Ever since Satya took over, Microsoft has just been doing Microsoft things—executing.

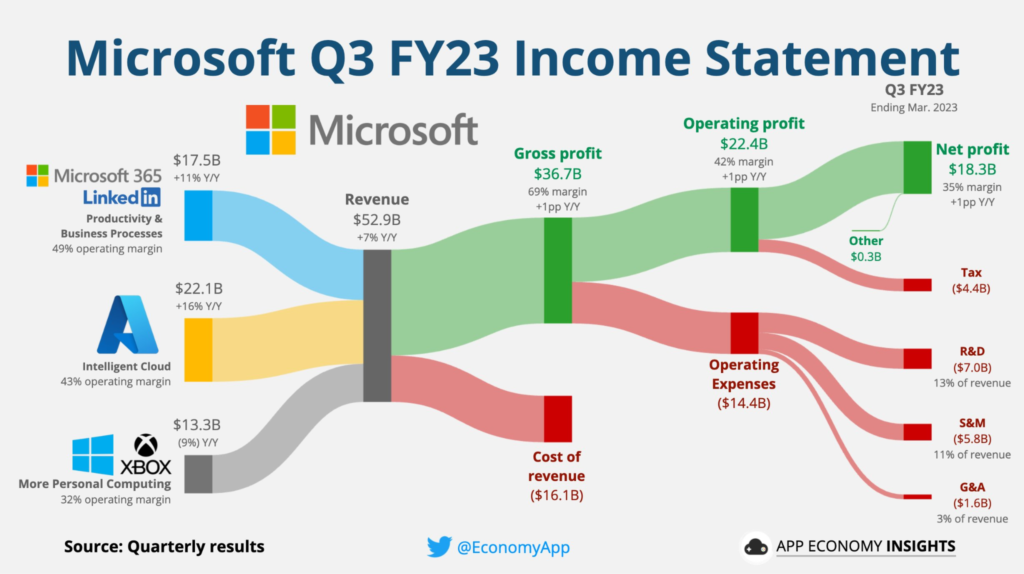

The company reported the following set of results:

- Revenue up 7% year-over-year (yoy) to $52.9b

- Gross profits up 9% yoy to $36.7b with margins at 69% (from 68%)

- Operating income up 10% to $22.4b with margins at 42% (from 41%)

- Net income up 9% to $18.3b with margins at 35%

Alright, let’s dive into the nitty gritty!

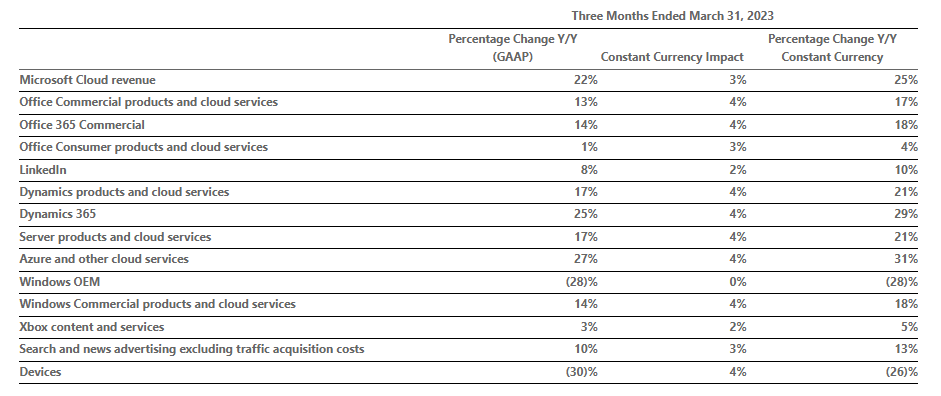

Azure up a whopping 27%

Azure and other cloud services continue to gain market share, growing 27%. Google too reported their results and grew 28% and turned profitable, but it is coming off a much smaller base.

Here’s what Satya said was Azure’s priorities:

“We continue to focus on 3 priorities: first, helping customers use the breadth and depth of the Microsoft Cloud to get the most value out of their digital spend; second, investing to lead in the new AI wave across our solution areas and expanding our TAM; and third, driving operating leverage, aligning our cost structure with our revenue growth.”

Challenging Google in search

For the longest time, Microsoft has aimed to dethrone Google (or at least form a duopoly) in search, but this attempt has been futile at best. This time, they’ve incorporated ChatGPT into Bing to challenge Google.

Engagement has been strong and Edge has increased market share for the eighth consecutive quarter.

“Two months since the launch of new Bing and Edge, we are very encouraged by user feedback and usage patterns. All up, Bing has more than 100 million daily active users. We are winning new customers on Windows and mobile. Daily installs on the Bing mobile app have grown 4x since launch. We are making progress in share gains.

Edge took share for the eighth consecutive quarter, and Bing once again grew share in the United States. We continue to innovate with first-of-their-kind AI-powered features, including the ability to set the tone of chat and create images from text prompts powered by DALL-E. Over 200 million images have been created to date, and we see that when people use these new AI features, their engagement with Bing and Edge goes up.

As we look towards a future where chat becomes a new way for people to seek information, consumers have real choice in business model and modalities with Azure-powered chat entry points across Bing, Edge, Windows and OpenAI’s ChatGPT. We look forward to continuing this journey in what is a generational shift in the largest software category, search.”

I don’t want to spill cold water on Bing, but revenue growth hasn’t accelerated sequentially. As of now, advertisers have not made a significant shift over to Bing, and it will be important to monitor if both users and advertisers are attracted to the integration of ChatGPT.

More than 930m active users on LinkedIn

LinkedIn revenue is up 8% and they saw record engagement of 930m members.

“Now on to LinkedIn. We once again saw record engagement as more than 930 million members turn to the professional social network to connect, learn, sell and get hired. Member growth accelerated for the seventh consecutive quarter as we expanded to new audiences.

We now have 100 million members in India, up 19%. And as Gen Z entered the workforce, we saw 73% year-over-year increase in the number of student sign-ups. In this persistently tight labor market, LinkedIn Talent Solutions continues to help hirers connect to job seekers and professionals to build the skills they need to access opportunity.”

Bird’s eye view

All in all, they’re firing on all cylinders with the exception of its personal computing segment, specifically the Windows OEM and Devices segment, which declined 28% and 30% respectively.

“Now on to Windows. While the PC market continues to face headwinds, we again saw record monthly active Windows devices and higher usage compared to prepandemic. We’re also seeing accelerated growth in Windows 11 commercial deployments. Over 90% of the Fortune 500 are currently trialing or have deployed Windows 11.”

I have previously written an in-depth research report on Microsoft for members only. Check it out by signing in here.

Disclaimer: This research reports constitute the author’s personal views only and are for educational purposes only. It is not to be construed as financial advice in any shape or form. From time to time, the author may hold positions in the below-mentioned stocks consistent with the views and opinions expressed in this article. Disclosure – I hold a position in Microsoft at the time of publishing this article (this is a disclosure and NOT A RECOMMENDATION).