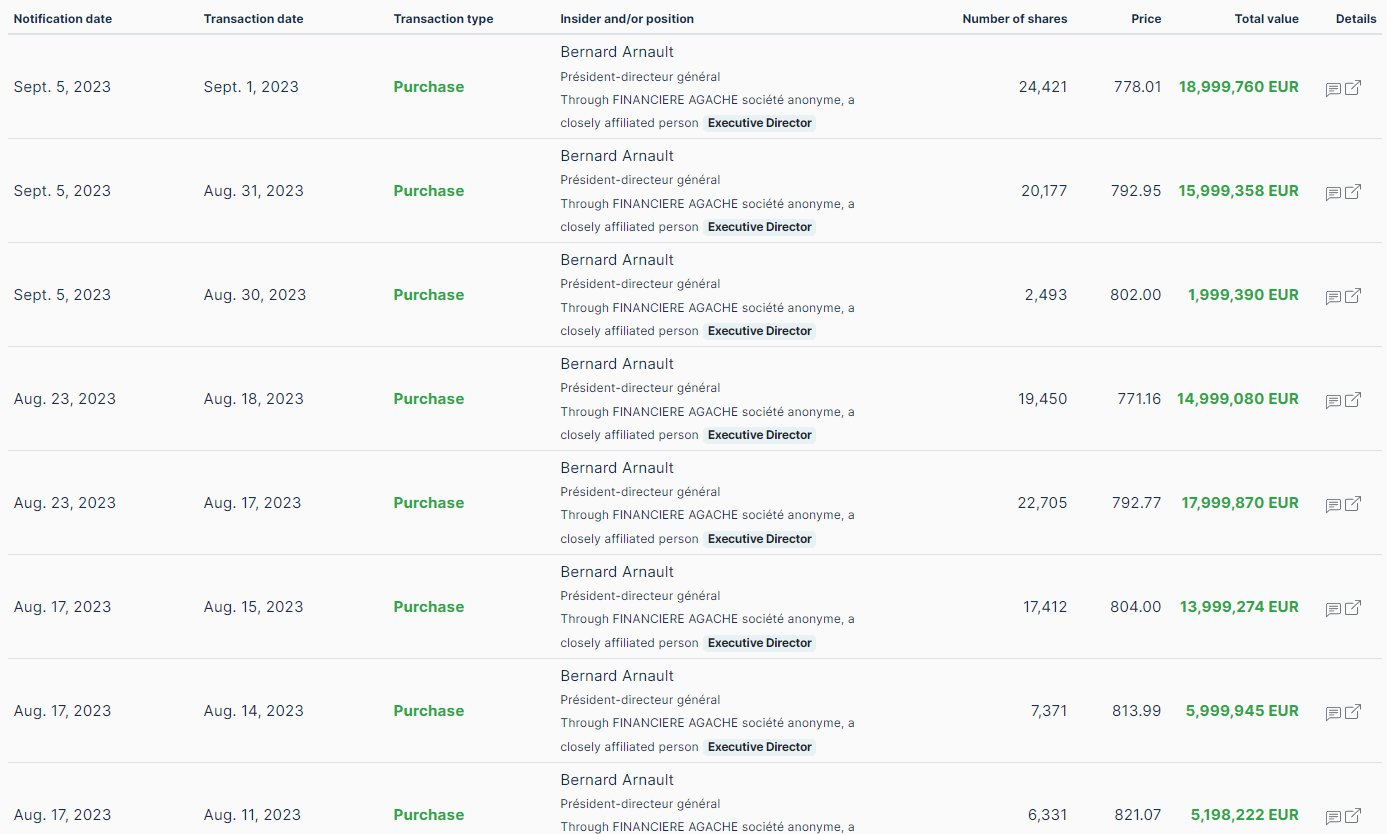

No, he isn’t buying back shares with the company’s money

He’s using his own money to buy the shares for himself.

Peter Lynch said it best in his book: “Insiders may sell their shares for many reasons, but they buy them for only one: they expect the price to rise.”

Nowadays, insiders might also buy back their own shares in order to send a false signal to the market that the company is still strong and that it was wrong to sell the company off.

*Takes a look at Docusign and Peloton.

However, LVMH isn’t desperate to prop up its share price like these loss-making companies that need to raise cash from time to time by issuing new shares.

It is also worth mentioning that Bernard Arnault, Chairman and CEO of LVMH, has a long history of making capital allocations and managing the luxury conglomerate well.

I have been watching LVMH and Hermes because of the Lindy Effect for quite some time.

Ever heard of the Lindy Effect?

A long-lasting company is more likely to exist in the future, perform well, and survive crises according to the Lindy Effect.

When a brand is as strong as LVMH, it’s hard to imagine how technology could disrupt it, or how another brand could surpass it.

It is hard to create the story and history of the most successful luxury brands, even if you have all the money in the world.

Time and again, they’ve proven resilient during economic downturns. Even during economic crises, the super rich do not cut their spending.

I would love to have some of these companies in my portfolio as steady compounders (pun intended).

That doesn’t mean I buy it outright now. However, Bernard’s decision to buy his own shares heavily is a good reason for me to dig deeper into this company.

This also means that the next deep-dive will be on LVMH.

Keep an eye out.

Thomas

P.S. If you aren’t on my email list already, make sure to join so that you don’t miss out.

>> Click here to join my email list.

Bernard Arnault Shares Buyback