Marathon Asset produced several iconic investors such as Nick Sleep and Jeremy Hosking.

Their letters from 2002 to 2015 provided a treasure trove of insights into their investment frameworks and how they look at the capital cycle.

Here are my main takeaways:

1. Periods of high profitability leads to reckless investments.

When profits are high:

- Boost CAPEX with little regard for ROIC

- Competitors will follow suit to avoid losing market share

- CEO’s incentives aren’t aligned with shareholders

It’s a race to the bottom.

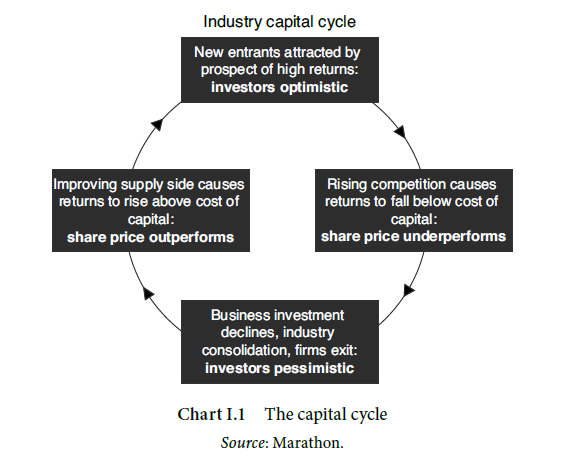

2. The capital cycle will swing down when investments are taken too far.

Forecasts that were reasonable will now look overly optimistic.

Profits collapse, management teams are changed, CAPEX is cut, and consolidation begins.

This will pave way for a recovery of profits.

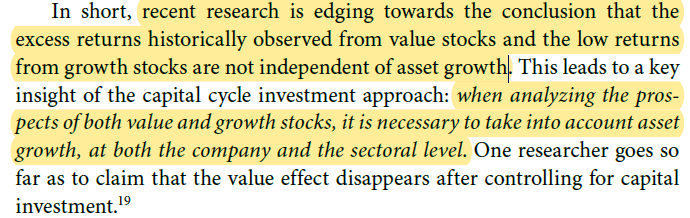

3. Asset growth matters

Consider both asset growth at the company and industry level.

Avoid industries where assets are growing rapidly.

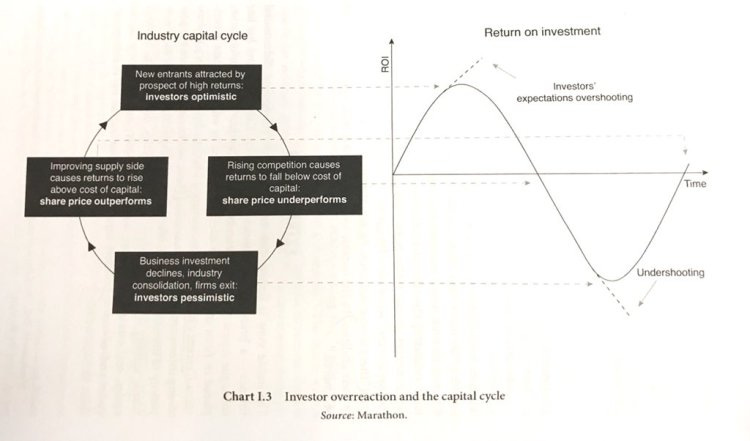

4. We tend to extrapolate

When overdone, investments that appear logical at first can become disastrous.

We have a tendency to forecast linearly when many things are cyclical.

Examples: trade cycles, credit cycles, etc.

5. Overconfidence

In making forecasts, investors and corporate managers are prone to be overconfident.

The overinvestment behavior is reinforced when many players in the industry do the same.

6. Focus on supply when making forecasts

Supply is far less uncertain than demand.

Since most analysts focus on demand, stock markets rarely price in supply shocks.

7. Six tenets of capital cycle analysis

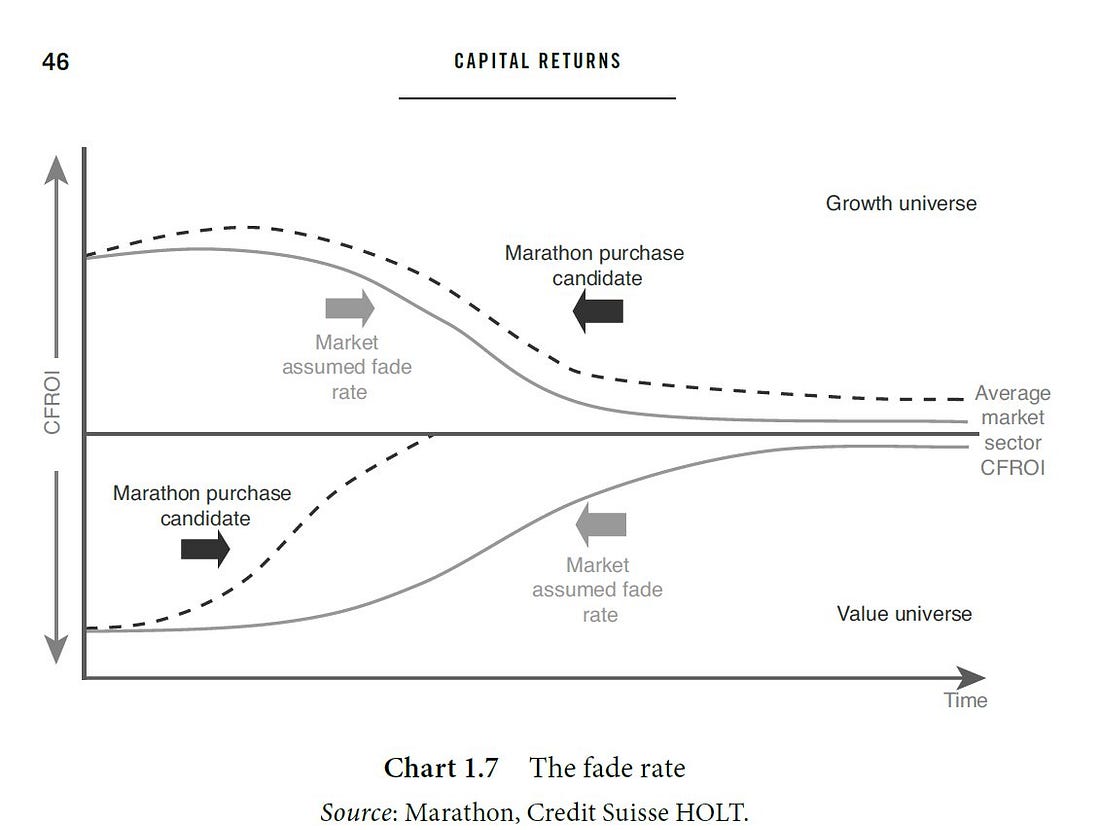

8. Hunting for growth & value

When seeking growth, they look for businesses whose returns are more sustainable than what the market expects.

When seeking value, they look for companies whose improvement potential is generally underestimated.

9. Primary driver of value is a favorable supply side.

In fact, a strong demand may destroy value as it triggers the industry to invest excessively.

10. Look at where capital has withdrawn

When competition exits, it is when profitability and valuation start to rise.

11. Companies with pricing power generate durable returns

It usually comes from:

- Oligopolistic market structure

- “Intrinsic” pricing power embedded in the product.

I.e. Branding of consumer products or mission-critical products.

That’s it!

If you like this, share it to help others find it.

Steady Compounding Research Service

As my content library builds, prices of my research service will be going up significantly in Q1 2022. I want to begin this next phase by extending a special offer to my earliest readers, including you!

Get a lifetime 20% off by signing up today:

Monthly membership ($12/month)➔ Sign up here

Annual membership ($103.20/year)➔ Sign up here