has received multiple inbound requests from wallets worldwide looking to join the platform.

This single initiative could transform PayPal from a 400 million user platform to a gateway for global digital commerce—all while leveraging existing merchant relationships.

International Expansion: Germany as Blueprint

PayPal’s first contactless mobile wallet launched nationwide in Germany on iOS and Android, achieving over 3 million enrollments since launch, with 2 million added in Q2 alone. Notably, over 50% of enrolled NFC users set PayPal as their default NFC wallet.

The German rollout demonstrates PayPal’s ability to compete in developed markets dominated by local players and Apple Pay. Additional features launched include:

- Pay Later To Go: In-store installment options (3, 6, 12, and 24 months)

- Deal Week: Rewards at over 2,000 stores through the PayPal app

Management sees this as a template for other markets, with NFC capabilities launching in Germany later this quarter and PayPal Everywhere coming to the U.K. in Q3.

Next-Generation Commerce Initiatives

PayPal is investing in three transformative areas that could reshape how commerce operates:

Agentic AI Commerce: PayPal claims first-mover advantage, having launched “the first remote MCP servers for commerce earlier this year.” The company is partnering with Perplexity, Anthropic, and Salesforce to enable AI agents that can shop on behalf of consumers—finding products, checking out, and tracking purchases automatically. PayPal’s differentiators include KYC/KYB expertise, the largest ecosystem of payment-ready wallets, and extensive customer data. This positions PayPal as the payment infrastructure for AI-powered shopping.

Advertising Platform: Two products launched in Q2:

- Offsite Ads: Reaching millions across the open web through display and video ads

- Storefront Ads: A revolutionary format where consumers can browse, shop, and pay directly within the ad unit

“What makes Storefront Ads truly differentiated is our ability to combine seamless in-ad checkout with direct merchant integration, and PayPal’s trusted payment capabilities,” management noted. The platform has expanded beyond the U.S. to Germany and the U.K.

Crypto and Stablecoins (PYUSD): Aiming to “advance global commerce by directly addressing pain points our customers face today—namely, the burdens of high fees and the slow speed of cross-border money transfers.” Recent developments include:

- Launch of Pay with Crypto supporting 100+ cryptocurrencies

- Integration with wallets like Coinbase and MetaMask, tapping into 650 million crypto users globally

- PYUSD expansion to Stellar and Arbitrum blockchains

- Partnerships with Coinbase, Fiserv, and Mastercard

These initiatives aren’t siloed—PayPal World will support PYUSD for cross-border transactions, agentic AI can leverage the ads platform for product discovery, and all benefit from PayPal’s trusted brand and payment infrastructure.

CEO Chriss emphasized: “I’m proud of our team for leading the industry forward in shaping the future of commerce with innovations like agentic commerce, ads, stablecoins, and PayPal World.”

Areas to Watch

While execution remains strong, a few metrics merit monitoring:

Transaction Loss Rates: The TL rate increased 3 basis points to 0.09% from 0.06% year-over-year. CFO Jamie Miller explained: “As we’ve been implementing and launching new products, we’re just seeing a little bit of an uptick there and things we have to work out and put more rules around and get those back into the flow.” At 0.09%, this remains a very low loss rate in absolute terms.

Geographic Performance Gap: U.S. revenue grew 4% while international surged 10%. This divergence largely reflects the deliberate Braintree volume reduction disproportionately impacting the U.S., along with tariff effects on Asia-to-U.S. commerce flows. International strength comes from Europe, where PayPal continues taking share, and strong cross-border volumes (+7% FXN) driven by intra-European corridors. Management expects this dynamic to flip in the second half of 2025 as Braintree returns to growth.

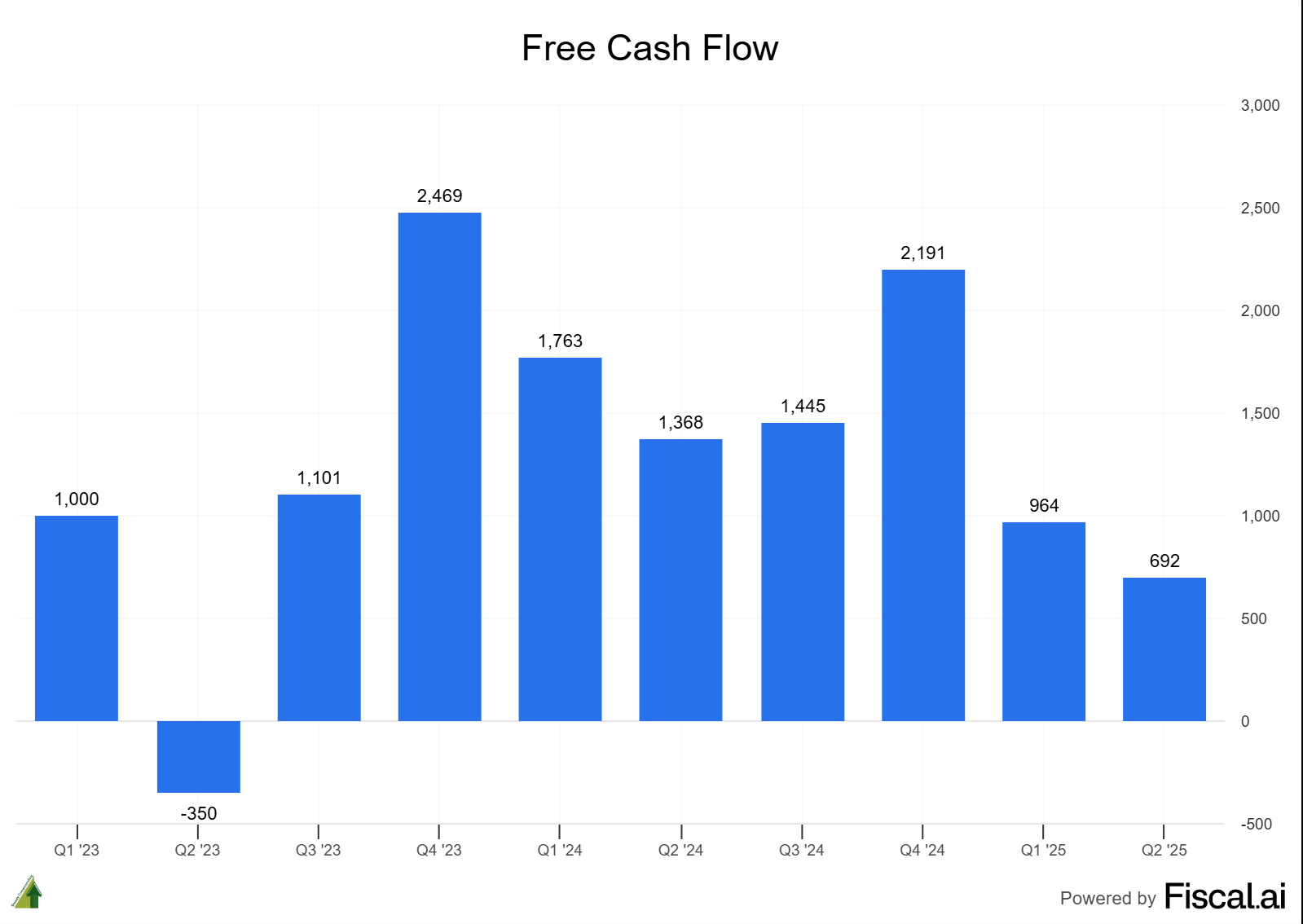

Free Cash Flow Timing: Q2 free cash flow of $692 million (-49% YoY) looks concerning at first glance. However, CFO Miller specifically explained: “Adjusted free cash flow was negatively impacted by timing shifts in working capital, which we expect to reverse in the second half of the year.” The company reaffirmed full-year guidance of $6-7 billion, implying over $5 billion in H2. We’ll continue to monitor if the cash shows up in Q3 and Q4.

Source: Fiscal AI (get a 15% discount using this link)

H2 Growth Deceleration: While management raised full-year guidance, the implied second-half deceleration was somewhat disappointing. After delivering ~7% TM$ growth in H1, the raised guidance still implies a slowdown to ~3-5% growth in H2’25. Given Braintree is at the cusp of returning to profitable growth and the momentum across branded experiences and Venmo, I expected an acceleration. Management may be sandbagging guidance due to tariff uncertainties and the unpredictable macroeconomic environment. We’ll monitor whether they can deliver upside surprises as the transformation gains further traction.Source: Fiscal AI (get a 15% discount using this link)

Valuation Remains Undemanding Despite Progress

Source: Fiscal AI (get a 15% discount using this link)

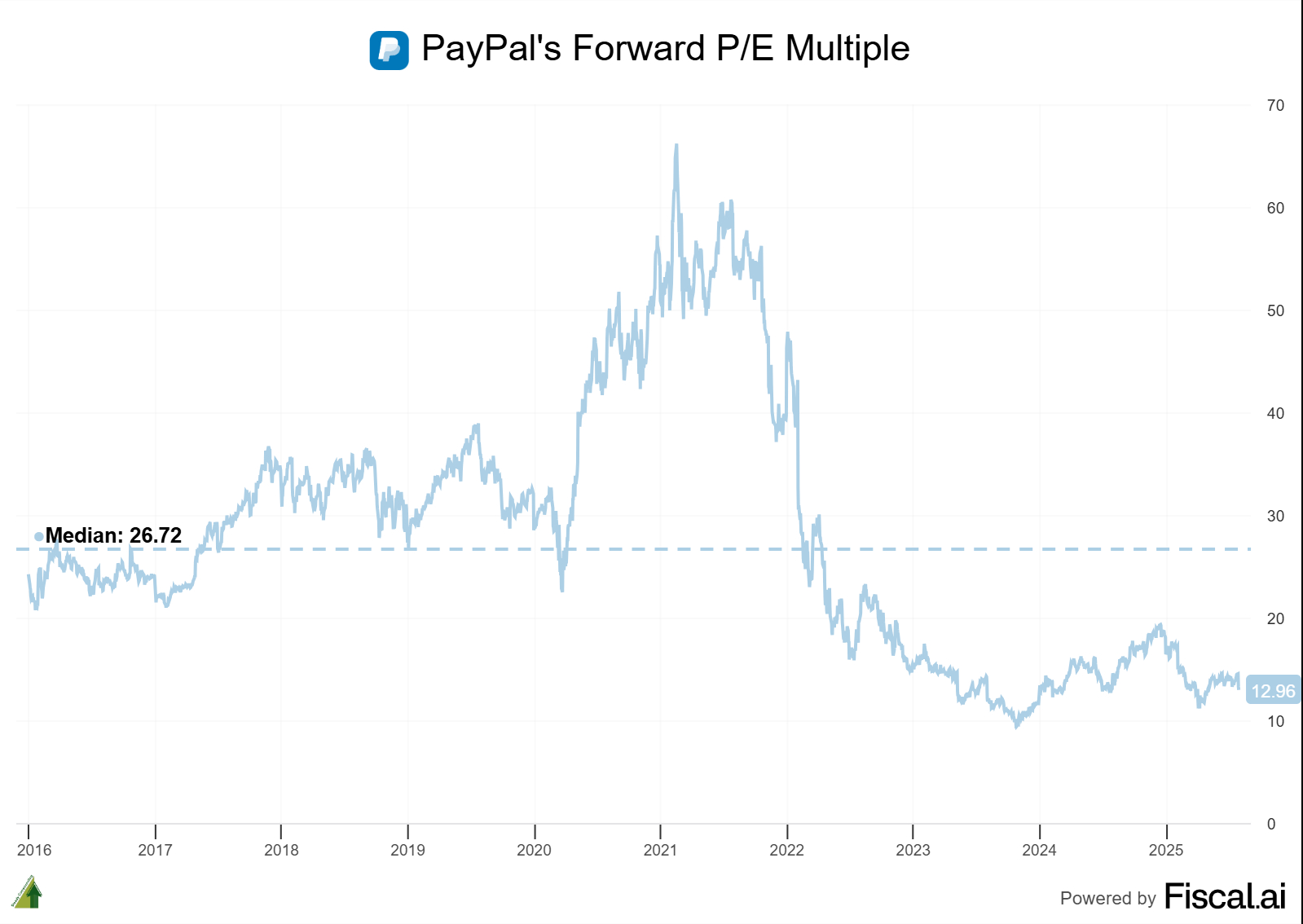

PayPal continues to trade at a very undemanding ~13x forward P/E despite improving fundamentals across multiple business lines. This valuation stands in stark contrast to its historical average of 26x—a multiple the company commanded when it was viewed as a high-growth fintech leader rather than a mature payments processor.

For PayPal to recapture anything close to its historical valuation, the company needs to demonstrate sustainable low-teens growth in both revenue and transaction margin dollars. With Braintree reverting to growth from Q3 onwards and multiple growth drivers gaining traction, we’ll monitor whether management can deliver the acceleration needed to justify a meaningful rerating.

Capital Allocation: Buybacks at Bargain Prices

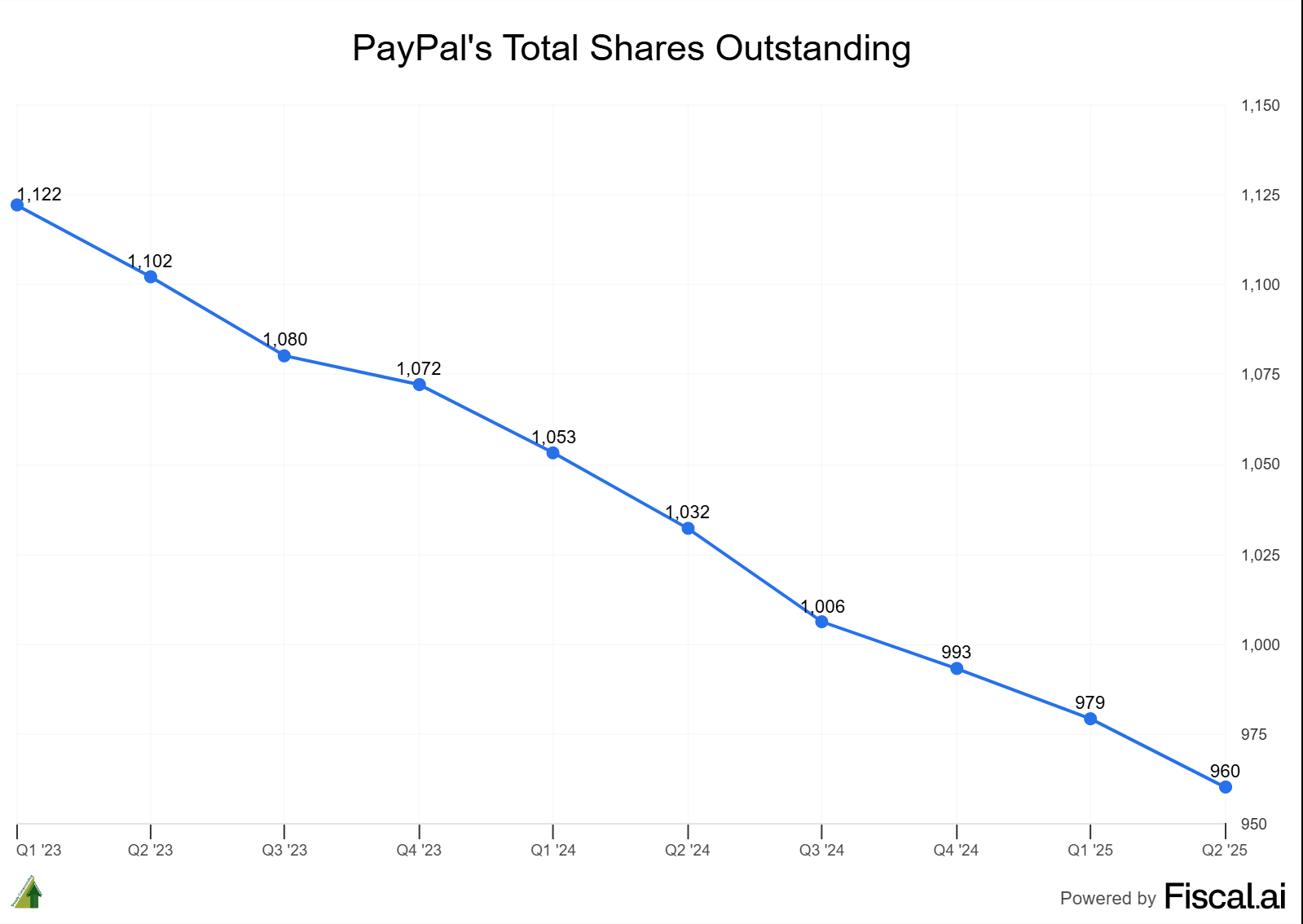

While we wait for the market to recognize PayPal’s improving fundamentals, management is capitalizing on the valuation disconnect through an aggressive share repurchase program. At today’s ~13x forward P/E, these buybacks will likely prove highly accretive to long-term shareholder value—particularly if the company returns to low-teens growth.

Current Buyback Momentum

In Q2 2025, PayPal repurchased $1.5 billion worth of stock (~22 million shares at an implied average of $68). Over the trailing twelve months, the company has returned $6.0 billion to shareholders, reducing the weighted average share count by 7%. This isn’t a one-time event—management has committed to maintaining this $6 billion annual pace through 2025.

Source: Fiscal AI (get a 15% discount using this link)

Balance Sheet Supports Continued Returns

PayPal’s fortress balance sheet enables this capital return strategy without compromising strategic flexibility:

- Total liquidity of $13.7 billion (cash, short-term, and long-term investments)

- Manageable debt of $11.5 billion

- Net cash position of $2.2 billion

This financial strength allows PayPal to simultaneously invest in growth initiatives (PayPal World, AI commerce, international expansion) while returning significant capital to shareholders at attractive prices.

Conclusion: Seeds Planted, Patience Required

Looking beyond the headline numbers, the underlying health of PayPal’s business remains robust. Excluding Braintree’s deliberate volume reduction, payment transactions grew 6% to 3.9 billion. Total payment volume reached $443.5 billion (+5% FXN), while transaction margin dollars excluding interest grew 8%—demonstrating that the core business continues to expand even as management reshapes the portfolio.

The results from the seeds Alex Chriss planted nearly two years ago are starting to show. From Venmo’s acceleration to 12% TPV growth, to branded experiences maintaining 8% growth, to Braintree’s earlier-than-expected return to profitability—the transformation playbook is working, albeit gradually.

While the market remains skeptical, trading the stock near multi-year lows, I’m willing to give the team more time to turn this ship around. The strategic pieces are falling into place, execution is improving quarter by quarter, and at current valuations, I think the odds are still in the investor’s favor.

[For Steady Compounding Insider Stocks Members]

The analysis continues with my portfolio positioning based on PayPal’s Q2 results and current market opportunities. Members can access:

- Portfolio Update: Two Additions at Different Stages – Why I’m adding to one turnaround story showing clear execution and nibbling on a quality retailer at GFC-level valuations

- My specific position sizing and entry rationale for each investment

- How these moves fit into my broader portfolio strategy following recent trades in Adobe and Alphabet

- Links to my complete research reports on all companies discussed

This portfolio update section, along with all my past research reports is available exclusively to Steady Compounding Insider Stocks members.

If you’re interested in following my investment journey and accessing the complete analysis, you can learn more about membership here.

Disclaimer: This research reports constitute the author’s personal views only and are for educational purposes only. It is not to be construed as financial advice in any shape or form. From time to time, the author may hold positions in the below-mentioned stocks consistent with the views and opinions expressed in this article. Disclosure – I hold a position in PayPal at the time of publishing this article (this is a disclosure and NOT A RECOMMENDATION).