It was alright not to buy Amazon in the early days, because that was a tough business and it survived to become the dominant force it has become today because Jeff Bezos is a “miracle worker.”

But when asked about Google, here’s what Munger has to say, “I feel like a horse’s ass for not identifying Google earlier … We screwed up.”

Even before Google IPOed, he could see that many of his companies (especially Geico) were spending a ton of money on Google for advertisement.

It Cost Almost Nothing to Earn An Extra Dollar Of Revenue

Traditionally, when we sell a product, we have to incur cost for making these products.

But for Google, it doesn’t cost anything to earn an additional dollar of advertisement revenue.

Google’s customers will go onto its platform, put in their credit card, and pay Google to funnel eyeballs to their websites.

This means that Google has minimal working capital requirements, and can use its capital to grow their business, buy back shares or acquire businesses.

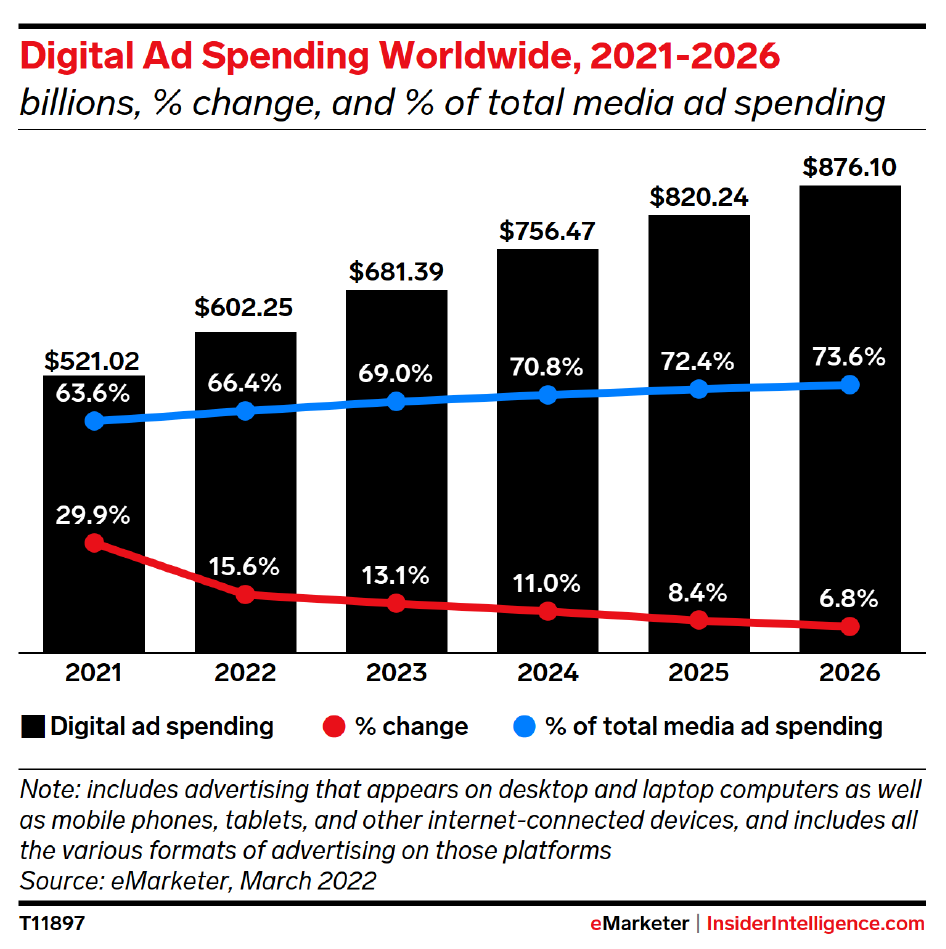

And they were sitting on a mega tailwind, with digital advertisement eating up sizable market share.

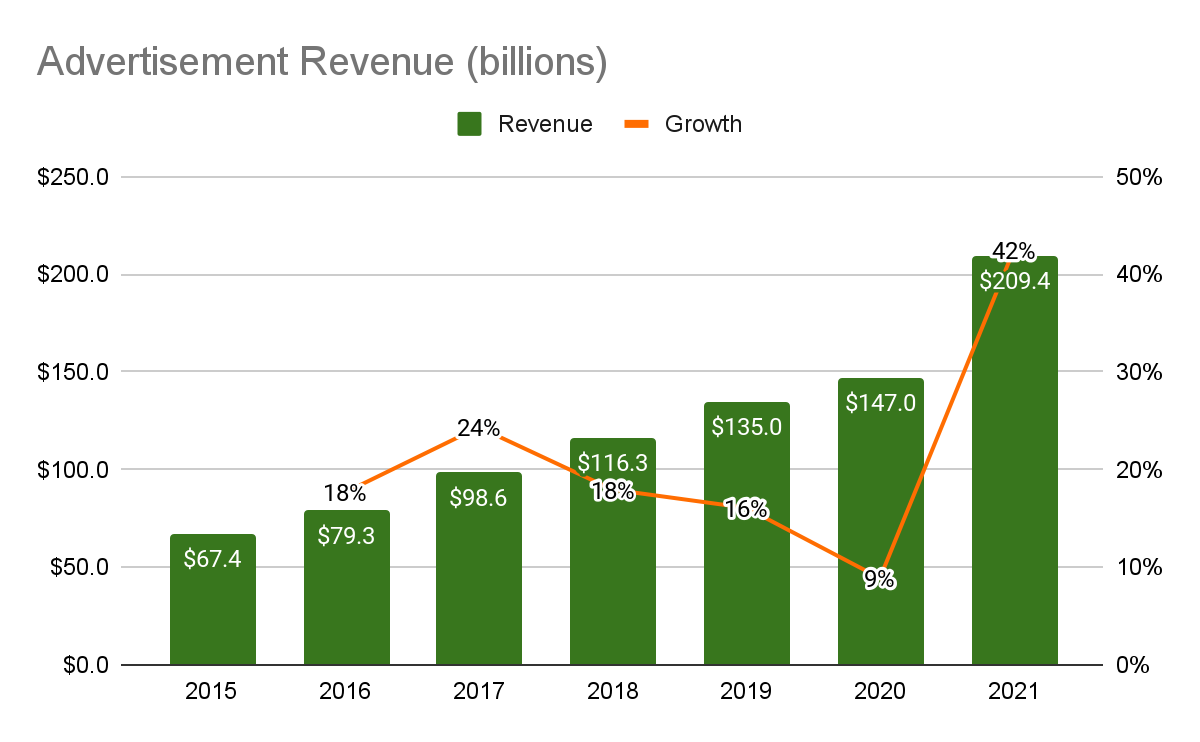

They grew their revenue at a whopping 17.6% over the past seven years, from $67.4B to $209.4B!

Hitting maturity but benefitting from Apple’s iOS changes

It definitely isn’t the early days of digital ad spend anymore but this segment will continue to grow at a steady clip over the next few years.

Apple’s latest iOS changes hurt social media platforms such as Meta, Twitter and Snap because it limits the flow of data between users and the platforms.

This reduces the return on investment (ROI) on the social media platforms and ad dollars will flow to intent-based marketing platforms such as Google.

Why?

When users begin a search on Google: “The best tuition centers for 12 year olds in New York.”

They are telling Google their problem and specifically what they need. Without requiring Google to guess what advertisement would be most relevant to them.

As opposed to Facebook, which guesses based on what its users like, follow, age group, and what they click.

Are you enjoying what you’ve read so far and looking forward to more?

Subscribing to Steady Compounding’s Stocks Research Reports gives you access to in-depth research!

In my research, I will explore Google’s business model, competitive advantages, financials, valuations and more.

BONUS: You also get access to my valuation model!

As a member, you will also gain access to all my previous research reports on companies such as Meta, Netflix, Amazon, Sea Limited, Adobe, and many others.

I’ll see you inside.

>>> Click here to access Stocks Research Reports

Cheers,

Thomas