Meta is operating like a finely tuned machine. In today’s article, I’ll delve into Meta’s financial performance, analyze key business highlights, provide insights from management’s commentary, and conclude with a perspective on my investment in the company.

Financial Highlights for Q4 2024:

Revenue: Soared to $48.4 billion, marking a robust 21% increase year-over-year (YoY).

This growth was predominantly fueled by a 21% YoY surge in advertising revenue, reaching $46.8 billion. CFO Susan Li highlighted online commerce as the primary growth driver within this segment.

“Other revenue” experienced an impressive 55% YoY jump, totaling $519 million. This surge was mainly attributed to the expanding business messaging revenue from the WhatsApp Business Platform.

Operating Income: Reached a remarkable $23.4 billion, a substantial 43% YoY increase. This translates to an impressive 48% operating margin, up a significant 700 basis points from the previous year.

This margin expansion was primarily a result of reduced legal expenses, contributing a favorable impact of $1.55 billion on Q4 2024 general and administrative (G&A) expenses.

Furthermore, Meta’s ongoing commitment to operational efficiency was crucial in moderating expense growth. Key initiatives include extending the useful life of servers and strategically deploying custom silicon (MTIA) to optimize costs. As CFO Susan Li explained:

“Our expectation going forward is that we’ll be able to use both our non-AI and AI servers for a longer period of time before replacing them, which we estimate will be approximately 5.5 years. This will deliver savings in annual CapEx and resulting depreciation expense, which is already included in our guidance.”

“Finally, we’re pursuing cost efficiencies by deploying our custom MTIA silicon in areas where we can achieve a lower cost of compute by optimizing the chip to our unique workloads.”

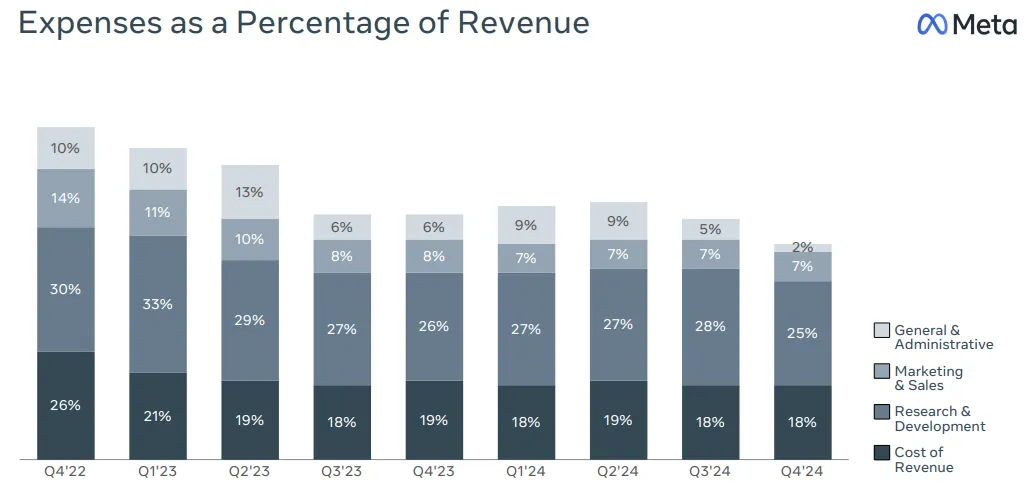

The chart below illustrates how expenses as a percentage of revenue have declined across the board, reflecting Meta’s improved cost discipline and operational leverage.

Net Income: Reached $20.8 billion, representing a substantial 49% increase YoY.

Diluted EPS: Grew to $8.02 per share, a 50% YoY increase.

Operating Cash Flow: Reached $28 billion, a significant 44% YoY increase.

Free Cash Flow: Stood at $13.15 billion, up 14% YoY.

Capital Expenditures (CAPEX): Investing in AI & Infrastructure

Meta spent $14.84 billion on CAPEX this quarter, primarily on servers, data centers, and network infrastructure—critical investments to support both AI expansion and core business growth.

Servers are projected to be the primary driver of CAPEX growth. This reflects Meta’s dual focus on expanding its AI capabilities, including generative AI, and bolstering its core business to support higher user engagement. The company is actively procuring more GPUs and developing its own custom silicon, MTIA, to enhance efficiency and performance.

CFO Susan Li on AI and server investments:

“We expect both growth in AI capacity as we support our gen AI efforts and continue to invest meaningfully in core AI, but we are also expecting growth in non-AI capacity as we invest in the core business, including to support a higher base of engagement and to refresh our existing servers.”

“…we’re pursuing cost efficiencies by deploying our custom MTIA silicon in areas where we can achieve a lower cost of compute by optimizing the chip to our unique workloads. In 2024, we started deploying MTIA to our ranking and recommendation influence workloads for ads and organic content. We expect to further ramp adoption of MTIA for these use cases throughout 2025, before extending our custom silicon efforts to training workloads for ranking and recommendations next year.”

Beyond servers, Meta is investing in the construction of large training clusters, higher power density data centers, and advanced networking equipment. These investments are designed to handle the increasing traffic demands and support the complex requirements of generative AI training clusters.

CEO Mark Zuckerberg emphasized the long-term strategic importance of these investments:

“I continue to think that investing very heavily in CapEx and infra is going to be a strategic advantage over time. It’s possible that we’ll learn otherwise at some point, but I just think it’s way too early to call that. And at this point, I would bet that the ability to build out that kind of infrastructure is going to be a major advantage for both the quality of the service and being able to serve the scale that we want to.”

Meta’s aggressive investment in AI not only improves product quality and engagement but also strengthens its competitive edge, ensuring that it remains at the forefront of the AI-driven digital ecosystem.

Strong User Engagement and Platform Growth

Meta’s Q4 2024 performance demonstrates sustained growth across its family of apps, driven by robust user engagement and successful platform enhancements.

Family Daily Active People (DAP): Reached 3.35 billion in December 2024, a 5% YoY increase, showcasing the continued widespread use of Meta’s platforms. Growth was observed across all apps – Facebook, Instagram, and WhatsApp – and in all geographic regions.

Video Consumption: Video remains a key driver of engagement.

- Global video time spent on Instagram saw double-digit percentage growth YoY.

- Reels are being reshared over 4.5 billion times daily, indicating their popularity and virality.

- In the U.S., video time spent on Facebook also experienced double-digit percentage growth YoY.

Threads Hits 320 Million Users & Begins Monetization

Meta’s newest platform, Threads, has rapidly gained traction, reaching 320 million users with approximately 100 million daily active users.

Meta aims to establish Threads as a hub for users to stay updated on their interests. This involves refining recommendation systems to prioritize recent posts, highlight content from top creators, and ensure users see more content from accounts they follow.

And in a big move—Meta has begun monetizing Threads.

CFO Susan Li on Threads Monetization:

“Longer term, we also see impression growth opportunities on unmonetized surfaces like Threads, which we are beginning to test ads in this quarter. We expect the introduction of ads on Threads will be gradual and don’t anticipate it being a meaningful driver of overall impression or revenue growth in 2025.”

Ad Performance & Pricing Power

Meta’s advertising business continues to deliver strong results, fueled by technological advancements and improved targeting.

Ad Impressions: Increased by 6% YoY in Q4 2024, with the Asia Pacific region being the primary growth driver, according to CFO Susan Li.

Average Price per Ad: Increased by a significant 14% YoY in Q4 2024. This growth was attributed to increased advertiser demand, partly resulting from improved ad performance and targeting capabilities.

Next-Level AI Ad Targeting – The Power of Andromeda

Meta introduced Andromeda, a new machine learning system built in partnership with NVIDIA, which significantly enhances ad personalization and ranking efficiency.

CFO Susan Li on Andromeda’s Impact:

“In the second half of 2024, we introduced an innovative new machine learning system in partnership with NVIDIA called Andromeda. This more efficient system enabled a 10,000x increase in the complexity of models we use for ads retrieval, which is the part of the ranking process where we narrow down a pool of tens of millions of ads to the few thousand we consider showing someone. The increase in model complexity is enabling us to run far more sophisticated prediction models to better personalize which ads we show someone. This has driven an 8% increase in the quality of ads that people see on objectives we’ve tested. Andromeda’s ability to efficiently process larger volumes of ads also positions us well for the future as advertisers use our generative AI tools to create and test more ads.”

Advantage+ – A $20 Billion Annual Run Rate

This suite of automated ad tools continues to gain traction, reaching a $20 billion annual run rate in Q4 2024, growing 70% YoY.

Meta is now testing a streamlined campaign creation flow to further drive adoption:

- Advertisers no longer have to choose between manual or Advantage+ campaigns—the system will now automatically opt them into Advantage+ by default.

- This improves ad performance for more advertisers, while still allowing customization when needed.

By making Advantage+ the default option, Meta ensures more advertisers benefit from its AI-powered ad optimization, which will likely increase ad demand and further boost pricing power.

Meta’s Long-Term Growth Story Remains Compelling

Meta has delivered exceptional performance—both as a business and as an investment. The stock’s rise has been fueled by a combination of strong earnings growth and multiple expansion, a dynamic that has significantly rewarded long-term shareholders.

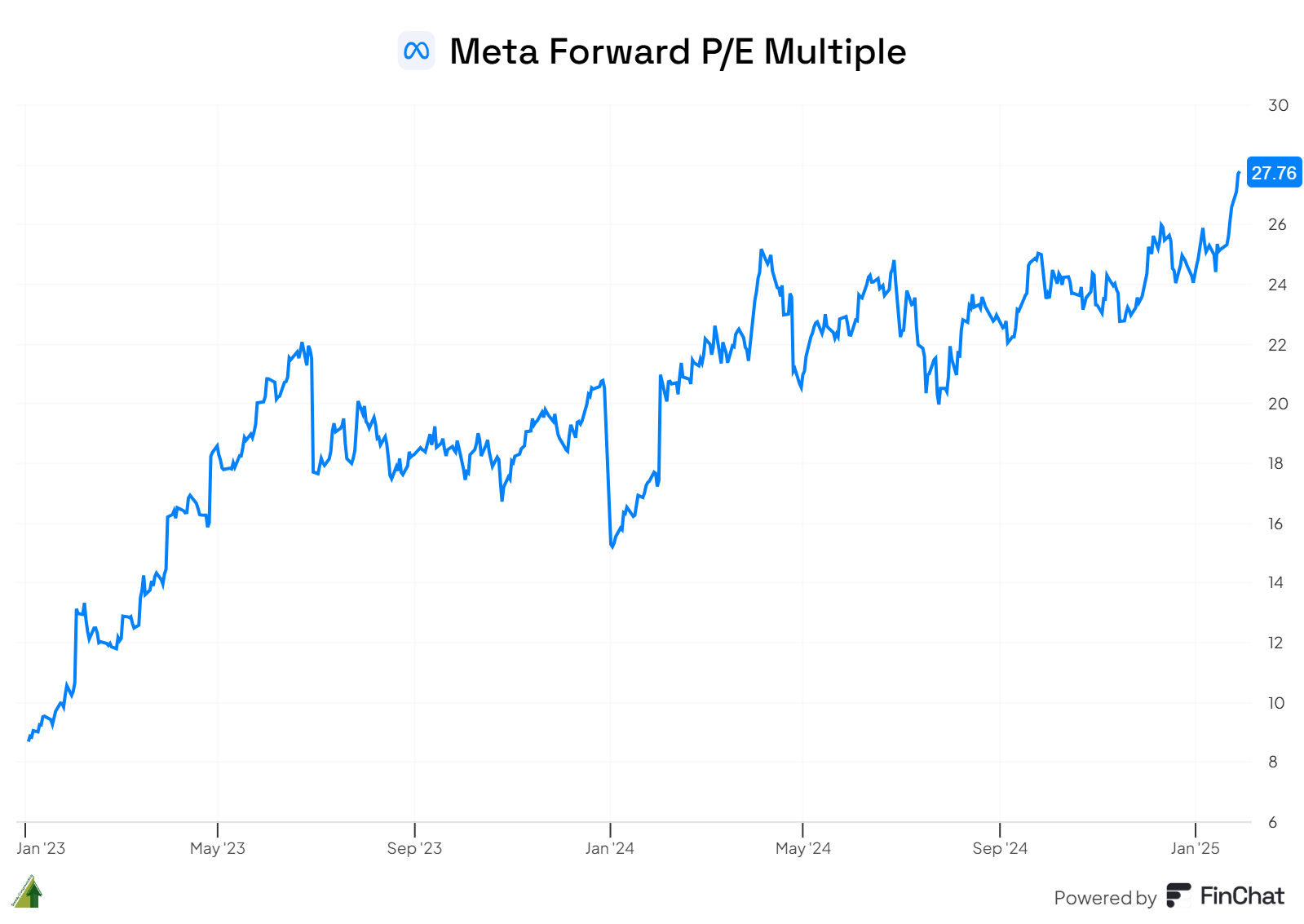

Valuation Multiple Expansion

During its peak pessimism phase, when Meta was trading at a mere 8.7x forward P/E, many doubted its long-term potential. Fast forward to today, the P/E multiple has expanded by 220% to around 28x.

While further multiple expansion is possible, it’s unlikely to be the primary driver of future share price appreciation. For the multiple to expand to a similar extent again would imply a forward P/E ratio of roughly 60x. Valuations of this magnitude are uncommon for large-cap companies and would necessitate an extraordinary level of market exuberance regarding Meta’s future prospects. Though not impossible, such a scenario is statistically improbable.

Source: Finchat. Get 15% off by signing up here.

EPS Growth: The Engine of Future Returns

Over the same period, Meta’s EPS has surged from $8.59 in FY 2022 to an impressive $23.86, representing a remarkable 278% increase.

The company continues to demonstrate robust growth, with the most recent quarter delivering 21% revenue growth and an impressive 48% operating margin, even while making significant investments for future growth.

Future Growth Drivers:

- Core Advertising Business: Meta’s core advertising business, encompassing its family of apps, remains a powerful growth engine.

- Threads: Management is strategically focused on growing Threads, and given their track record of successful execution, it’s reasonable to anticipate that Threads will begin to contribute more meaningfully to advertising revenue by mid-to-late 2026.

- Business Messaging: The burgeoning field of business messaging, particularly with Meta’s investment in its AI assistant, holds significant potential to empower both businesses and consumers, creating new revenue streams.

- Ray-Ban Meta AI Glasses: 2025 will be a pivotal year for Ray-Ban Meta AI glasses, providing valuable insights into the trajectory of the AI glasses category as a whole. This is a high-potential area for long-term growth and innovation.

Conclusion

While the potential for substantial capital appreciation driven solely by multiple expansion may be more limited going forward, Meta’s compelling long-term growth prospects continue to make it an attractive investment. The company’s strong core business, combined with emerging opportunities in Threads, business messaging, and AI-powered hardware like the Ray-Ban Meta AI glasses, position it well for continued success. As a result, Meta will remain a core, long-term holding in my portfolio.

Disclaimer: These research reports constitute the author’s personal views and are for educational purposes only. It is not to be construed as financial advice in any shape or form. From time to time, the author may hold positions in the stocks mentioned below that are consistent with the views and opinions expressed in this article. Disclosure – I have a position at Meta at the time of publishing this article (this is a disclosure and NOT A RECOMMENDATION).