This article has been brought to you by Syfe.

When I started out to learn about investing 14 years ago, I felt confused 98% of the time.

Many finance professors argued that the stock market is efficient which means that stock prices reflect everything that is known about a company and the economy.

Then, there are investors such as Warren Buffett and William Ruane who have beaten the market across decades.

The truth is, the market is efficient, but not all the time.

The market goes crazy from time to time. We saw this in theWall Street Bets GameStop saga or how the market tanked more than 30% in March 2020 only to do a sharp V shape recovery.

And this can be explained by behavioral finance, which has the core proposition that investors are not rational and fall prey to cognitive biases.

The stock market is made out of humans, and humans fall prey to errors in their judgment and decision-making.

1. System 1 VS System 2 Thinking

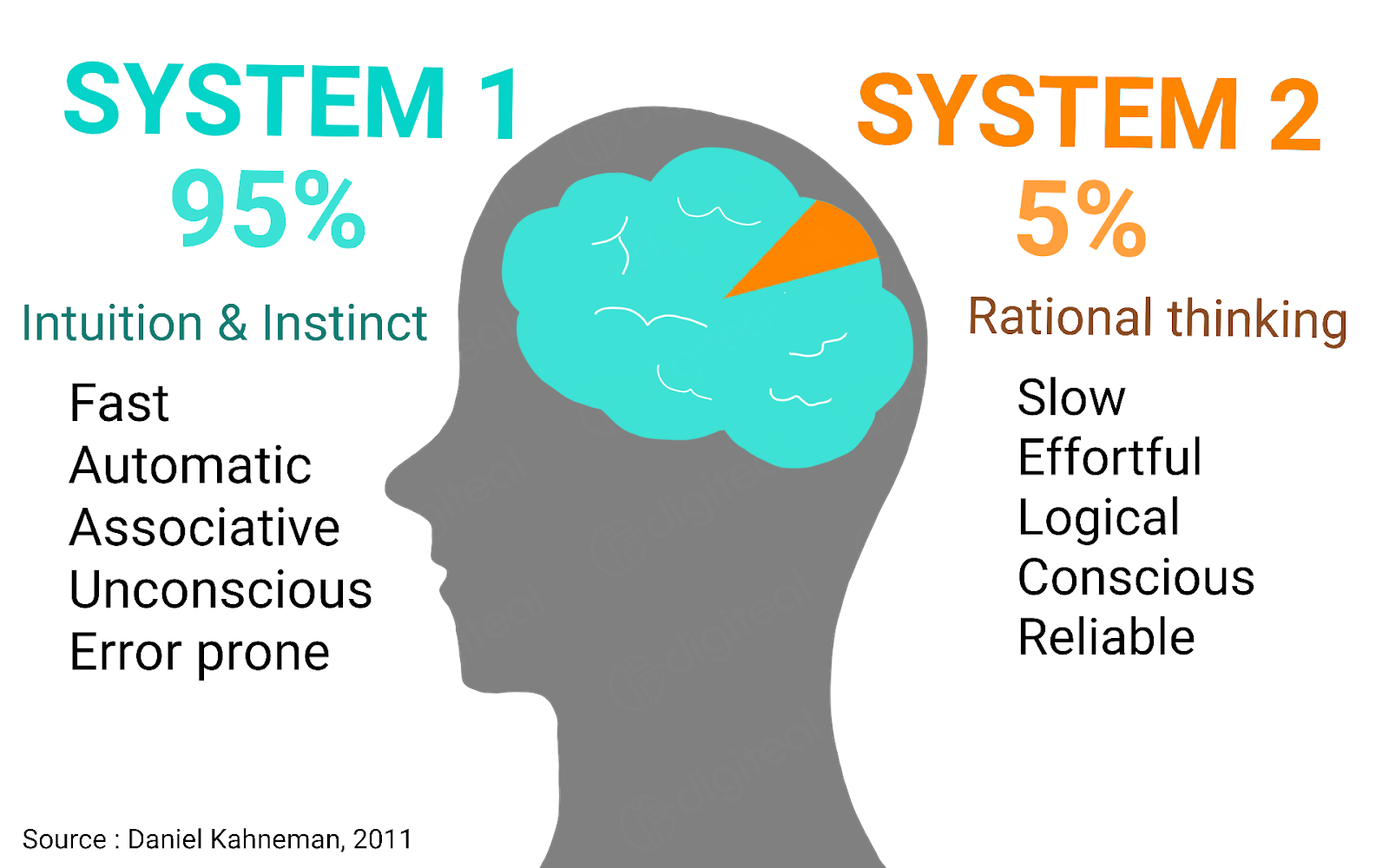

In Daniel Kahneman’s book: Thinking, Fast and Slow, he shared why our brain could be our biggest enemy in today’s world. Our brain follows two main systems of thinking.

Image from davidadcock.de

System 1 thinking is automatic and impulsive.

It reacts to our environment. It raises our heart rate when we are under duress, triggers our sweat glands so we remain cool. This is what makes us run when we see a tiger, lest our movement triggers the chasing instinct of predators.

It is our flight or fight response. It is a remnant from our past, and it was essential for our survival in our hunter-gatherer days where we had to forage for food and avoid being eaten.

But it’s also what makes us panic when the stock market collapses.

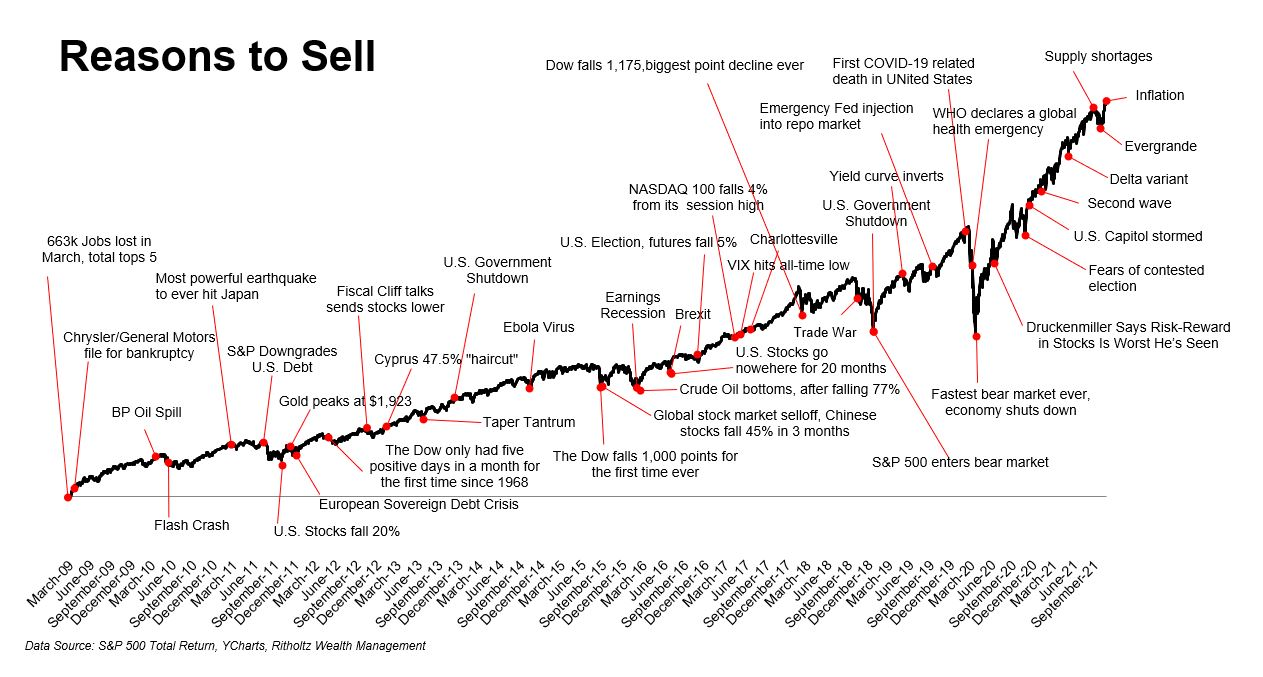

Here’s why this becomes a huge problem when investing in the stock market. Despite the S&P 500 returning 12.9% per year (data from Syfe) over the last 10 years, there was never a shortage of reasons to sell.

Chart from The Irrelevant Investor

System 2 thinking is conscious, aware and considerate.

It is usually activated when we are doing something that’s challenging, something that doesn’t come naturally to us.

This is the mind’s slower, analytical mode where reason dominates.

It’s what helps us succeed in today’s world, where we are rewarded for making good decisions and solving complex problems.

We may think that we are in control, that we activate our system 2 thinking most of the time. But research shows that that is not the case.

Try this quiz: A baseball bat and a ball cost $1.10. The bat costs $1 more than the ball. How much does the ball cost?

I’ll give you a second to think.

…

Got it?

If your answer is $0.10, I’m sorry to inform you that system 1 just tricked you.

You see, the ball must cost $0.05. If the bat costs $1 more, it comes out to $1.05.

Combined, it gives you $1.10.

When system 1 faces a problem it can’t solve, it’ll call onto system 2.

The problem comes when your brain underestimates the problem and allows system 1 to handle complex problems.

The market will provide you with 1001 reasons why you should sell a stock. When we see the news blasting headlines as shown in the chart above, it inevitably triggers our system 1 thinking, causing many to sell or withhold from investing during these pullbacks.

2. Loss Aversion Bias

One of the common reasons I hear from friends who don’t invest is that “I don’t want to lose money”. This fear can be traced to a term in psychology called “loss aversion”.

As humans, we hate losing money more than we enjoy gaining money.

The pain of losing is felt twice as strong compared to the pleasure from an equivalent gain.

This is nature’s way of making us risk-averse to protect ourselves from dangerous situations. But it can also prevent us from making the best decisions.

In this case, it would be the long-term returns in the stock market.

However, investing is short-term risky. Not investing is long-term risky.

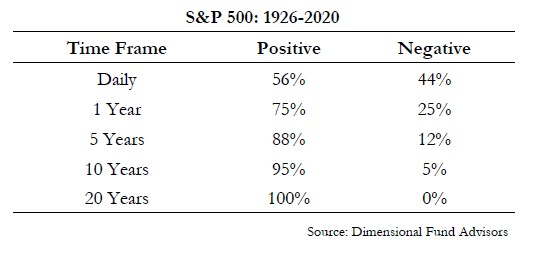

The probability of losses in the stock market reduces with time. In fact, over 94 years, on any rolling 20 years period, the probability of you losing money is a big fat 0%.

Table from A Wealth of Common Sense

While past performance is no indicator of future performance, the odds of losing money when you are investing for the long haul are extremely low.

Investing is short-term risky!

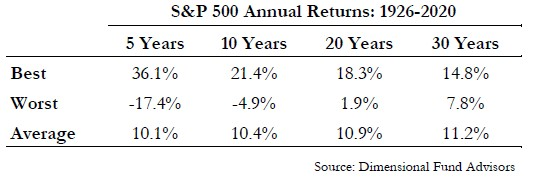

In fact, the following table shows that even if you invest at the worst timings over a 30 year period, you will still generate a decent 7.8% per year.

Table from A Wealth of Common Sense

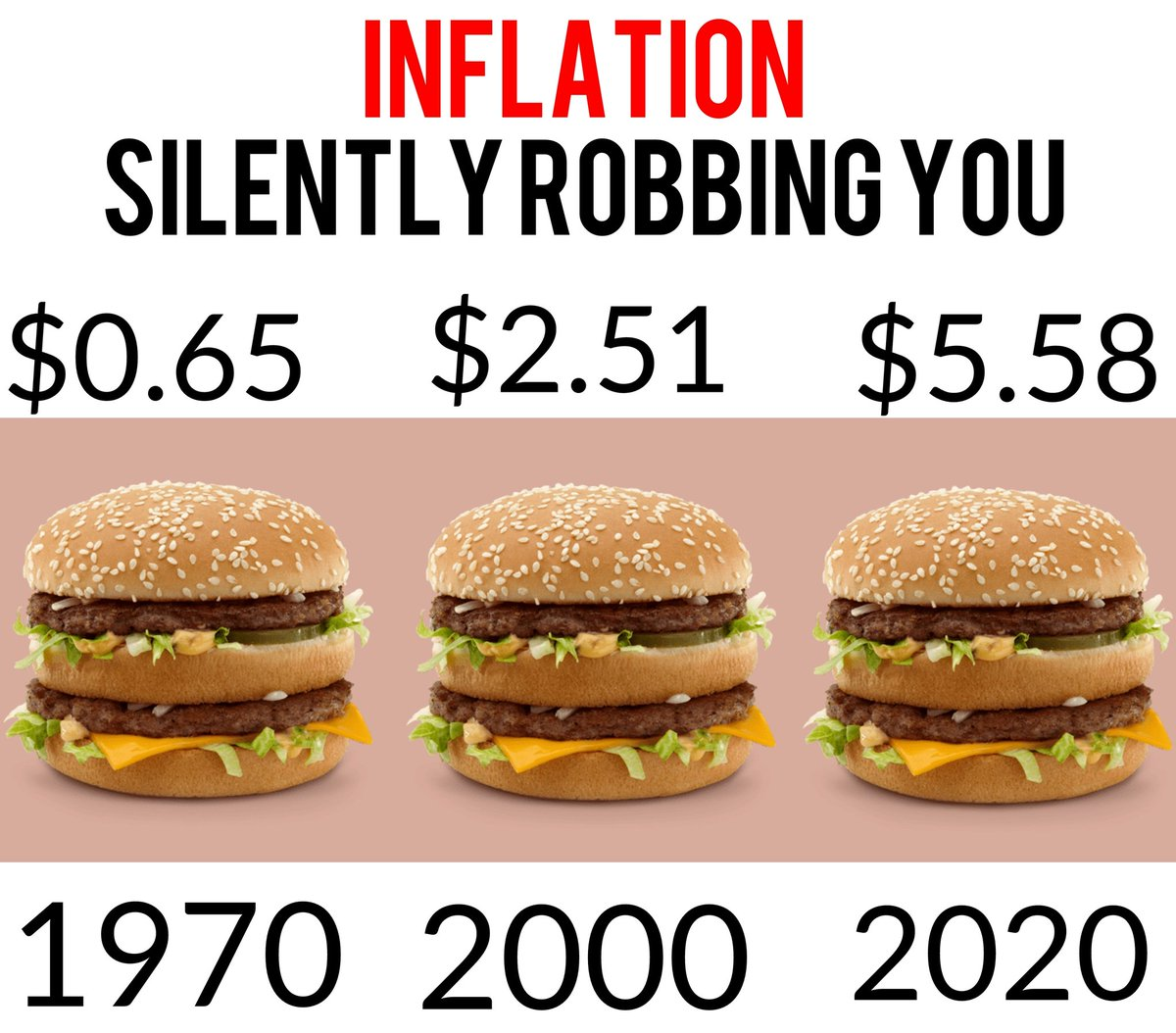

And here’s the truth, not investing your money is long-term risky! Thanks to inflation, the value of your savings is guaranteed to lose value over time.

It is better to stay invested compared to not at all.

3. Anchoring Bias

This cognitive bias causes us to rely heavily on the first or most recent piece of information (e.g. price) when making decisions. Retailers know this and they exploit it thoroughly.

When you go shopping for furniture, you will notice that the most expensive items are placed at the storefront, even though they’re often not what a consumer is looking for nor are they the best-selling items.

If a skilled salesperson attends to you, they will show you the dining set that costs $3,999 first before showing you something similar that costs just $699.

Even though it might be a little out of our budget, we buy it anyway because in our mind it’s a bargain compared to the first one.

When it comes to investing, I’ve seen anchoring undermine many investors, both when the stock is falling and when it is rising.

The first trap is anchoring to past higher share prices and thinking that just because the stock had a higher price in the past, it must be a bargain now.

The truth is what the share price was in the past has no bearing on what its value is today. It is the future earnings that determine a company’s worth. Buying solely based on price anchoring to a previous higher share price is a bad idea.

The second trap investors fall into is hoping for share prices to retrace themselves downwards and thinking just because it was lower in the past. The past will act like gravity and pull it back.

I repeat, a company’s past share price is not an indication of its value today. The market is forward-looking and discounts future cash flow to the present, not the past.

How to Overcome These Biases?

It takes a lot of introspection work to overcome these biases. Even today it is still a work in progress for me.

If there’s one thing I can guarantee, it’s that Mr. Market will go into a fit every now and then.

So how do we prepare for times like these?

As Sun Tzu said, “rely not on the likelihood of the enemy’s not coming, but on our own readiness to receive him.”

Here are some strategies that work for me as an active investor:

- Have a game plan. Keep a watchlist of companies I like to own and at what price. When the market goes into a rapid decline and system 1 thinking kicks in, I have my game plan to fall back on and I buy even if my stomach starts churning.

- Keep a journal. Record all your investing decisions and if something went wrong, be honest with yourself and evaluate them to develop better pattern recognition.

- Meditation. Meditation and simple breathing exercises help give power back to system 2 thinking.

For most of my friends who want to grow their wealth but do not have the interest or time to analyze businesses, dollar-cost averaging (DCA) into a fund routinely would help overcome these biases.

What Is Dollar-Cost Averaging?

A DCA is a strategy where we make regular investments into a fund. We don’t time the market, pick individual stocks nor do we pay attention to the news, we simply put our money to work by automating this whole process.

Applying a DCA strategy and investing for the long haul would remove the greatest enemy of most investors—our behavioral biases.

An affordable and convenient way to DCA is to automate your investments with Syfe.

Syfe is a digital wealth management platform that aims to offer best-in-class institutional level solutions for everyone at a fraction of the cost. It’s regulated by the Monetary Authority of Singapore (MAS) and the company recently won at the 2021 Singapore FinTech Festival.

Automating your investments with Syfe

When it comes to automating your investments, it’s as easy as setting up a recurring transfer or standing instruction with your bank to transfer funds to your Syfe portfolio(s) every month.

This automated process takes the emotions out of investing – and keeps you from succumbing to cognitive biases.

Syfe offers three investment portfolios: 1) Syfe Core, 2) Syfe REIT+ and 3) Syfe Select.

There are four options under Syfe Core, which is designed to serve as your core investment holdings.

Core Equity100 is designed for investors who want 100% exposure to global equities. There’re 13 ETFs tracking indices like the Nasdaq 100, S&P500, and more, covering over 1,500 global companies.

Core Growth offers a predominantly equities portfolio to capture the long-term growth potential of the stock market. Its portfolio asset allocation is 70% equity, 24.7% bonds and 5.2% commodity as of 31st Oct 2021.

Core Balanced offers a mix of equities, bonds and gold for investors seeking income and long-term growth in a single portfolio. Its portfolio asset allocation is 39.4% equity, 50.1% bonds and 10.6% commodity as of 31st Oct 2021.

Core Defensive is designed for investors who prefer relatively stable returns and income. Its portfolio asset allocation is 19.9% equity, 71% bond and 9.1% commodity as of 31st Oct 2021.

Syfe REIT+ is designed for investors who wish to earn passive income. It offers exposure to 20 of the largest real estate investment trusts (REITs) in Singapore such as Ascendas REIT, Mapletree Commercial Trust and CapitaLand Integrated Commercial Trust and more.

For investors who prefer to customize their portfolio, Syfe offers Syfe Select Custom which allows you to choose up to 8 ETFs from over 100 ETFs curated by Syfe. You can choose broadly diversified ETFs such as VWRA, VOO, EIMI, or thematic ETFs focusing on clean energy, disruption, healthcare and more.

My rule-of-thumb

For investors with an investment horizon of more than 5 to 10 years, you can take advantage of the compounding power of the stock market

This means leaning towards a portfolio with higher equity weighting.

After all, the risk of losing money decreases when your investment horizon is across decades.

Investors that are close to retirement or have retired may want to consider a more balanced or defensive portfolio.

This contains a mix of income and growth assets.

Do note that the ideal portfolio for you depends on your risk tolerance, liquidity and investment horizon. If you are unsure, you can schedule a free consultation with Syfe or take a look at their core-satellite investing framework.

Conclusion

Investing is simple, but not easy.

When investing, we are often our greatest enemy because of our cognitive biases.

Robo-advisory is one way to automate your investment and overcome these cognitive biases.

With Syfe, it offers investors a convenient and low-cost solution to grow our wealth. If you’re interested to get started, use code STEADY to enjoy 3 months of free investing, for investments of up to $50,000.

Note: This article is sponsored by Syfe. All opinions are our own. The information provided is not financial advice. Past performance is not indicative of future results. Investing comes with risks and it is important to take factors such as your investment horizon, risk appetite and liquidity needs into consideration. If necessary, please consult your financial advisor. This advertisement has not been reviewed by the Monetary Authority of Singapore.