This is an extract of the deep-dive for members, if you like to access the complete research report and the entire archive of past research…

>> Click here to become a Steady Compounding member!

“Bad companies are destroyed by crisis, Good companies survive them, Great companies are improved by them.” — Andy Grove

When I researched Airbnb, it reminded me of this quote because the company was born during the subprime crisis in 2008 and then it took another big hit from the Covid crisis, which directly impacted the business.

How it all began

Airbnb’s founders, Joe Gebbia and Brian Chesky both went to art school and didn’t have the traditional IT or business background like most founders of tech companies. After they graduated, Brian Chesky worked as an industrial designer in Los Angeles but working in a big corporation didn’t allow him to create the impact he was looking for.

So he quit this job in October 2007 and moved to San Francisco to start a company with Joe Gebbia with only $1,000 in his bank account.

And then, two things happened which led to the birth of an idea:

Firstly, they were notified that their rent was increased by 25%. For two unemployed design students this was a looming deadline that would almost certainly make them homeless.

Secondly, there was a large design conference coming up that weekend in San Francisco and all the hotels in the area were sold out.

Joe suggested that they offer their place to anybody who wanted to stay on the air beds they had in the closet.

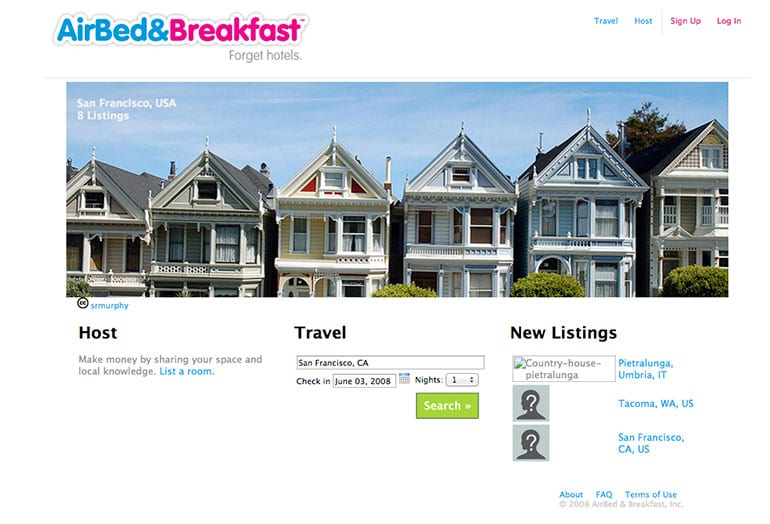

Sure enough, they launched their website, airbedandbreakfast.com for $80 and offered designers a place to stay for the weekend event.

Both Joe and Brian had such a great experience they wanted to create a way to offer that experience to more people and decided to bring in Nathan Blecharczyk, a specialist in coding and technology.

Getting ready for the Democratic National Convention (DNC)

They were looking for the next big event to ride on for web traffic and awareness, and settled on targeting the DNC speech coming up in Denver by Barack Obama in 2008. More than 80,000 people were expected to arrive in Denver but the city only had 27,000 hotel rooms.

There was an accommodation crisis and they launched their site again,financing the entire project using their credit card. But this time, there was media attention on their site. In just four weeks, they went from zero listings to over 800 listings.

But after the speech, the site’s traffic disappeared. Taking advantage of this wave of media interest, they started to meet with investors but not a single one of them were interested in investing.

Brian and Joe had to brainstorm ways to self-finance their business, because the walls are closing in with crippling debt.

Obama vs McCain

In the run-up to the 2008 election, they wanted to capitalize on the political atmosphere. Brian and Joe came up with a creative idea: politically focused cereal boxes. They printed 1,000 boxes, 500 boxes for each candidate: Obama O’s and Cap’n McCain’s cereals.

They did this by bringing their idea to an illustrator who printed all 1,000 boxes. Then they bought regular cereal from their local supermarket, put it in their new boxes and created a website to start selling them.

And because they only had 1,000 boxes, they printed a number on each box to market them as limited edition collector’s items.This allowed them to sell it for $40 a box!

And the most shocking factor out of all these was that it worked. They managed to sell over 800 boxes, generating over $30,000 in profits.

In addition to clearing up a bunch of their debt… they caught the attention of Y Combinator’s co-founder Paul Graham.

Securing investors capital

Life is funny like these, they sold the cereals because they couldn’t get investors. But it was the cereals that got them investors eventually, not the Airbnb idea.

Paul Graham was doubtful of their Airbnb idea, the company didn’t have growth, it didn’t have profits and who the hell would welcome a stranger into their home or stay on a stranger’s couch?

Graham took them on because of their attitude and grit in selling simple cereal boxes to self-finance their business. If they could sell cereal for $40 a box, they might actually pull off this idea.

Y Combinator invested only $20,000. But Graham’s stamp of approval opened the door to other investors and they raised over $600,000 in the first round of funding.

The power of the Airbnb brand

Being both a verb and a noun is a great advantage. Over 90% of traffic to airbnb.com was unpaid organic search compared to 78% for Booking Holdings and 84% for Expedia.

The power of Airbnb brand:

Revenue

Booking: $11b

Expedia: $8.6b

Airbnb: $6b

Marketing spend

Booking: $3.8b

Expedia: $4.2b

Airbnb: $1.2b

Marketing as a % of revenue

Booking: 34.5%

Expedia: 48.8%

Airbnb: 20%

By driving direct search (over 90%) instead of relying solely on paid search rankings, Airbnb is reaping the benefits. Airbnb has to pay only 20% of its revenue in marketing expenses in comparison to Booking that pays 34.5% and Expedia 48.8% of its revenue in 2021.

Access the entire Airbnb research by becoming a member

If you like to access Airbnb financial breakdown, risks, valuation and more…