DocuSign is not a company I have covered in my research reports nor do I hold an investment in it, but I have received a lot of questions about the recent departure of CEO Dan Springer. The announcement comes less than two weeks after he discussed DocuSign’s strategy for reinvigorating growth in the company during its latest quarterly conference call.

But before we go on to talk about Dan Springer, let’s dig into the other underlying issues at Docusign.

Decent revenue growth but weak billing guidance

The revenue growth came in at 25%, but the billing guidance, which gives us a glimpse into the future, was particularly underwhelming.

Billing guidance came in at $2.541B (I am taking the upper bound range) for FY’23. Now Q1 billings came in at $614M and that implies that Q2 to Q4 for FY’23 billings are forecasted to come in at $1.927B.

Comparing that to Q2 to Q4 in FY’22, billings came in at $1.831B. From $1.831B to $1.927B, it is only a 5.2% growth!

Growth is grinding to a screeching halt for Docusign.

The plan to reinvigorate growth in Q1 earnings call

They were hiring a bunch of new sales leaders to boost the salesforce because let’s face it, it didn’t require any effort at all to sell DocuSign during the COVID-19 period because it basically sells itself and all the sales team had to do was to sit back and collect commissions.

Here’s the optimistic picture management painted on the new growth plan:

“We’re confident in our strategy and path to becoming a $5 billion revenue company. DocuSign continues to be the clear market leader in the electronic signature space, and we are excited about our progress in defining the broader Agreement Cloud category as well. Our dedication to innovation and our investments in attracting high-caliber talent position us to build upon our leading market share. Our plan to scale is well underway, and we are encouraged by the early traction we are seeing, though the level of growth in certain areas is lower than our prior expectations….

“… we are focused on a second half growth plan that allows us to be successful despite some of the current macro headwinds and gives us a foundation of sustainable and predictable growth going into fiscal year ’24.”

The CEO who backs up his words

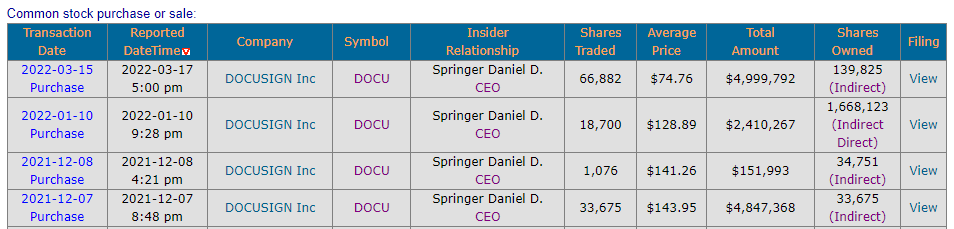

Daniel Springer has been in charge for five years and has not only promised all these changes in order to boost growth, he has also been putting his money where his mouth is.

And then the plot twist happened

Dan Springer was abruptly rid off by the Board of Directors.

I might be wrong, but something is going on at DocuSign and it seems to be way worse than how they portrayed it during the earnings call.

Why did the Board ask Springer to step down?

Well it is up to anyone’s guess but if it was a well planned transition, it would usually be announced during the earnings call. Or if it was another person who was better able to lead the company, there would be a successor who would be announced. But in this case, Chairman of the Board Mary Agnes is appointed as interim CEO while the Board is leading a search for the next CEO.

My guess is that it is a combination of getting inpatient with the results and there was bad blood in the boardroom or C-suite. We won’t really find out… until perhaps when Springer decides to write a biography?

The challenge with DocuSign as an investment

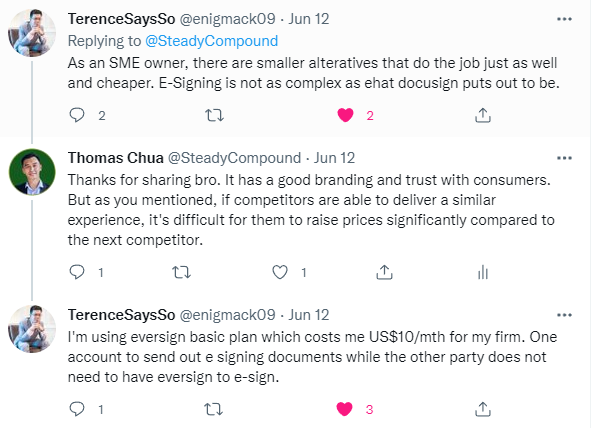

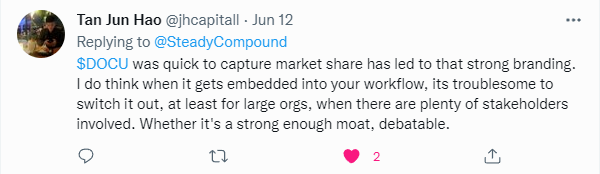

I struggle to imagine a durable moat for DocuSign. It certainly has a great product and a great branding, but what is it doing to differentiate themselves or protect themselves against competition?

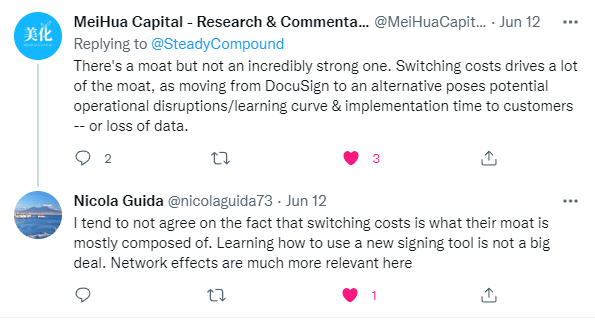

When I posted my concerns on Twitter, I got some really good replies back so I’m just going to share them here:

Ultimately, they do have an excellent product that creates value for its users.

But, is it able to capture that value for itself? There’s plenty of other reliable and easy to use alternatives out there.

Slowing growth, abrupt CEO resignation and uncertain moat trajectory… I’m going to shelve DocuSign into the too hard pile for now and continue monitoring its future developments.

Thanks Thomas, that’s very insightful! Indeed ‘too hard’ pile for me too. Furthermore, all insider transactions are sales sinces Daniel’s last purchase March 2022.

https://www.dataroma.com/m/ins/ins.php?t=y2&am=0&sym=DOCU&o=fd&d=d

That’s a good spot Pranav and thanks for sharing the link. Indeed, Dan was the only one purchasing, and till today, it’s tough to evaluate if the moat that Docusign is building is strong enough to deter competition. To the too hard pile it goes!