This week, let’s talk about an interview with Yen Liow, Managing Partner at Aravt Global, on his investing philosophy with running a long-short fund (basically a fund that is able to buy and short stocks).

He started Aravt Global with a focus on capturing the rewards of both the right-tail and left-tail. In other words, he focuses on going long on companies that could generate huge returns and shorting companies that are fragile.

Yen also discusses extensively how he views and manages volatility—which is crucial given that he runs a concentrated portfolio with very low cash levels.

Alright, let’s start off with how he captures the returns from the right tail!

There are three right-tail strategies: (1) compounders, (2) secular within cyclical, and (3) quality transitions.

Compounders

Yen only looks at monopolistic and oligopolistic market structures that can compound earnings power at over 20% to 30% over a long period of time. Buying them at reasonable prices helps with navigating volatility through up and down cycles. This is the most important thing they do for investing and the most mathematically elegant.

A fund manager is in the business of predicting the future, which, by definition, is unknowable. There is a massive difference between investing in a high and low prediction environment. Competition significantly reduces predictive ability because competitors can change the terms of engagement anytime.

Monopolies and oligopolies are in higher predictable environments because the element of competition has been isolated.

In the short-term, multiple expansions are going to drive most of your returns, but when we look at the long-term, earnings growth is the main factor that will drive your returns. In fact, by year 10, it is only earnings growth that matters.

The toughest part about investing in high-quality companies is in building the patience needed for them to become cheap, or having the emotional control to hold them through volatility—periods of overvaluation followed by drawdowns. Mathematically, it’s easy to think that holding compounders will bring investors the best outcome, but practically, the execution is tough.

Finding them, owning them, and then just waiting. Simple, yet difficult.

Secular within Cyclical

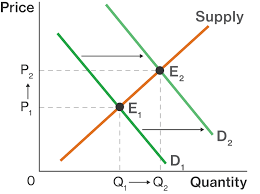

This is a commodity framework where there’s a demand shock with a delayed supply response. This usually happens in sectors such as energy, chips, agriculture, etc.

Demand shock describes a sudden shift in the demand curve where supply can’t catch up. With demand outstripping supply, prices surge and margins expand for businesses. With revenue and margins rising rapidly, Mr. Market will likely assign them a higher multiple.

It’s very possible to get a 10-bagger very quickly but this is infrequent because a demand shock and a delayed supply response is needed.

Yen mentioned that he sees quite a few opportunities unfolding now in certain sectors as the economy starts to reopen with vaccination efforts rolling out rapidly.

Quality Transitions

These are turnaround plays which typically involve change in management, merger & acquisitions (M&A), or industry consolidation which results in better economics and thus rerating of multiples occur.

This is the toughest one and Yen spends the least amount of attention here because there are just too many moving pieces.

Left Tail Strategies

Generating returns from the left tail basically means we are looking to short a stock. On this side, Yen typically looks for businesses in structural declines, where the company is being disrupted due to technology or their business model just doesn’t work anymore.

A classic example would be newspaper companies losing advertising revenue to social media companies and Google or Blockbuster being disrupted by Netflix.

Reduced earnings and shrinking multiples could bring big returns but long-tail risk could be extremely deadly. Just take a look at the Gamestop incident—chances of something like WallStreetBets happening is low but the damage is deadly when it happens.

Preparing for War

Price volatility favors the prepared. The biggest driver of investment returns is how well we invest through the various cycles of the market. Aravt Global has three books on hand to take advantage of volatility.

Book One reflects their existing positions of about 20 companies and for Aravt Global, the top 10 positions make up for more than 90% of their portfolio. This is where Yen focuses his attention while his analysts prepare Book Two.

Book Two is their watchlist of companies which ranges between 20 to 40 companies. During pullbacks, the window of opportunity arrives for investors to rotate into high-quality compounders. For example, in Dec 2018 and Mar 2020, Aravt Global had the opportunity to make three investments from Book Two for each period.

Book Three contains between 100 to 200 companies that their analysts are constantly tracking.

My Premium Membership provides in-depth research reports on high-quality compounders which can help you prepare your Book Two! Sign up today with the coupon “20OFF” and lock in today’s low prices at 20% off.

Staying Fully Invested

Yen argues against having a war chest of cash to take advantage of drawdowns, especially when the fund is compounding at above 20% a year. It may be tempting to hold on to dry powder and prepare for drawdowns but historical data shows that holding on to cash is very expensive.

While it is extremely satisfying to be able to deploy cash during drawdowns, investors must rewire our brains to not have the compulsion to set aside cash to add on the way down. Rather, we should stay invested at all times and act with equanimity when the market is drawing down.

Afterall, history shows that a pullback of 15% happens every other year and a steeper drawdown of over 30% is going to happen every decade or so.

Volatility

Most people only associate volatility with drawdowns only. But volatility is very much about spikes in share prices of companies you own as well—managing upside volatility is the true show of skill.

We need to accept periods of extreme high multiples (i.e., overvaluation) followed by periods where drawdowns or underperformance are likely, especially after a huge run up.

It is impossible to predict and we have to surrender to the uncertainty willingly, knowing that we will likely outperform in the long run by holding on to these compounders.

Take Amazon for example:

After having a run up of 800%, the share price went nowhere for 6 years despite the business showing rapidly improving metrics such as increasing customer satisfaction, rising transaction volume, etc. An investor who sold would have missed out on the 3,442% runup thereafter!

The hard part about upside volatility is that if we have made good returns in the short-run, we have to accept that we may underperform for a short while and we should hold onto our stocks regardless.

Many would be tempted to switch to the next sexy idea.

Having patience and letting share prices run to the upside isn’t intuitive and Yen suggests that investors focus on the profit potential, quality of business, and the management actions. His team’s source of patience comes from a focus on earnings power and separating price signals from the underlying business’ earnings power.

The Lesson He Wishes He Knew Earlier

Pick unfair fights!

Find out what’s your unfair advantage over others and work on those.

Simply having tennis lessons for over 40 years will not help in making Yen take over Roger Federer. He knows what a perfect forehand looks like but it’s impossible for him to execute it consistently under stress. Just because we know how to do it doesn’t mean that we can actually do it.

We have to match who we are with our strategy. If you don’t choose the right game, no amount of effort would make sense.

Conclusion

The biggest returns earned over a long period would come from compounders—that is, companies who are monopolistic or oligopolistic and are able to grow their earnings power by 20% to 30% with a long runway. Find these companies and hold on to them for a long time. Focus not on price movements but on the company’s earnings power.

Prepare for volatility as it often opens up a window of opportunity to own these compounders. Subscribe to our Premium Membership today and gain access to our deep-dive reports on high-quality compounders.